Merrill kommer i en analyse med en klar advarsel om en voksende statslig styring af økonomien. Statsstøtte har været nødvendig for at bekæmpe coronakrisen, men erfaringen er, at øget statslig indgriben – Big Government – skaber foryrrelser på markedet og giver virksomhederne en lavere indtjening og investorerne et lavere afkast, og det kan føre til højere inflation og højere renter. Statslig indgriben som Trumps handelskrig mod Kina og staters forsøger på at udvikle “champions” forstyrrer også markedets dispositioner. Derfor kal investorerne fremover kalkulere med virkningen af mere statslig indgriben, mener Merrill.

Big shocks = Big government

The pendulum began to swing back to the state in the aftermath of the Great Financial Crisis (GFC) of 2008/09.

Even before the pandemic of 2020, in other words, the tide was turning against the

markets—and turned even harder toward more government once coronavirus struck.

How couldn’t it? Nothing demands more of government than a once-in-a-century-public healthcare-crisis-cum-deep recession.

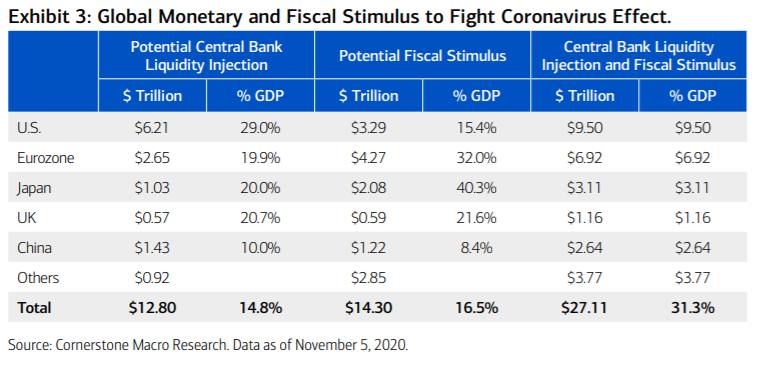

As Exhibit 3 highlights, the government policy response—both fiscal and monetary—has been unprecedented, totaling 44% of GDP in the U.S., 52% of GDP in the eurozone and a staggering 60% in Japan.

Rarely has the footprint of government been so large; and rarely in the past few decades has the government exerted so much control of the “commanding heights.”

But all crises spur government activism. As a recent Wall Street Journal article noted,

“The Great Depression produced both a bigger social safety net and a host of new

government programs.”

And then there is China and the rising U.S.-Sino tensions that have triggered U.S.

trade sanctions against Chinese goods; a geostrategic attack on Huawei, a Chinese

multinational technology company; and U.S. government demands that U.S. firms

decamp from China and produce more goods at home, among other initiatives.

None of these actions, to say the least, are pro-market. And neither is the U.S. response to China’s rising global competitiveness, which the current administration sees both as an economic and national security threat.

This has sparked rising bipartisan support for a U.S. industrial policy in such key sectors as Aerospace, Electronics, rare earth minerals, Telecom, Agriculture and other sectors deemed vital to national security.

Similar strategies are being considered overseas; meanwhile, the idea and acceptance

of “Big Government” is gaining traction in virtually every part of the world. Whether in France, Japan or India, governments are becoming more involved in imposing conditions on which goods, services and technologies can be bought or sold, and which foreign partners are deemed trustworthy.

The fostering of “national champions” demands that supply chains be redesigned and brought home; greater scrutiny of foreign investment deals; the creation of indigenous data firewalls; financial support/subsidies to encourage

in-country mergers—these policies, and many more like them, are anathema to

the private sector and could lead over the long term to a number of unfavorable,

unintended consequences.

As control of the “commanding heights” shifts toward the state, the macro risks to the

private sector could manifest themselves in slower/stagnate economic growth, lower

return on invested capital, higher taxes, less offshoring and greater margin pressure as a result, and higher inflation and therefore interest rates.

Nothing just mentioned—in most cases—is favorable for corporate profits or valuations.

In the end, and looking forward, investors would increasingly have to weigh the effects of a more visible hand (state) in the economy versus the invisible hand (the markets) and the underlying effects on future corporate earnings and profit growth.

That said, let’s be clear: State intervention during the pandemic has been largely effective in helping to provide support for the capital markets and strengthening the global economy.

But history shows that the bigger the government presence in the economy, the greater the odds of misallocated resources and market distortions over the long term.

Future market returns will increasingly be influenced by the delicate balance in who controls the “commanding heights.”