Sjældent har de finansielle markeder været ramt af en så ondskabsfuld sammenblanding af tre negative forhold, nemlig tre-enigheden mellem høj inflation, lockdown i Kina og krigen i Ukraine, skriver Merrill i en af de mest dystre prognoser for investorer. Det har ført til den værste start på markedet i 50 år med et fald i årets første fire en halv måned på 15 pct. Indeksene i Tyskland, Kina og Rusland er endnu værre. Det ser risikabelt ud for resten af året, og Merrill venter en periode med en negativ udvikling og megen volatilitet. Merrill har nedjusteret aktierne i vægtningen af sine anbefalinger, også de internationale aktier og de små selskaber. Banken har dog opjusteret energi, råvarer og finans. Banken tvivler på, at USA kan få en blød økonomisk landing. Handelsunderskuddet er steget dramatisk, og den høje dollar gør tingene værre. Eksternt er der masser af modvind, f.eks. med den kinesiske lockdown og et Europa med dramatiske stigninger i energipriserne i forhold til USA. En eventuel lempelig finanspolitik i Europa vil komme for sent. Indtil Fed får styr på inflationen, indtil Kina ændrer sin covid-nul-tolerance-politik, og indtil krigen i Ukraine ophører, bliver der ikke forbedring for investorerne.

The Markets are Captive to a Toxic Trifecta

Rarely have the stars so malignantly aligned for investors. The global capital markets are struggling with not just one seismic challenge like elevated rates of inflation not seen in decades in the U.S. and elsewhere. Nor two: a pandemic that is sapping China of its economic vigor,

creating negative ripple effects for the rest of the world. But rather three tectonic market-moving hazards when the brutal invasion in the heart of Europe is added to the mix. Stir the three together—inflation, pandemic, invasion—and you’ve got one toxic trifecta.

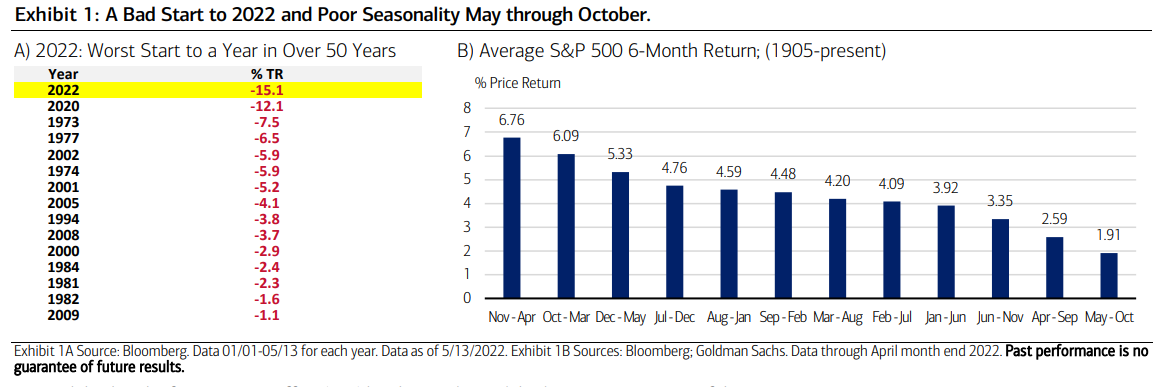

So virulent is this stew that S&P 500 total returns in the first four-and-a-half months of 2022 are the worst in over 50 years, down 15% since the start of the year (Exhibit 1A). Overseas, returns have been even worse: with with Germany’s DAX Index down 19% for the year, China’s Shanghai

Composite Index has fallen 20%, and Russia’s main Index, the MOEX, is down a depressed 30% year-to-date (YTD).

Despite the fact that the markets have priced in a number of negative variables, we still expect the markets to remain choppy and volatile over the near term. Putting a bottom beneath asset prices requires that policy makers gain the upper hand on inflation, come to grips with the virus,

and find an exit ramp from the Ukraine crisis. At this juncture, we are still waiting and watching. And keep in mind seasonality—as Exhibit 1B depicts―May-October returns are typically among the weakest based on historical patterns. The hits keep coming.

Meanwhile, the Chief Investment Office (CIO) has lowered its risk budget across most portfolios and asset classes. As spelled out in the CIO’s May Viewpoint “Clash of Competing Forces,” we have lowered our Equity overweight relative to Fixed Income by lowering International Developed Markets and trimming exposure to Small-cap Value. We have added to cash and Fixed Income, and adjusted our sector allocations, raising our allocation to Real Estate, Health Care and Utilities, while lowering our outlook for Technology and Industrials to neutral.

We remain overweight Energy, Materials and Financials, and continue to emphasize portfolio construction that is underpinned by high-quality, diversified assets across all spectrums.

Reconciling Policy Follies

Correcting for past policy failures will dictate the near-term trajectory of asset prices. In the U.S., this pivots on the Fed and its ability to engineer a “soft landing.” The latter isn’t impossible, with the Financial Times recently noting that in seven of the last 11 occasions of Fed tightening cycles, the Fed did engine a “soft landing.” However, today’s elevated price levels—April consumer price index (CPI) at 8.3%, Core at 6.2%—makes a “soft landing” scenario that much more difficult.

True, headline inflation edged down last month (from 8.5% in March), but the consensus remains that inflation is expected to remain persistently higher for longer, meaning a more hawkish stance from the Fed in terms of raising the fed funds rate and reducing the Fed’s balance sheet. How fast and far the Fed will need to go in reanchoring inflation and inflation expectations remains unclear. Less hazy: The risks of a U.S. recession are rising, with the initial read of real GDP decreasing at a 1.4% annualized rate in Q1. The “second” estimate is due at the end of the month and is expected to be better.

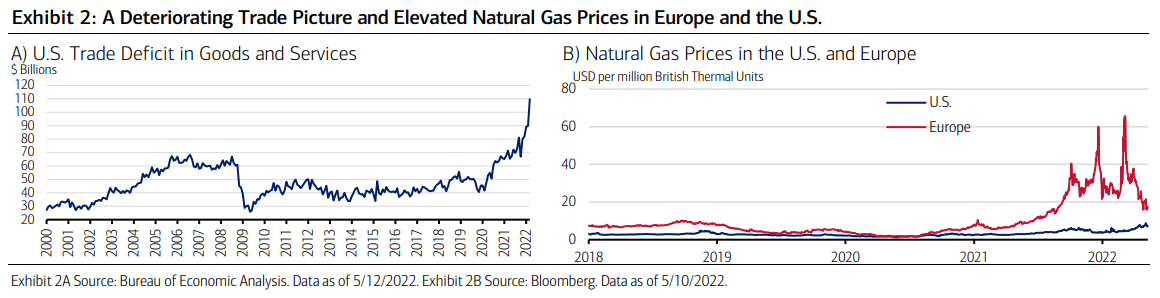

But as Exhibit 2A depicts, America’s deteriorating trade picture could be the catalyst for much weaker-than-expected U.S. growth over the near term. To wit, America’s monthly trade deficit in goods and services hit a staggering $110 billion in March, emblematic of strong consumer demand in the U.S. juxtaposed against softening demand overseas, notably in Europe and the emerging markets.

The stronger U.S. dollar isn’t helping matters either. That said, slower-than-expected real GDP growth—not a recession—is our operating base case for the U.S. over the next 12 to 18 months. In the face of a hawkish Fed are numerous growth tailwinds: the fading pandemic; a flush consumer with some $2 trillion in excess savings; the need for massive inventory rebuilding; well-capitalized Corporate America; and the lagged effects of the massive monetary stimulus of the past two years.

In China, the near-term performance of the economy rests on the country’s ability to contain and live with the virus. As of late April, some 373 million people in 45 cities have been under some kind of shutdown, with these locations accounting for roughly 40% of total GDP.3 Anti-virus shutdowns in March and April took a toll via weaker levels of trade and consumption, with April car sales in China down 36% from a year earlier; auto production figures were even weaker—down 41% from the same period a year ago. April retail sales were weaker-than-expected, down 11.1% from a year ago, as was industrial production, falling 2.9% from the prior year. Exports, meanwhile, rose by just 3.9% year-over-year in April after rising nearly 15% the month before. New home sales have declined in recent months; not surprisingly, the harsh conditions of the shutdown contributed to China’s service Purchasing Managers’ Index (PMI) plunging to 36.2% in April, while the manufacturing PMI dropped to 47.4. If there is a silver lining to all of the above, it’s this: Shanghai has managed to sharply reduce its numbers of new virus cases, and the government, recognizing the deteriorating macro picture, has stepped up its efforts to stimulate the economy. The government is still aiming for 5.5% growth this year, which portends a near-term pickup in credit growth, more government spending, more funds for infrastructure spending and, hopefully, more relaxed virus-related restrictions.

Finally, the outlook in Europe remains challenging as the crisis in Ukraine drags on, with few prospects of a ceasefire or diplomatic solution. Not for the first time, nor the last time, Europe has emerged as the weak link of the global economy. Proximity to the conflict in Ukraine, and

Europe’s energy dependence on Russian oil and gas, have hobbled one of the key pillars of the world economy. Inflation in Europe is largely tied to energy costs, and, as Exhibit 2B highlights, energy costs in Europe are well above those in the U.S.

Rising prices and failing growth prospects leave the European Central Bank in a policy bind— namely, raising interest rates in the near term to combat inflation risks exacerbating the unfolding economic slowdown. Some fiscal supplemental spending is expected from Brussels and other

individual nations, but easier fiscal policies will come too little, too late to offset Europe’s energy induced economic slowdown/recession.

The bottom line: Constructing a market bottom requires that the Fed gain the upper hand on inflation; China becomes more tolerant of virus and reflates; and Europe counters the spike in energy costs with fiscal and monetary levers, and the Ukraine crisis abates. Until these policy

shifts start to materialize or take shape, investors will likely continue to swirl in a stew of uncertainty and remain captive to a most toxic trifecta.