Det bliver “risky business” for investorerne i år, skriver Merrill. Selv om der er udsigt til en stærk vækst i de kommende måneder, så vokser risiciene betragteligt. Stigningen i inflationen kan tvinge centralbanken til at stramme kursen så meget, at der kommer en recession, og den kommer typisk to et halvt år efter en top-indtjening. Det har virksomhederne i denne tid. Merrill forudser, at recessionen kommer i slutningen af 2023 eller begyndelsen af 2024. Den konstante forbedring, vi har oplevet de seneste år, er “over and gone.” Merrill advarer investorerne: De skal indstille sig på en turbulent tid, men de skal også være parate til at købe op efter store kursfald. Historisk giver kursfald på over 10 pct. altid opkøbsmuligheder, mener Merrill. Aktierne er faldet så meget i år.

Risky Business (Cycle)

The 2022 growth outlook for the U.S. economy remains positive. The Leading Economic Index points to strong growth in the next six months, for example.

Consumers are well positioned to spend and there is pent up demand for autos and housing, with home builder confidence near an all-time high. Businesses are investing to boost productivity given a very tight labor market. Credit conditions are supportive.

With the probability of a recession low, historical analysis shows pullbacks in the equity market of greater than 10% like we just experienced suggests a good buying opportunity.

Looking further ahead, business cycle risk is set to pick up substantially for a number of reasons.

Monetary policy is tightening as inflation continues to surprise to the upside. Nonfinancial

margins are under pressure from a tight labor market and rising labor costs. And housing and

business investment sectors, sources of fundamental strength this year as the economy

overheats, could be sources of fundamental vulnerability next year and thereafter.

One of the biggest risks to the length of the expansion is if the Fed is forced to induce a

recession to arrest persistent inflation. For much of the decade since the Fed has been

formally targeting 2% inflation, its credibility was at risk from being unable to generate

inflation over 2%. Now the reverse is occurring. The market is unsure how the Fed will get

inflation back to its 2% target without causing a recession, as most inflation metrics are

running well over 5% year-over-year (YoY), and there are very few signs that it is poised to roll

over.

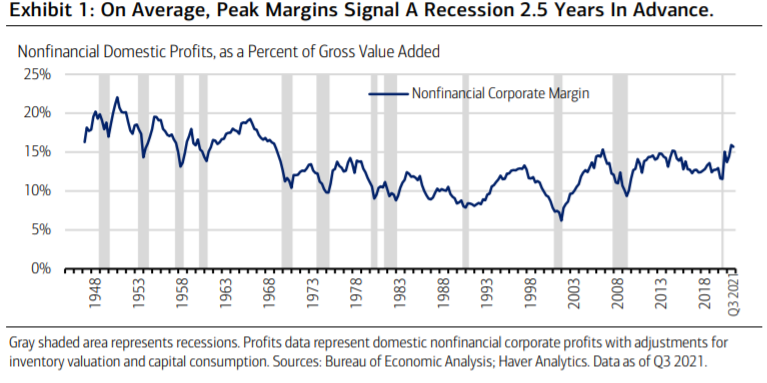

Profit margins: Peaked or peaking?

Profit margins are a reliable business cycle timing indicator. In the post-World War II

period, nonfinancial profit margins tend to peak about two and half years before

recessions and may be peaking now. The second quarter of 2021 was the most recent

peak level, using gross domestic product (GDP) profits, and margins contracted some in

Q3. Q4 data will arrive in a few weeks. While the top-line revenue growth benefits from

faster nominal growth in this environment, a very tight labor market is putting upward

pressure on employment costs.

If Q2 2021 peak holds, the historical average suggests

that the economy will be vulnerable to a recession in later 2023 or early 2024. Looking at

a different indicator of margins, with over half of S&P 500 companies reported, average

operating margins appear to have narrowed slightly in Q4. It is also likely monetary policy

will be substantially tighter at the end of next year.

“Slow and steady” no more

The slow and steady pace of macroeconomic growth, inflation and monetary policy seen in

previous cycles is probably long gone. All variables seem to be moving faster and with

more volatility in this cycle, perhaps suggesting the expansion could also be shorter.

The equity market and other risk assets like high-yield corporate bonds are leading

indicators. If the probability of a recession in the next few years goes up as some indicators

suggest, risk assets will start pricing this in well in advance, perhaps by year-end. It wouldn’t

surprise us to see investors starting to pare back risk asset allocations (like Equities and

high-yield corporates) as we move deeper into the year, if not sooner.