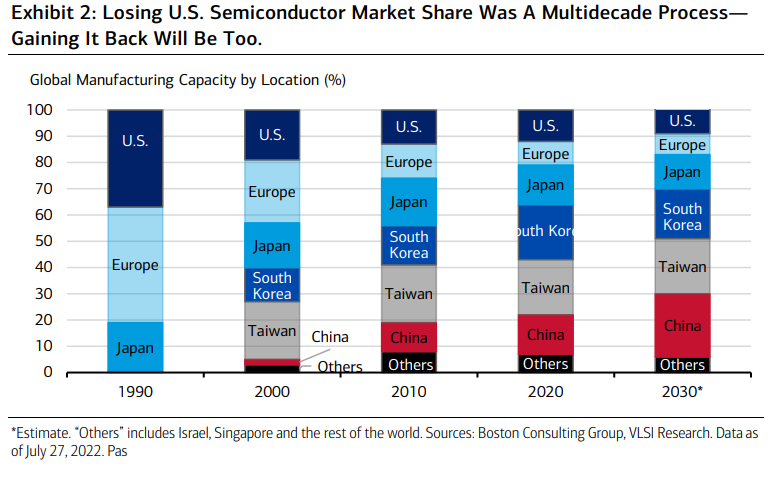

USA og Europa har siden 1990 fuldstændig mistet chip-markedet til Asien. Dengang stod de for 80 pct. af chipproduktionen. Nu er det Japan og resten af Asien – Kina, Taiwan og Sydkorea – der står for 80 pct. USA vil gerne ind på markedet igen, men det bliver svært at genvinde en tabt markedsandel, skriver Merrill Lynch. En ny lov i USA, der skal støtte produktionen, samt en vedtaget lov i EU hjælper, men ikke tilstrækkeligt. Sagen er, at alle powerhouse-virksomheder sidder i Asien. Det værste for USA er, at Kina optrapper sin chipproduktion – fra et allerede højt niveau. For investorer har udviklingen betydning, men Merrill Lynch tror, at investorerne snarere skal fokusere på undergrupper, f.eks. brugerne af chips, for dér kommer der en betydelig udvikling, mere end hos selve chip-producenterne.

Chips and Competitiveness One Year On

Last year an Executive Order mandated a review of vulnerabilities across critical supply

chains, including strategic sectors such as semiconductor manufacturing, large capacity

batteries, critical minerals/materials and pharmaceuticals. The belief was that securing

supply chains closer to home would insulate the U.S. economy, bolster U.S. national

security, and embellish the global technological leadership position of the U.S.

One year on and for a number of reasons, reality has fallen short of all the hype. While our

view is that such a dramatic reorientation of supply chains would be particularly costly to

the U.S., building in more resiliencies is a likely longer term goal for corporate America.

Accordingly, and on the path to passage/funding is a legislative package that includes the

CHIPS Act, providing $52 billion to boost U.S. semiconductor manufacturing while

offering additional subsidies and tax credits. The congressional delay had put large chip

manufacturers’ investment plans at risk, of which were counting on billions in subsidies.

For example—and contingent on funding—one chipmaker has said it’s unwilling to move

forward on two $10 billion foundries in Ohio if the bill doesn’t pass.

Emphasis on and incentives for domestic semiconductor production is a global initiative,

as the European Commission passed the European Chips Act last May, directing billions of

dollars in local chip production. Riding that news, some chipmakers have announced plans

to expand plants in France, while one chipmaker penciled in an $88 billion investment

across Europe, namely Germany. All of the above should help boost Europe’s meager 8%

of the global manufacturing capacity.

The stars of semiconductor production are housed in Asia, where two-thirds of global

chips are manufactured, and China, where a quarter of that is produced (Exhibit 2). The

U.S.’s share of global manufacturing has decreased from 37% in the 1990s, to an

insufficient 10%, ceding the bulk of its market share of past decades to Asian giants.

South Korean heavyweight overtook the U.S. largest chipmaker as the biggest chipmaker

by revenue last year.

Not unexpectedly, China’s state-led economy is focused on building out its own indigenous

supply of chips. China hopes to have domestic suppliers meet 70% of the nation’s

semiconductor needs by 2025. While that target is ambitious, the trend is clear: China,

much like Europe and many parts of Asia, is scaling up its chip production.

Given the policy intentions surrounding this bill, a number of catalysts underpin a strong

global capital expenditure cycle: Nations favoring self-sufficiency in the production of critical

goods such as semiconductors; the accelerating race for technological leadership in various

industries; and the urgent need to grapple with supply and demand dynamics. America has

the technological wherewithal to compete against China and other Asian chip foundries.

While this bill is an incremental positive, especially for sentiment, the chip industry will

require funding in the hundreds of billions of dollars from both the public and private sectors.

Other proposed China competitiveness bills take a parallel stance of increasing U.S. research

and development spending in a number of sectors under threat from China.

From a portfolio perspective, we maintain a neutral weighting to the Technology sector

but expect the further digitalization of the global economy as a clear positive for semi

demand considering the energy transition, the need to automate the labor force, and

future electric vehicle adoption. A secular rise in spending on supply chains should boost

demand for industrial and service automation and its related investments. With policy and

public investment serving as tailwinds, we believe long-term growth opportunities exist

more broadly within technology subindustries such as software and services,

semiconductor capital equipment and hardware applications such as networking

equipment, and cloud servers.

As Pat Gelsinger, chief executive officer of Intel, said, “[The location of] oil has defined

geopolitics in the past five decades. But fabs [i.e. fabrication factories for chips] will shape the

next five—this is the new geopolitics.” Consider staying long chips.