Small-cap selskaber ligger i Russell-indeksene efter de store selskaber, men Merrill venter, at deres indtjening i år vil blive bedre end store selskabers. Deres valuering er den laveste i 20 år, og de ligger 30 pct. under de store selskabers. De har været forholdsvis hårdt ramt af coronaen, fordi de er jobintensive og i høj grad findes i servicesektoren. Merrill venter dog, at deres indtjening vil stige med 30 pct. i år, mens store selskabers indtjening kun ventes at stige med 9 pct. Derfor er small-cap en god investeringsmulighed, hvis investorerne holder sig til kvalitetsselskaber, value-aktier og selskaber, der giver en god dividende.

Small-cap Snapshot

Despite an economic backdrop that has historically been favorable for Small-caps, the

Russell 2000 Index is currently lagging the Russell 1000 Index by roughly 4% year-to-date.

Moreover, Small-caps briefly fell into bear market territory as the index fell 20% from its

recent high in November.

We see a number of factors for the recent disappointing performance in Small-caps.

Investor’s flight to quality following the Fed’s hawkish pivot has led high-beta, high-volatility,

and non-profitable stocks to underperform. This includes certain Small-caps, as about 44%

of the Russell 2000 index comprises of non-earners.

The rise of the Omicron variant has

likely added to the downside, as Small-caps tend to be labor intensive and skewed toward

services. Persistent inflation may be pressuring margins for smaller companies that are

unable to pass through rising costs, with 22% of small business owners citing inflation and

11% citing costs of labor as their top business problem in January.

It’s important to keep in mind that Small-cap corrections are not uncommon—on average,

10% pullbacks occur 1.3x times a year, while 20% pullbacks occur 0.4x a year, according to

BofA Global Research. Still, a variety of indicators suggests reason for optimism. Small-cap

earnings are expected to grow by 30% this year, while Large-cap earnings are expected to

grow by a more moderate 9% pace.

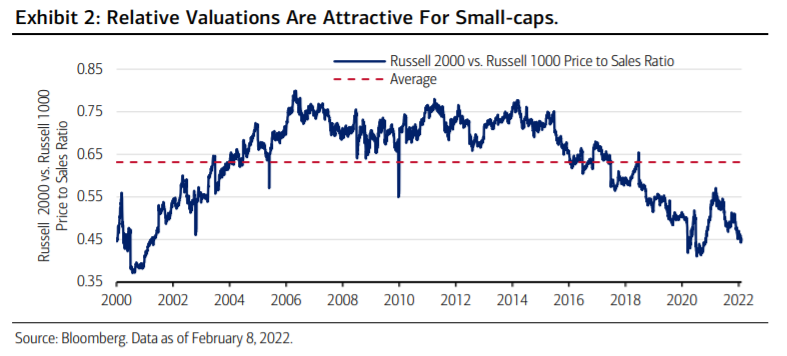

Valuations are close to 20-year lows (Exhibit 2), with

Small-caps trading at a roughly 30% relative discount to Large-caps. Unlike past Fed

tightening cycles, Small-caps are cheap compared to Large-caps heading into the first hike,

which could suggest that further multiple compression may be limited.

While certain risks remain, it’s our view that the economic backdrop should remain

supportive for Small-caps as coronavirus concerns begin to abate, U.S. GDP growth solidly

expands, and the services economy continues to recover.

Steeply discounted valuations

should continue to make Small-caps appear attractive, and strong forecasts for earnings

growth remain as a tailwind. From a portfolio positioning perspective, investors may want to

avoid riskier unprofitable companies and instead consider Small-caps that offer quality, Value

and dividend-growth.