Der var handelskrig mellem USA og Kina under Trump, men under Biden bliver kampen mellem supermagterne ikke mindre, nu kommer det blot til at handle om højteknologi og den sikkerhedspoltiske konfrontation. Det giver investorene helt nye muligheder, vurderer Merrill, for der bliver pumpet enorme beløb ud i et højteknoplogisk kapløb, og de selskaber, der får gavn af det, er virksomheder i USA, Kina og en række nyindustrialiserede lande i Fjernøsten. Det højteknologiske marked bliver et af de mest lovende for investorerne i de kommende år, mener Merrill, og det vil altså gavne virksomheder i netop de nævnte regioner. Det er dér, markedskapitaliseringen af high-tech selskaber er højest.

Still Frosty: U.S.-China Relations and the Implications for U.S.

Investors

Notwithstanding the summer heat, and the fact that parts of the world are experiencing

some of the hottest weather in history, bilateral relations between the U.S. and China

remain frosty. A big chill remains despite market expectations that after four years of

tumult and uncertainty under the Trump administration, the Biden White House would dial

back the market-moving, anti-China rhetoric and policies of its predecessor.

What does this mean for U.S. investors?

Just as we have seen over recent years, the new U.S. administration is likely to remain in

periodic conflict with China as it looks to preserve its economic and national security

interests in strategic areas such as intellectual property protection, supply chain resilience

and data security. More bilateral frictions of the type seen under the previous

administration clearly have the potential to increase market volatility as they did

intermittently in 2018 and 2019.

Both the U.S. and China would potentially be at risk should any new restrictions on trade

and technology be imposed. Tighter controls, for example, on U.S. semiconductor supplies

or manufacturing equipment to China could curtail local Chinese production of consumer

electronics and delay the rollout of next-generation 5G telecommunication networks on

the mainland. The same action could also potentially dent profits for U.S. leaders in the

chip industry. And at the same time, potential retaliatory moves from China could risk lost

access to the fast-growing Chinese market across a broader set of U.S. companies.

*

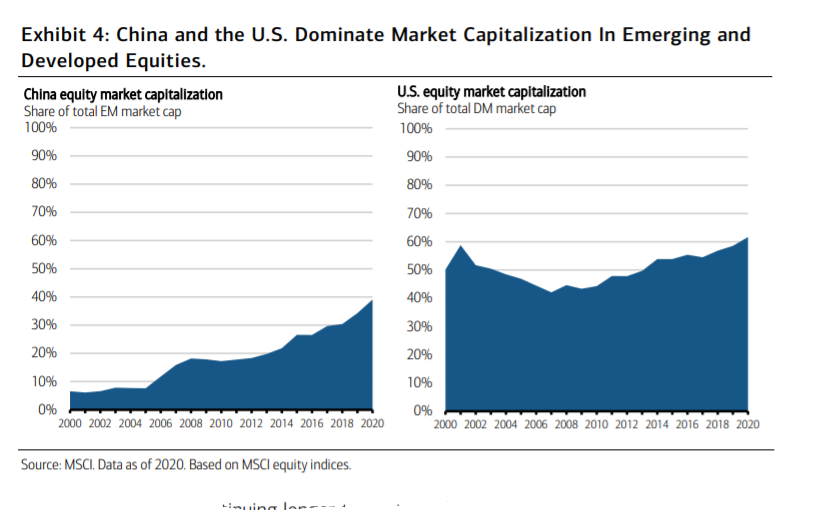

China and the U.S. have each seen their equity market size increase significantly over recent cycles, and each now dominates emerging market (EM) and developed market (DM) capitalization respectively (Exhibit 4). Any spillovers of this type from bilateral frictions between the two countries into their real economies will therefore remain a risk for investors exposed to global equities in either the developed or emerging worlds.

We nonetheless see continuing longer-term strength within technology-driven sectors in

both markets. A post-pandemic global economy should see the shift toward automation

and digitization in traditional activities such as media, retail and manufacturing continue to

progress at an accelerated pace. And a prolonged period of competition for technological

leadership between the world’s two largest economies is likely to pull forward investment

in research and innovation through greater levels of sustained government support.

China will need to increase its spending within the key growth segments of the digital

economy as it aims to move toward greater self-sufficiency in areas such as

semiconductors and mobile operating systems. Indeed this has already been evident in the

Chinese government’s prioritization of “new infrastructure” investment for the post-coronavirus recovery.

Under this plan, China’s National Development and Reform Commission aims to spend a total of around $1.4 trillion over the five years to 2025 across seven growth industries including the industrial internet, artificial intelligence and electric vehicles. Similarly, U.S. policy measures like the Innovation and Competition Act will aim to support technology investment domestically.

For investors, this could mean long-term growth opportunities across information

technology software and services, chipmakers, semiconductor capital equipment and

hardware applications such as networking equipment, cloud servers, electric vehicles and

industrial robots.

The growing geopolitical rivalry should also boost defense sector spending on advanced military hardware such as hypersonic missiles and anti-satellite weapons, as well as on enhanced cyber capability.

Technology-related equity market segments have lagged the broad indexes so far in 2021, as investors have rotated away from growth sectors over the course of the year. But alongside ongoing growth in the global digital economy, these policy shifts reinforce our view that equity sectors most

closely tied to these future trends should remain longer-term market leaders as we move

further into the new decade.

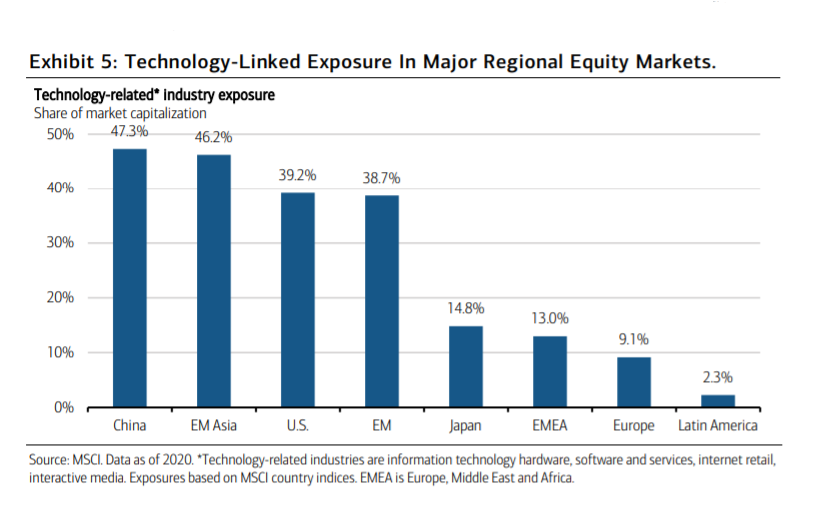

Regionally, this should favor investor exposure to the U.S., China and emerging Asia more

broadly given the large concentration of these markets in the most tech-focused areas

across the Information Technology, Communication Services and Consumer Discretionary

sectors (Exhibit 5).

China and the U.S., for example, have around 40% to 50% of their domestic market in

information technology hardware, software and services, internet retail and interactive

media. This stands well in excess of the 10% to 15% across these same segments in

Europe and Japan. Though value-oriented regions have led the global equity rally over

recent months, we would therefore expect the ongoing U.S.-China technology rivalry to

further fuel longer-term strength in these growth markets of the future.

In the end, the era of great power competition between the U.S. and China is in full bloom,

and will be a defining market/investment characteristic for the foreseeable future given

the economic weight of both nations. Bilateral friction will be a frequent source of market

volatility but also a catalyst for long-term investment opportunities in tech-related sectors

like 5G, artificial intelligence, industrial robots, cloud computing, renewable energies and

related activities.