Merrill venter en global forbrugsfest, fordi den enorme ekstra opsparing under pandemien nu “skal brændes af.” Den ekstra opsparing anslås til 5400 milliarder dollar. Amerikanerne har det største beløb, og de ventes at fyre pengene af meget hurtigt, mens europæerne og kineserne ventes at bruge pengene i andet halvår.

“Cashing In” On the Global Consumer Recovery

With so much said about pent-up consumer demand as the next leg of the U.S. recovery,

it’s worth tracking the U.S. consumer to its global peers. Why? Because the consumption

boom, while U.S.-led, is about to go global, positioning likely future earnings upside for

such sectors as Consumer Discretionary, Technology and various cyclical plays.

The three largest consumer markets in the world—the U.S., China and the Euro Area—

experienced a varied (ranging from 11% to 26%) drop in consumption and a rise in

consumer savings (ranging from 4 to 20 percentage points) during the pandemic. For this

reason, the outlook for the global economy has never been more closely tied to the

consumer.

In part thanks to government stimulus measures, disposable incomes remained

elevated during the pandemic, and excess savings lined consumers’ pockets.

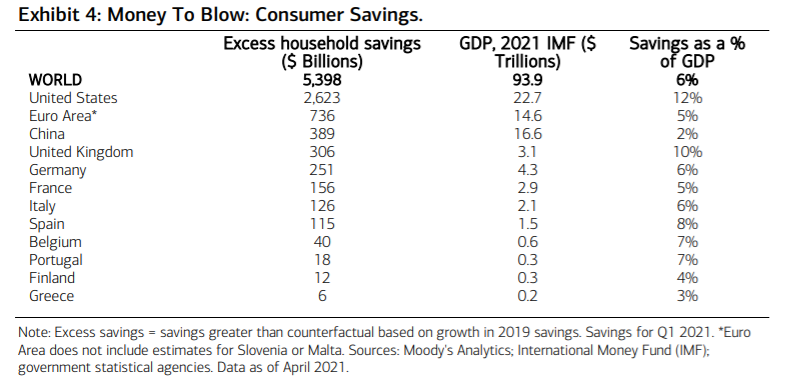

At the global level, Moody’s Analytics estimates households had accrued $5.4 trillion in pandemicrelated savings by the end of the first quarter of this year, as shown in Exhibit 4. Over the

course of the crisis, U.S. households saved a very sizable $2.6 trillion, while the Euro Area

and China amassed $736 billion and $389 billion, respectively.

Excess savings account for 12% of gross domestic product (GDP) in the U.S. and more than 6% of output globally.

The takeaway: While the U.S. consumer is most ready to spend over the near term, a great

deal of dry powder (consumer spending) is poised to be unleashed in both Europe and

China over the second half of this year.