En Merrill-analyse viser, at de amerikanske virksomheder svømmer over i penge. Deres kontantbeholdning er steget voldsomt til 2200 milliarder dollar, mens buybacks og dividender er faldet dramatisk i 2020. Merrill mener, at virksomhederne bør bruge pengebjerget til udbetaling af dividende, buybacks, reduktion af deres gæld, opkøb af virksomheder og til flere investeringer, der kan styrke vækst og produktivitet. Det vil også gavne kursniveauet for investorerne. Spørgsmålet er, om der har været en tilsvarende udvikling i europæiske virksomheder.

Cash Buildup And Deployment For U.S. Corporations

Conclusion

U.S. corporates should begin to deploy their cash hoards as economic growth accelerates

in 2021 and 2022. In varying degrees, cash outlays could be deployed in shareholder

friendly actions such as higher dividends and buybacks, paying down debt and investing for

higher growth and productivity. These actions should be ultimately supportive of higher

valuation levels and investor sentiment.

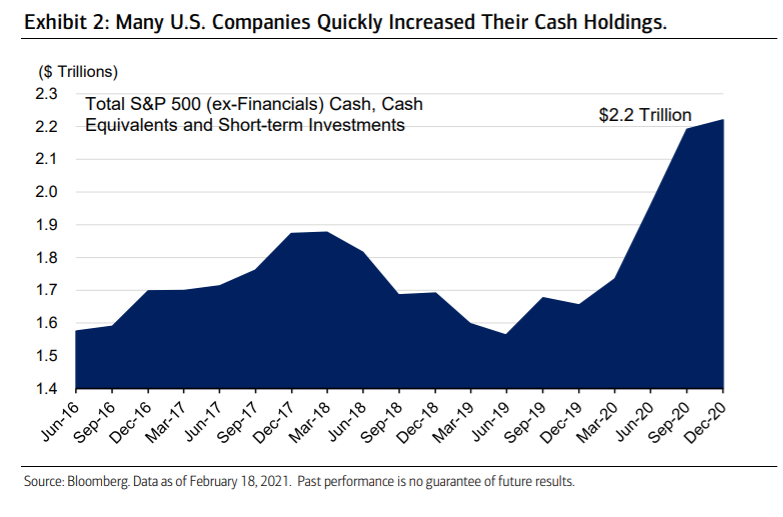

Cash mountain

Remarkably, many U.S. companies have built up a rather large cash mountain despite the

pandemic. Rather than widespread solvency issues resulting from economic shutdowns,

corporations on aggregate entered the New Year well supported. Total cash holdings and

short-term investments sitting on corporate balance sheets for many S&P 500 companies,

excluding Financials, grew to as high as $2.2 trillion recently (Exhibit 2), with the

Technology and Industrial sectors holding the largest share of the cash pile.

Companies have remained conservative with their cash deployment, keeping their balance

sheets flush as they continue to monitor the economic recovery, but there are some signs

of the purse strings loosening. With the distribution of coronavirus vaccines, additional

fiscal stimulus, and accommodative monetary policy and pent-up consumer demand

supporting profit margins and cash flows, and the time might be right for companies to

normalize or increase the usages of their cash.

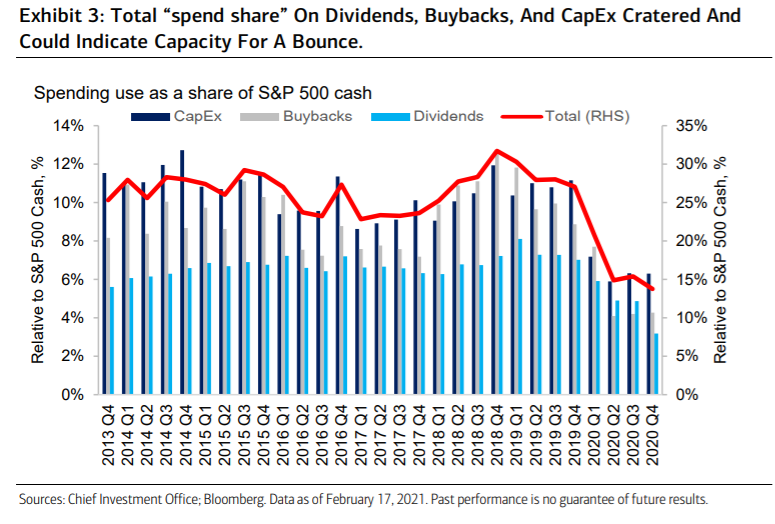

From an investor perspective, higher CapEx would signal better growth prospects at the

company level and higher productivity at the macro level. Business investment for the S&P

500 wasn’t spared from last year’s pandemic fallout, and data from Bloomberg suggests

an approximate 12% year-over-year decrease from 2019 expenditures of $765 billion.

Shareholder returns should rise

While companies were quick to lever up during the pandemic in response to record low

rates and the desire to bolster liquidity, they were also quick to taper their pace of

buybacks (Exhibit 3). As opposed to dividends, which tend to be treated in a more

programmatic manner, and CapEx, which generally is longer term in focus, buybacks are

amongst the quickest programs for management to suspend, which they did in earnest.

Buybacks for many S&P 500 companies hit their high-water mark in 2018 at $751 billion

following the TCJA. However, net share repurchases plunged 41% from that level in 2020,

to an estimated $444 billion, according to Evercore ISI Research. There are green shoots

for renewed activity as the economy begins its journey toward normalization, and the pace

of buybacks has recovered a bit from its bottom (2Q 2020). In fact, the number of

announced buybacks over the past three months is more than double the average from

last April through October, according to Strategas Research Partners. But this level is still

below prepandemic levels. For context, third-quarter buybacks were about 50% less than

average quarterly activity before the pandemic and even 10% less than levels prior to the

TCJA. However, the same agility to cut buybacks can be used to ramp them back up. For

example, many Financials voluntarily suspended buyback programs and may decide to

restart them. As the sector with the second-largest repurchase footprint, that would be a

significant kick-start back to a normal repurchase level which would be a support for

equities.

Dividends, like buybacks, are welcomed by shareholders as a return of capital and could be

a use for excess cash on corporate balance sheets. However, unlike buybacks and other

forms of capital deployment, dividends are typically more stable. From 2010 through 2019,

S&P 500 dividends grew at a stable 10% annualized rate, until the pandemic-induced dip

last year. As such, an economic recovery with strengthening corporate fundamentals

doesn’t necessarily mean that much higher levels of dividend growth are on the way.

Rather, the actual proportion of shareholder yield that is attributable to dividends has been

in decline relative to buybacks. Due to the sharp reduction in net buybacks, 2020 is

expected to mark only the fourth year since 2005 in which dividends paid surpassed share

repurchases. That being said, for dividends paid to recover back to the average annual

growth trend of 10% from prepandemic levels, it would imply an additional $136 billion

paid this year on top of expected 2020 dividends of $487 billion, according to Evercore ISI

Research calculations.

Mergers & Acquisitions (M&A) should ramp higher

Some of the large corporate cash pile may be attributable to a dearth of M&A deals in

2020, as acquisition cash outlays were the second-lowest in 15 years for the S&P 500.

Data from Evercore ISI Research illustrates that cash spend on acquisitions had averaged

approximately $342 billion each year since 2015 and was accelerating, but last year’s

expenditures cratered to $151 billion. The intense freeze in M&A activity is further

illustrated when viewed within the context of the broader equity market, as monthly deal

value as a percentage of S&P 500 market cap was only 0.2% across the summer months.

This was the lowest proportion on record dating back to 1995, according to Strategas

Research Partners. However, a recent pickup in activity has also been noted. Since

September, the average number of deals and transaction values has rebounded to

prepandemic levels and could even reflect nascent pent-up demand for deal making. A

renewed focus on growth, the need for accelerated innovation, and more stable capital

markets are likely to fuel M&A outlays going forward.