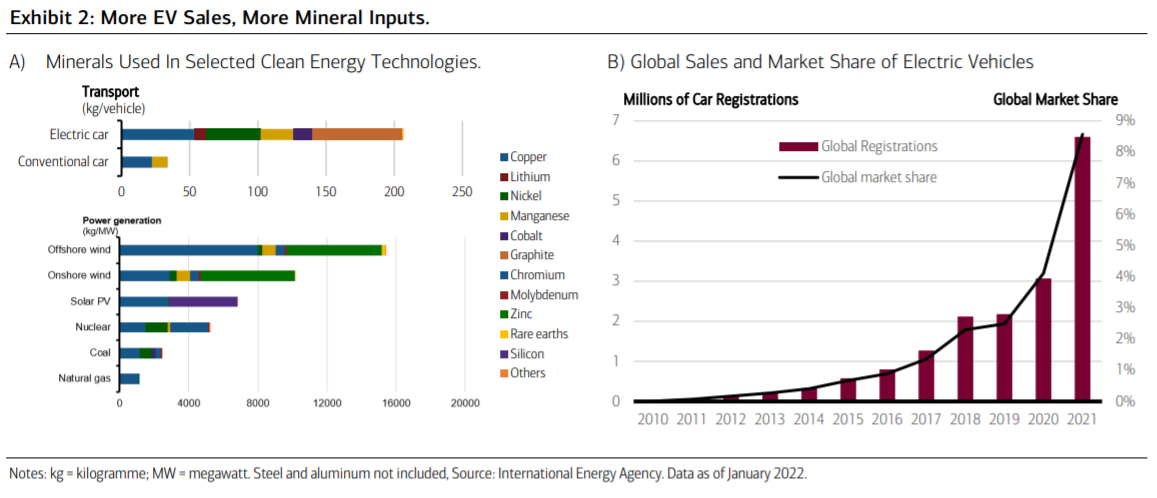

Salget af el-biler vil stige kraftigt i dette årti og det næste, og det vil også føre til en meget kraftig stigning i forbruget af råvarer som kobber, nikkel, lithium, mangan, cobolt og grafit. En el-bil bruger typisk seks gange så mange mineraler som en traditionel bil. Det globale salg af el-biler steg til 6,6 millioner sidste år, en tre-dobling i forhold til 2019. Kina lå helt i spidsen med 3,4 millioner, dvs. at der var et større salg af el-biler i Kina end i resten af verden. Dernæst kom Europa med to millioner, mens USA halter langt bagefter.

Soaring EV Sales Put Metal/Mineral Suppliers In The Driver’s Seat

If the future entails more electric vehicles (EV) (as we believe), then the future also suggests

sustained and rising demand for key metals and minerals like copper, lithium, nickel,

manganese, cobalt and graphite.

As Exhibit 2A underscores, the mineral demands of an EV

are radically different from and greater than the conventional car. According to the

International Energy Agency, a typical electric vehicle requires six times the mineral inputs of

a conventional car.

Not surprisingly then, as demand for EV has soared over the past few

years, so has demand for numerous metals, helping to make the global mining/energy sector

among the best performing of the past few years.

EV manufacturers have had a relatively good expierence throughout the pandemic, with

global sales of electric cars hitting 6.6 million in 2021, triple the level of 2019 (2.2 million

units). China leads the world in electric car sales, with sales of 3.4 million in 2021 greater

than the total sales of the rest of the world.

That said, however, the embrace of EVs is

going mainstream. EV sales in Europe spiked nearly 70% in 2021, to 2.3 million units,

owing to state subsidies and new carbon emission standards. In Germany, more than one

in three cars sold in late 2021 were electric.

Sales of EVs in the U.S. more than doubled in

2021 (albeit from a low base); presently, EVs account for only 4.5% of overall car market in

the U.S., although that figure is expected to rise as more models are introduced and

prices trend lower.

On a global basis, EV sales account for just 9% of global sales,

portending tremendous upside for future sales of EV, as well as continued demand/pressure

on many of the world’s key resources, ranging from copper to zinc. In the end, soaring EV

sales will likely keep metals/minerals in the driver’s seat well into this decade.