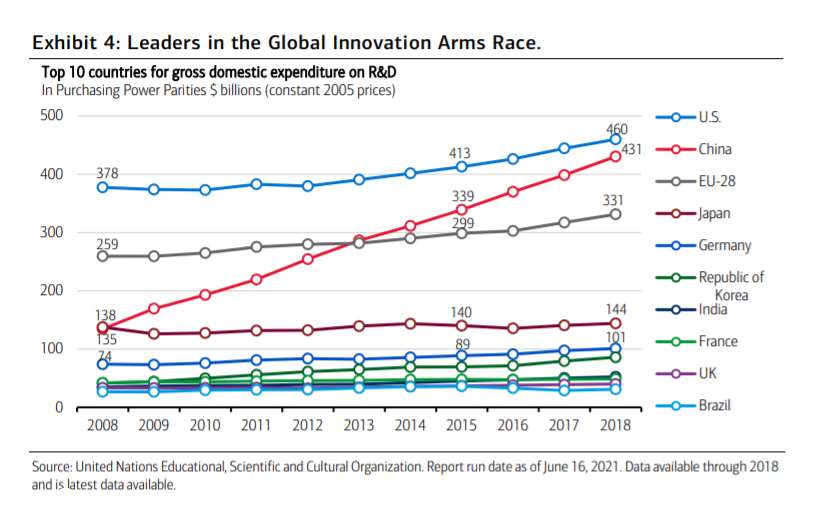

Ifølge Merrill er verden på vej ind i et “våbenkapløb” inden for forskning og udvikling, R&D, og det må investorerne indrette sig efter, hvis de vil have et godt afkast. De virksomheder, der vil have en førerrolle, er nødt til at ligge i spidsen, hvad R&D angår. Det samme gælder landene. Kina har haft en forrygende udvikling. For ti år siden var de kinesiske R&D-udgifter en tredjedel af USA’s, men med udgifter i 2018 på 431 milliarder dollar er Kina næsten på niveau med USA. Verden står over for et teknologisk og militært kapløb mellem USA og Kina. Udgifterne er også steget i Europa, men ikke nær så meget. Merrill anbefaler derfor investorer at investere i R&D-tunge virksomheder og især inden for brancherne: Technology, Healthcare, Communication Services and Consumer Discretionary sectors.

R&D As a Key Driver of Global Growth and Competitiveness

The world has entered a new global arms race around innovation, with the leaders likely to

be those nations/companies that sink the most into research and development (R&D). The

latter, remember, is an essential building block of future growth and prosperity, and a

critical differentiator when it comes to global competitiveness.

The premium on R&D will never be greater than in the next few years, owing to a number

of factors. Nations favoring self-sufficiency in the production of critical goods; the

accelerating race for technological leadership in various industries; and the urgent need to

grapple with the multiple challenges of climate change—all are catalysts underpinning the

coming boom in R&D. Rising U.S.-China tensions will have a similar effect, with the U.S.

Innovation and Competition Act—designed to boost U.S. R&D spending in a number of key

sectors under threat from China—just the most recent example of renewed R&D spending

by governments.

Meanwhile, beyond the U.S., Europe has adopted an industrial strategy to support more

R&D in renewable energy and the digital economy. Japan has similar plans, while China

continues to prioritize innovation-led growth through greater state-led R&D in such key

sectors as E-commerce, Mobile Payments, Artificial Intelligence and 5G. As Exhibit 4

makes clear, China’s drive to innovate via rising R&D expenditures has been nothing short

of stunning, with gross domestic expenditures on R&D rising from just $137 billion in

2008 to $439 billion in 2018, the last year of available data from the United Nations.

The exhibit serves as a wakeup call to the rest of the world of China’s expanding

technological capabilities; it’s triggered a rethink among governments and corporations as

to the importance of R&D in driving future growth and earnings. That said, and over the

long-term, we continue to be overweight Technology, Healthcare, Communication Services

and Consumer Discretionary sectors, with these sectors containing many important

leaders in R&D. Also, consider staying long U.S. and China technology leaders.