Merrill har analyseret den amerikanske genstart under præsident Biden og konkluderer, at den vil trække resten af verden med op. De amerikanske stimuli overgår så langt, hvad andre lande gør. USA ventes at få en vækst i år på 7 pct. og på 5,5 pct. næste år. Den svarer til genstarten efter Den anden Verdenskrig. Det betyder, at Merrill ser mere positivt på amerikanske aktier i forhold til internationale aktier.

The Great American Growth Revival

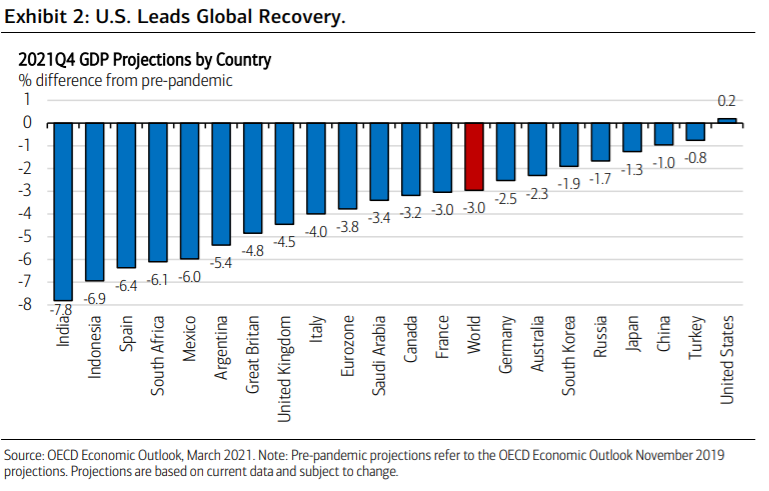

As the global economic recovery continues, the U.S. has emerged as the clear front-runner.

The swift coronavirus vaccine rollouts, unprecedented stimulus and gradual reopenings

should allow the U.S. economy to rise 7% in 2021 and 5.5% in 2022, likely outperforming

the rest of the world (Exhibit 2). As a result, U.S. equities have been on a tear, rising 11%

year to date, likely outperforming the rest of the world by 5%.

The U.S. has administered 190 million vaccine doses, with projections showing that 75% of

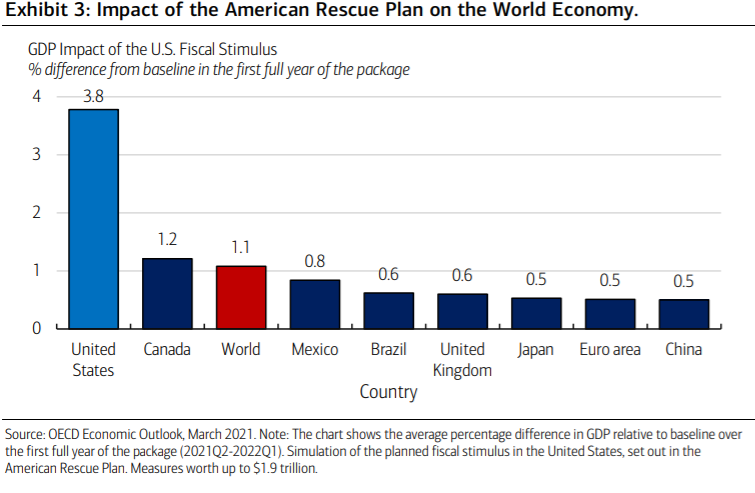

the population could be covered in the next three months. Record levels of fiscal and

monetary stimulus (over 57% of GDP) have been deployed in the U.S., and the OECD

estimates that the recent $1.9 trillion package alone is large enough to lift the U.S. while

also providing a boost to the rest of the world (Exhibit 3). All things considered, the U.S. is

well equipped to support an economic revival beginning in 2021.

Today’s Growth Revival Is Reminiscent of post-WWII, 1980s and 1990s

Post-World War II consumer pent-up demand: Consumer sentiment has improved recently

as evidenced by the Conference Board’s March Consumer Confidence Index logging the

largest monthly increase since 2003, reaching its highest level in a year. Fiscal stimulus

checks, improving jobs recovery and lack of avenues to spend have left many consumers

flush with cash and excess savings not seen since the 1940s. This lays the foundation for

consumer spending that is reminiscent of the end of World War II.

The U.S. growth revival keeps us favorable on U.S. versus international equities. Economically

sensitive sectors that benefit from normalizing inflationary trends and higher interest rates

such as Financials, Energy and Industrials are likely to outperform, with Technology

experiencing secular tailwinds. The dollar may find support in the near term as Europe’s

recovery lags and global capital is attracted to better U.S. yields. Over time, the U.S. growth

revival should pull up economic activity globally and lead to higher bond yields overseas and

an opportunity for international Equities to play catch-up. Thematically, areas such as

technology-oriented capex like automation and digital transformation, climate change

solutions, growth in the housing stock, and consumer spending in experiences and services

are attractive.