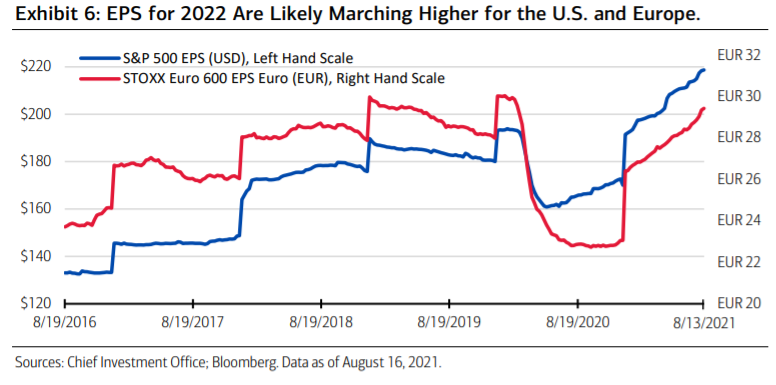

Merrill har analyseret virksomhedernes indtjening og ser en klar tendens til, at indtjeningen pr. aktie vokser i resten af året, og at indtjeningen næste år bliver højere end i år. Det gælder i både USA og Europa. Merrill vurderer dog, at både store og små amerikanske selskaber vil klare sig bedre end udenlandske. Blandt S&P 500-aktierne ventes EPS at stige med 10 pct. i forhold til i år og sætte rekord med 219 dollar pr. aktier. Det går ikke helt så godt i Emerging Markets, men Merrill råder investorerne til at holde fast i EM-aktierne.

Key Drivers and Portfolio Considerations for the rest of 2021

So far this year, economic growth has been running at over 10%, while inflation reports have consistently come in above the Fed’s flexible target of 2%.

U.S. equities have continued to trend higher (large-caps +18%; small-caps +11% YTD2), but below the surface we’ve seen some significant churn, which in part can be attributed to the Delta wave. Value stocks have underperformed Growth by roughly 9% since May. Cyclical sectors like financials, materials and industrials have stalled, while mega-cap technology names have regained their leadership, overcoming valuation concerns.

Meanwhile, the reopening trades have been challenged—the Hotels, Restaurants & Leisure index3 has underperformed the S&P 500 by 12% since March; the Airlines index4 by a whopping 33%. Virus concerns seem to have sent investors back into the tried and tested Growth names, which generated enormous cash flows and benefited from longterm trends such as digitization.

Portfolio strategy considerations

An acceleration in economic activity and corporate earnings, lower interest rates, more fiscal stimulus, improving investor sentiment and a robust environment for deal activity have been powerful tailwinds for risk assets. We still favor remaining invested in Equities, with a preference for U.S. Large- and Small-cap stocks over International. U.S. corporate

earnings are currently coming in exceptionally strong, and the S&P 500 index’s earnings per share (EPS) estimate for 2022 is at a new high of $219, which is roughly 10% better than this year’s estimate (Exhibit 6).

The new orders component of purchasing managers indexes (PMI) continues to be elevated, setting the stage for more revisions higher— global earnings revisions ratios have strengthened to 1.52, the third-highest level on record, and is particularly strong for the U.S. and Europe.6 Additionally, operating margin for the S&P 500 has risen to 14%, which is higher than prepandemic levels, in part because companies have been able to manage costs through productivity improvements.

Our view remains that U.S. Equities are likely to grind higher over a 12-month horizon.

Outside the U.S., European fundamentals remain attractive as vaccination rates move up, and employment and the services sector further improve potentially bringing the economy to its pre-virus size in the coming months. However, the Tourism sector is being held back due to travel restrictions causing the southern economies to lag.

Emerging markets (EM)

may still face headwinds as China continues with their regulatory crackdown, and many countries struggle to contain the virus; however, we believe it is worth staying invested in EM as valuations look reasonable compared to the U.S. Timing this volatile asset class is difficult, as performance has tended to come in short-term bursts—for example, in 2020,

EM outperformed the MSCI All-country World Index by 1.9% and the S&P 500 by 40 basis point on a total return basis, and, in 2017, by 13% and 16%, respectively.