Virksomhedernes indtjening i USA har været historisk høj i andet kvartal, skriver Merrill. Med 90 pct. af regnskaberne for S%P 500 selskaberne offentliggjort, har indtjeningen været 17,1 pct. over estimaterne. Omsætningen er steget med 24,7 pct., men det er dog efter en lav aktivitet under pandemien sidste år. De små selskaber har i særdeleshed forbedret deres indtjening i år – igen efter kriseåret 2020. Der meldes også om meget gode resultater i Europa, især inden for energi, banker og chipproducenter. Revisionenen af resultaterne tyder på en bedre indtjening i de kommende måneder. Dog påpeger Merrill, at omkostningerne, herunder med stigende lønninger, kan presse indtjeningen senere hen.

An Update on Q2 Earnings Season

Corporate earnings have been historically strong, and future expectations are gathering

steam at the halfway point of Q2 earnings season.

With 89% of companies reporting, the S&P 500 Index is tracking earnings growth of 88.8%, the highest year-over-year (YoY) increase for the index since Q4 2009.2 Companies are reporting earnings in aggregate that are 17.1% above estimates—well above the five-year average of 7.8%.

Revenue growth is tracking 24.7% so far, according to FactSet.

Small-cap companies continue to beat earnings per share (EPS) expectations and

consensus estimates 268.6% YoY earnings growth for Q2, driven by cyclical sectors.

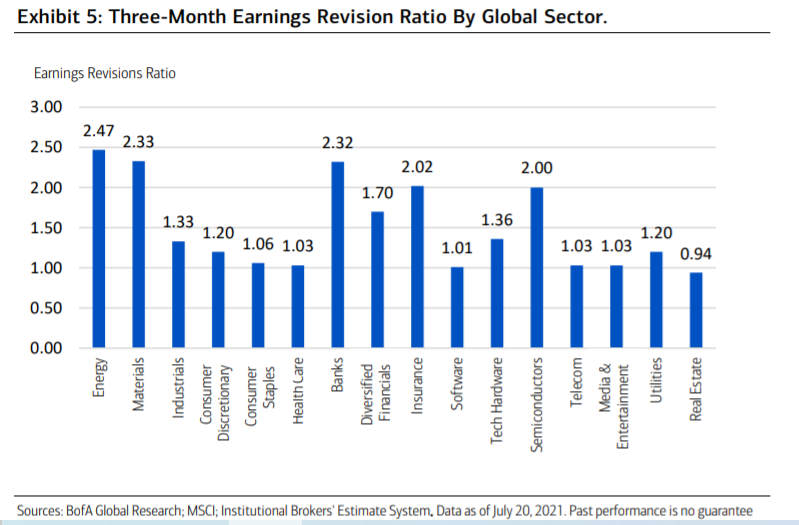

Profits are also shaping up to be strong overseas, with earnings revisions for Europe

recently reaching the second-highest level on record, and consensus now estimating

51.9% earnings growth for the year. Earnings revisions remain the strongest for global

cyclical sectors that should continue to benefit from a reflationary environment and rising

commodity prices (Exhibit 5).

These above-average growth rates in Q2 are attributable to both higher nominal GDP

growth and base effects from weaker earnings this time last year, when the economy was

shut down. Still, earnings and revenue beats are indicating that analysts continue to

underestimate the extent of the economic recovery.

Revisions are signaling more strength ahead, as evidenced by the weekly BofA Global Earnings Revision Ratio improving to an alltime high of 1.63 in August.

The strong earnings outlook is not without risk, and deterrents like coronavirus variants and increasing input and labor costs could still present headwinds. In fact, many companies are reporting higher input costs and are having to pay higher wages to retain and attract workers to enable them to meet the strong demand.

Many have been able to pass on these higher costs to their customers or plan to do so,

while some are experiencing margin pressures.