Merrill har analyseret det enorme dyk i amerikanernes sundhedsforbrug, som er en paradoksal sideeffekt af coronakrisen. To tredjedele af faldet er indvundet, men det skaber stadig grundlag for en kraftig fremgang, når der sker en bedring af pandemien og økonomien, og samme effekt vil ses i rejse- og underholdningsbranchen. Det bliver dér, der kan ses fremgang i det nye år, mener Merrill.

Unleashing of demand for hard-hit services is likely in 2021.

The bad news is the lagging performance of certain service-sector activity, as

government restrictions and fear of coronavirus hamper reopenings.

While consumption spending on goods set a fresh record almost 7% above pre-pandemic levels in the third quarter, spending on services was still about 8% below its year-end 2019 level.

Although both sectors recovered sharply, the service sector remains on a much lower recovery path.

The good news is that service-sector laggards are generally strong secular growers

that have just been derailed by the pandemic. A good example is the unprecedented

collapse in consumption of medical-care services.

Aging demographics and technological advances and new medical treatments make this one of the strongest growth areas for the future.

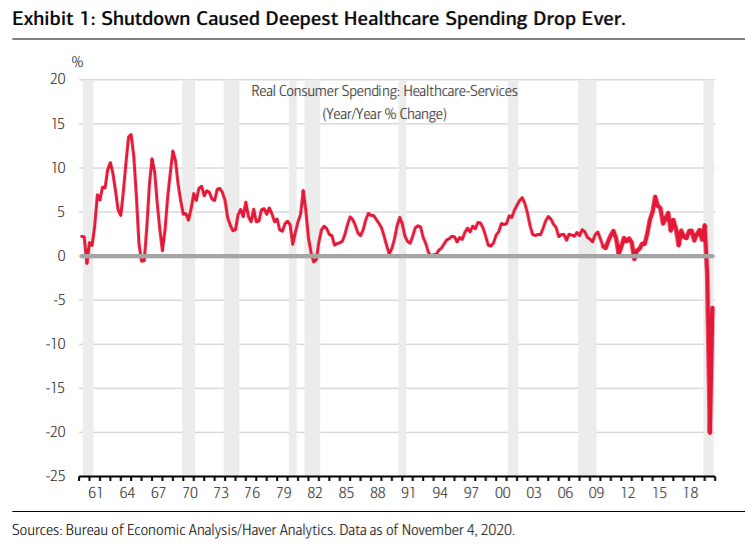

However, shutdowns and coronavirus precautions caused an unprecedented

drop in medical-care spending by consumers in the second quarter (Exhibit 1).

Exhibit 1: Shutdown Caused Deepest Healthcare Spending Drop Ever.

In fact, this is a major reason why many scientists and healthcare professionals

now believe the negative consequences of shutdowns outweigh the positives. Many

consumers neglected normal basic health procedures to avoid contact with medical

service providers.

Fortunately, this consumption of medical services has recuperated

about two-thirds of its unprecedented 21% second-quarter collapse. However, it remains about 7% below pre-pandemic levels, raising the risk that non-coronavirus health problems could become more of a long-term issue for households.

Still, as people adapt to the coronavirus and therapies continues to improve, demand for postponed and delayed medical care should continue to recover toward its strong longterm trend.

For the same reasons, a similar unleashing of demand for travel, entertainment

and other hard-hit services is also likely in 2021. Combined with the new, stronger

underlying demand for goods led by the accelerated WFH trend, the preconditions for an overall economic boom in 2021 are thus falling into place, in our view.