Merrill hæfter sig ved, at økonomien har udviklet sig helt anderledes end ventet under pandemien – på alle områder – og at den teknologiske udvikling og klima-politikken også har haft en stor virkning. F.eks. er det den massive vækst i el-biler, der har ført til voldsomme forsyningsvanskeligheder omkring chips. Dette og det ekstremt høje forbrug har øget investeringerne massivt, ikke mindst fordi virksomhedernes indtjening har været særdeles høj. S&P 500-indtjeningen steg med 15 pct. i første halvår, og det førte til den største stigning i indtjeningsforventningerne, der er set i 45 år. Merrill forventer også en pæn stigning i investeringerne næste år, på 7 pct., og alt i alt indikerer det et stærkt aktiemarked.

Strong U.S. Capex Outlook

The economic recovery out of the pandemic shutdown was not expected to be V-shaped,

fiscal transfers were not expected to create labor shortages, and inflation was not

expected to be high and sustained.

Instead, U.S. real gross domestic product (GDP) got

back on its 1995-to-2019 trend by early 2021, businesses have never reported bigger

difficulty finding labor, and annualized consumer durable-goods inflation averaged 17%

between January and August, its highest reading since this Bureau of Labor Statistics

inflation series began in 1956.

This shouldn’t be surprising, since, as discussed in past reports, the nature of the shock

and unparalleled government response to the pandemic have boosted inflation-adjusted

demand for consumer durable goods this year 35% above its 1995-to-2019 trend,

according to data from the Bureau of Economic Analysis, much in excess of domestic

supply, even though manufacturing output also rebounded quickly.

Still, with domestic industrial equipment spending lagging since 2001, when China entered

the World Trade Organization (WTO), manufacturing output flatlining, and reliance on

imports increasing, it’s not surprising to see the past year’s surge in demand result in

major logistical bottlenecks and shortages.

What’s more, as ongoing semiconductor chip shortages caused by coronavirus-related

Asian production disruptions and the government-stimulus-fueled surge in demand for

consumer electronics and other “smart” goods starved carmakers of necessary

components, motor-vehicle inventories are expected to remain depressed relative to

demand.

The sudden global swing in favor of vastly boosting production of electric vehicles (EV),

which reportedly use 10 times more chips than current internal-combustion car models, is

likely exacerbating the shortage of chips.

Shortages, combined with very elevated excess personal savings and labor income growth

running at an almost 10% pace through August and likely to remain robust

because of exceptionally strong labor demand and accelerating wages, suggest that

consumer demand should remain elevated, keeping economic growth and inflation high by

the standards of the past two decades.

Leading indicators of

employment suggest hiring should increase at about a 3%-to-4% pace over the next year

(twice, or more, as fast as between 2013 and 2019), resulting in millions more paychecks

and a further decline in the unemployment rate to about 4% in 2022. With wages also

rising the most in two or three decades, this implies strong income gains and firm support

for economic activity.

Thus, in our view, there’s much fuel for consumer spending growth

ahead even absent enhanced unemployment benefits. This means corporate revenue

growth is likely to remain strong. Given our domestic income and spending outlook, as well

as improving pandemic-related conditions overseas and massive backlogs of unfilled

manufacturing orders, we expect corporate revenue growth of about 10% to 14% in 2021

and 2022. This would be at the top of the range that prevailed in the past 30 years, and

combined with low interest costs should help keep profit margins high, in our view, despite

rising input costs.

Q2 GDPbased data show pre-tax domestic profit margins expanding to a 7-year high. What’s more,

company earnings reports have generally indicated management confidence in the ability

to keep margins high, or rising, as a result of unprecedented pricing power. Supporting this

view, the Evercore ISI Research proprietary survey of company pricing power has increased

to a fresh record.

In light of S&P 500 revenue surging 15% in the first half and margins expanding, analysts

have revised their 2021 profits estimates by the most in 45 years (about 25% from their

January forecast), boosting equity prices and helping keep credit spreads much narrower

than expected.

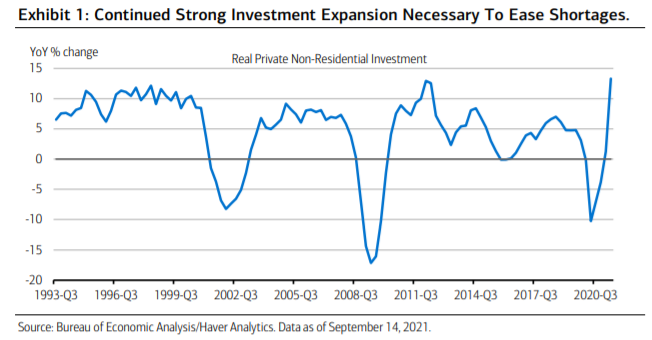

We expect more upside for profits as well as real nonresidential CapEx, after its 13%

year-over-year (YoY) surge in Q2 to a new record (Exhibit 1). Unprecedented labor constraints

spurring automation and productivity enhancements alongside concerns about supply chain

resilience also suggest sustained robust domestic investment.

The rebound in capex has been led by real industrial equipment spending, which reached a

fresh record 7% above the pre-pandemic peak in Q2. All in all, we expect real

business investment to increase around 6% to 7% in 2021 and 2022, which would be on the

strong side by the standards of the past 20 years.