På grund af stærkt stigende lønnninger bliver virksomhedernes indtjening i USA lavere end sidste år, vurderer Merrill. Det boom, alle oplevede sidste år, aftager i løbet af i år, og det skyldes også den stigende inflation. Men lønomkostningerne vil lægge et kraftigt pres på virksomhedernes indtjening, fordi de ventes at stige med 5-6 pct. Det er den største stigning siden 1983. I 2023 bliver der formentlig stagflation, dvs. stagnation med høj inflation, vurderer Merrill.

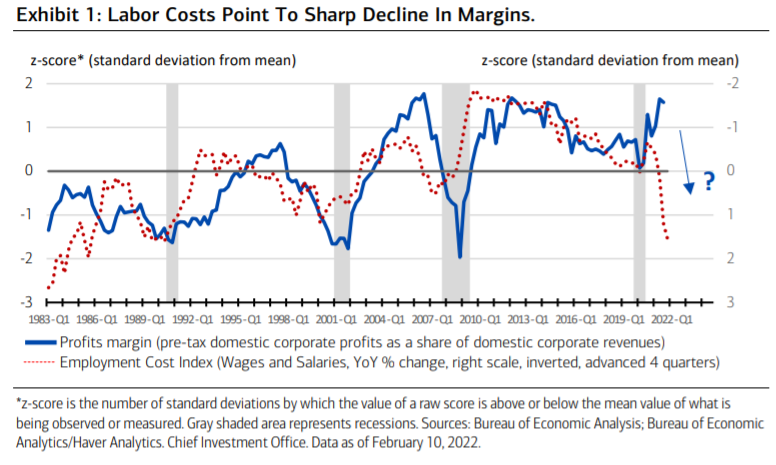

Wage Inflation Suggests Growing Downside Pressures On Margins

We believe 2022 corporate profits are likely to increase much less than in 2021, with rising risks of a

potentially big profits decline in 2023, due to accelerating wage growth and Fed tightening to

restrain inflation.

As discussed in recent reports, the 2022 U.S. GDP growth fundamentals remain strong.

Not surprisingly, the Conference Board U.S. Index of Leading Indicators, which has a long

record of predicting economic growth six months ahead, was strong through December

2021, consistent with robust economic growth in the first half of 2022. Surveys of

corporate sales and trucking company revenues, which tend to correlate well with GDP

growth, have also remained elevated.

That said, there are reasons to believe that the inflationary boom of 2021—characterized

by 40-year-high real growth and inflation—may start losing momentum despite the young

age of the current expansion.

The profit margins are likely to come under downward pressure as 2022

progresses, and especially in 2023 as the labor market tightens more and labor costs

continue to accelerate into the 5% to 6% range, in our view. Indeed, as shown in Exhibit 1,

there’s a strong negative correlation between profit margins and year-over-year (YoY)

changes in the Employment Cost Index for the private-sector, which leads by four quarters.

This closely watched labor cost measure accelerated sharply over the past two years,

reaching 5% at the end of 2021, the fastest YoY gain since 1983, which points to

potentially large declines in margins ahead.

Basically, labor costs lag behind inflation in the early stage of the price spiral, when

companies increase prices faster than workers get raises and margins rise, as we saw in

2021. Eventually, however, workers catch up, while business revenues growth starts to fall

behind as the economy slows due to monetary-policy tightening, causing margins to drop,

as seems likely into 2023, when stagflation probably sets in.

Indeed, given growing labormarket tightness, our research indicates little wage growth moderation in coming quarters. As high labor-cost inflation combines with slowing growth in nominal

magnitudes, such as GDP and corporate revenues, we expect earnings growth to

decelerate significantly as margins contract, with a mid-single-digit profits gain likely this

year followed by a potentially large decline in profits in 2023.

In sum, excess demand combined with labor shortages, energy-supply limitations, and a

government-policy-related surge in inflation create risks of a much shorter expansion

compared to past business cycles. The combination of elevated P/E ratio multiples, rising

interest rates, and significant profits headwinds ahead, suggests that the economy may

enter the late-cycle phase of the business cycle, with uncertainty, volatility and risk

aversion increasing as 2023 approaches. Without glaring excesses on the business

investment or residential housing construction front, a profits recession would be the

most obvious channel for the next recession to end the greatest inflation since the1970s.