Den kraftige vækst i år i USA på forventet 6,4 pct. gavner ikke kun USA, men også virksomheder i Europa og Asien, som har stor eksport til USA. Virkningen er især stor for de virksomheder, der ikke blot eksporterer til USA, men har en stor produktion i USA. Flere europæiske virksomheder har op til 10 gange så megen afsætning fra deres filialer i USA som eksport fra hjemmebasen. 63 pct. af den amerikanske import fra EU kommer i form af salg fra moderselskaber til deres filialer i USA. Der er fem gange så mange virksomhedsinvesteringer i USA, som der er i Kina.

The U.S. as the World’s Earnings Locomotive

The strength of the U.S. economy—with real GDP rising at an annualized rate of 6.4% in the

first quarter of 2021—is not only considered a seismic tailwind for U.S. corporate earnings.

It also represents a powerful blast to global earnings, notably among firms in key developed

markets like France, Germany and the United Kingdom.

While we continue to prefer U.S. Equities relative to the rest of the world, we continue to monitor investment opportunities abroad, notably in the context of the U.S. being the world’s locomotive for earnings.

“What’s good for America is good for blue-chip Europe”, with roughly one-fifth of the earnings of the Euro Stoxx 50 leveraged to the United States.

Germany is even more leveraged to the United States, with America accounting for roughly

23% of German global earnings. Ditto for France (20%), the United Kingdom (24.7%) and

Denmark (27%). Over 30% of Swiss and Irish earnings emanate from the U.S., while

Corporate Spain and Italy, in contrast, are more local than their European counterparts.

Asia’s earnings are also more local or domestic, although the U.S. still ranks as the second most important market for corporate earnings in such economies as India, Japan and South

Korea. Corporate Taiwan is just as leveraged to the U.S. as many Europe firms. Brazilian and

Mexican firms are similar to Europe’s Mediterranean cohorts—or more dependent on

domestic variables as opposed to global dynamics.

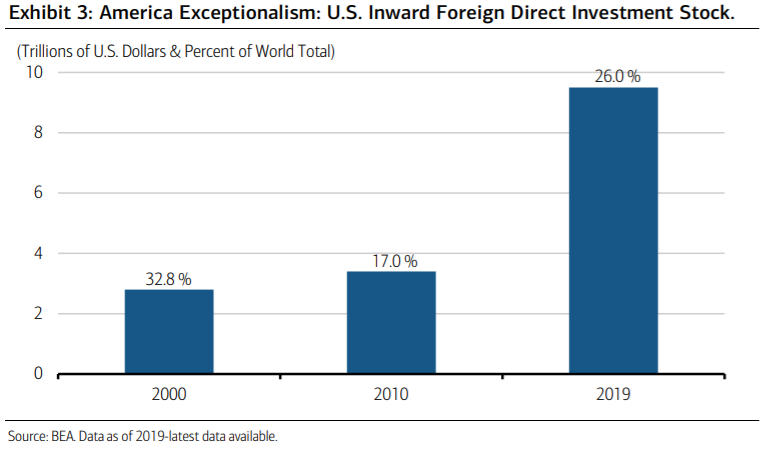

Exhibit 2 highlights how European firms and others derive earnings in the United States. In a

nutshell, it’s through foreign direct investment (or operating in the U.S. via foreign affiliates)

not trade (or exports). Note the ratio of foreign affiliate sales to exports—with French U.S.

affiliate sales more than seven times France’s exports to the United States.

British and Dutch U.S. affiliates are even more geared to doing business locally versus exporting, with a ratio of sales/exports of 10.5 for the U.K. and 12.6 for the Netherlands. And while Japan and

South Korea are among the top exporting countries in the world, note that when it comes to

accessing the U.S. market, the preferred option is through U.S. affiliates, not trade.

As an aside, in most cases, foreign direct investment and trade are compliments, not

substitutes, with one (investment) pulling the other (trade). To this point, and reflecting the

tight linkages between European parent companies and their U.S. affiliates, roughly 63% of

U.S. imports from the European Union consist of related-party trade, or cross-border trade

that stays within the ambit of the company. Think BMW Germany sending parts and

components to its U.S. foreign affiliate in South Carolina, as an example.

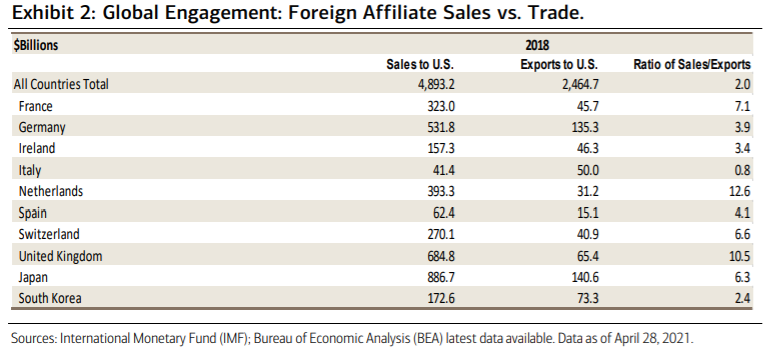

All of the above reflects the fact that the U.S. economy is among the most open and

competitive in the world, and therefore among the most attractive markets to foreign

multinationals. Indeed, America is exceptional when it comes to attracting foreign direct

investment (FDI), with total U.S. inward FDI stock amounting to $9.5 trillion in 2019 (Exhibit

3).

The comparable figure for China—$1.8 trillion—is much smaller and reflects the closed

economy of China and limited investment opportunities in the Middle Kingdom. In the

aggregate, 26% of total world FDI inward stock is sunk in the United States—a dynamic that

is mutually beneficial to both foreign multinationals and the U.S.