Merrill har analyseret investeringerne i USA i de seneste år og hæfter sig ved, at de akuelle investeringer er usædvanligt høje. Investeringerne i erhvervslivet ventes at stige med 6 pct. i år og 7 pct. næste år. Det lover godt for indtjeningen, vurderer Merrill og hæfter sig ved, at indtjeningsforventningerne blev sat kraftigt i vejret efter resultaterne fra 1. halvår.

Strong U.S. Capex Outlook

In light of S&P 500 revenue surging 15% in the first half and margins expanding, analysts

have revised their 2021 profits estimates by the most in 45 years (about 25% from their

January forecast), boosting equity prices and helping keep credit spreads much narrower

than expected.

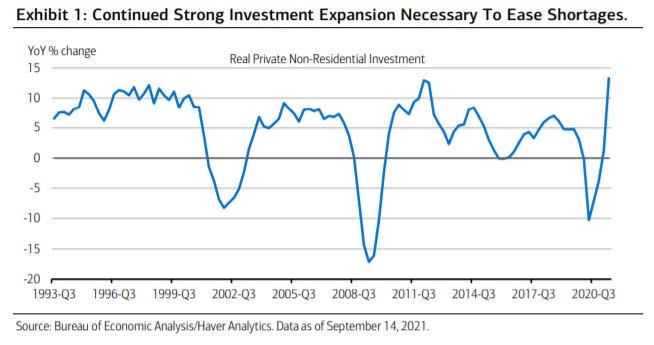

With strong revenue growth, elevated margins, and record easing of bank

lending terms for commercial and industrial (C&I) loans to firms large and small in Q3, we

expect more upside for profits as well as real nonresidential CapEx, after its 13% year-over-year

(YoY) surge in Q2 to a new record (Exhibit 1). Unprecedented labor constraints

spurring automation and productivity enhancements alongside concerns about

supply chain resilience also suggest sustained robust domestic investment.

The rebound in capex has been led by real industrial equipment spending, which reached a

fresh record 7% above the pre-pandemic peak in Q2, and by information processing

equipment, which was 20% above its pre-pandemic peak.

All in all, we expect real business investment to increase around 6% to 7% in 2021 and 2022,

which would be on the strong side by the standards of the past 20 years.