Merrill ser meget optimistisk på virksomhedernes indtjening og dermed aktiemarkedet i 2021. Merrill betragter den hidtidige udvikling som udtryk for, at markedet har reageret mere på virksomhedernes situation end på corona-effekten og hæfter sig ved, at der er en lav volatilitet på markedet, og at finansieringsvilkårene er gunstige.

Financial Markets Shaped More By Profits Than Coronavirus News

Inherent daily market volatility, alarming coronavirus infection rates and unease/

uncertainty about economic and tax policy have kept investors and consumers on edge.

The election results and coronavirus contagion seem to have suppressed consumer

sentiment.

An anticipated doubledip recession in Europe, where shutdowns are starting to materially affect economic activity, compound the near-term risks to U.S. and global growth from the pandemic.

However, financial markets have remained unphased, choosing to look beyond this hurdle.

This is not surprising. There’s been unequivocal improvement on the economic conditions front to date, which has resulted in: 1) higher-than-expected third quarter S&P 500 profits, with 50% of sectors reporting rising pretax margins; 2) declining credit spreads and equity-market Chicago Board Options Exchange (CBOE) Volatility Index (VIX); 3) a widening spread between the 10-year Treasury note yield and fed funds rate (i.e., a steeper yield curve); and 4) a relative market performance shift

from Growth stocks to cyclical/Value stocks.

All of which validate the strong signals for a likely brightening economic and profits outlook coming from the equity market since late March.

All in all, the combination of the fastest economic rebound ever, surge in goods and

housing-sector demand, record-low corporate interest rates, and slowing wage growth

has set the stage for more margin expansion and a big profit growth spurt through 2021, which should continue to shape financial-market trends ahead more than coronavirus contagion news, in our view.

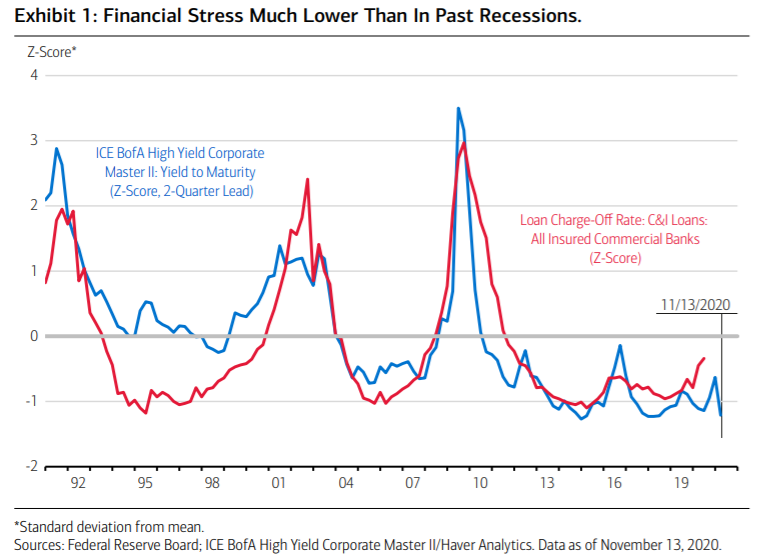

Looking ahead, the drop in speculative-bond yields to fresh lows following encouraging

coronavirus vaccine news bodes well for commercial-and-industrial (C&I) loan charge-off

rates.

As shown in Exhibit 1, they appear poised to peak soon and at levels way below the

2008–2009 recession. Similarly, following a pandemic-related spike to levels of tightness

last seen in 2008–2009, bank lending standards have eased sharply in the fourth quarter

and appear likely to continue to reverse their shock surge and return to more favorable

levels, consistent with inflation, profit margins, credit-spread and the VIX conditions.