De amerikanske virksomheder har i andet kvartal haft en bedre indtjening end forventet, og samtidig investerer de kraftigt i produktivitetsforbedringer, skriver Merrill. Kapitalinvesteringerne boomer. Det kan gå ud over beskæftigelsen, men det vil også dæmpe inflationspresset og dermed hindre centralbanken i at stramme pengepolitikken for meget. Men ifølge Merrill skal investorerne dog være opmærksomme på, at de store investeringer kan føre til en overinvestering, der ødelægger fremgangen.

Uddrag fra Merrill:

Macro In Brief

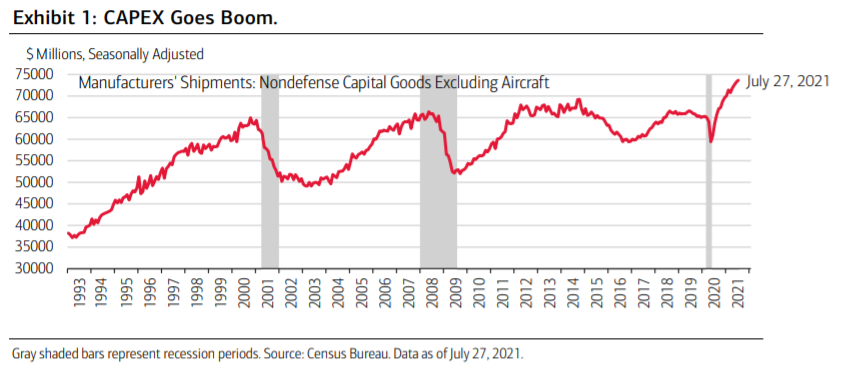

Earnings: With over half of the S&P 500 reporting Q2 earnings so far, over

80% of firms are beating on both earnings and sales. The profits cycle reinforces the overall

business cycle in part because strong earnings feed business capital expenditures (CAPEX),

which is booming (Exhibit 1).

Productivity enhancing investments could also play a pivotal role in dampening inflation pressures in the years ahead and keeping the Fed from having to slam on the brakes.

One reason investors should welcome labor market data that is not too hot in the months ahead is to help keep labor cost pressures contained, further supporting profit margins and the profits cycle and extending the overall cycle.

U.S. Business Investment Spending: As mentioned, firms faced with a tight labor

market, robust demand and strong earnings growth are currently investing in productivity-enhancing equipment that could ultimately help put a small dent in inflationary pressures.

Shipments of “core” capital goods (nondefense capital goods excluding aircraft) released

last week suggest CAPEX is booming.

As Exhibit 1 shows, the level of shipments far exceeds the previous peak. And new orders of core capital goods are running at a 16% and 13% annual rate over the last three and six months, respectively, suggesting the CAPEX expansion is carrying a lot of momentum into the second half of the year.

Additionally, regional Fed manufacturing survey data show capital investment intentions

remain relatively high. For investors, CAPEX plays an important role in potentially

dampening inflation pressures if it helps keep the Fed from strangling the cyclical

expansion with tighter monetary policy. But it could also create business cycle risk later on

if businesses overinvest and a boom goes bust.