Merrill mener, der er udsigt til stigende indtjening i virksomhederne i år, og det betyder, at der kan blive en positiv udvkling på markedet, selv om der er et voksende antal analytikere, som advarer mod et bear-market og en situation, der minder om dot.com-krisen. Disse negative vurderingen næres af de meget store kursstigninger det sidste år, og at der har været et stort antal børsintroduktioner i januar på grund af de høje kursværdier. Men det ændrer ikke ved forventninger om en kraftig stigning i earnings per share for 2021 – på 24 pct.

Near-term Sentiment Risk Balanced with Medium-term Upside in

Earnings

As we near almost a year into this pandemic, it is hard not to reflect on the remarkable current run in the equity market. The S&P 500 is now up 74% on a total return basis since the March lows, as ultra-accommodative monetary policy and unprecedented fiscal stimulus helped to light the fire beneath the rally.

And in recent months, vaccine prospects and renewed hopes for another round of fiscal stimulus have led to greater investor optimism and an improvement in market breadth, with roughly 90% of S&P 500 stocks trading above their 200-day moving average.

Stock-market bears have roared louder, however, as positive sentiment has teetered the line of overly optimistic and a recent spike in volatility led by speculative trading has led to some uncertainty. Fund manager cash allocation levels have fallen to 3.9% on average, sending a bearish “sell signal,” according to BofA Global Research, and absolute equity valuations appear extended.

Some market pundits have compared today to the dot-com era following a surge in initial public offering (IPO) valuations. 2020 saw five of the top 10 U.S. trading debuts on record for companies that went public and raised more than $1 billion, and January of this year saw more U.S. companies go public than any other month in the last 20 years.

Still, near-term sentiment risk appears more balanced against the backdrop of reasonable relative valuations, rising economic activity and a positive earnings outlook for 2021.

Even further, the economic outlook in the dot-com era looked far different from today, with a Fed that was tightening rates, an inverted yield curve, and real GDP running above potential.

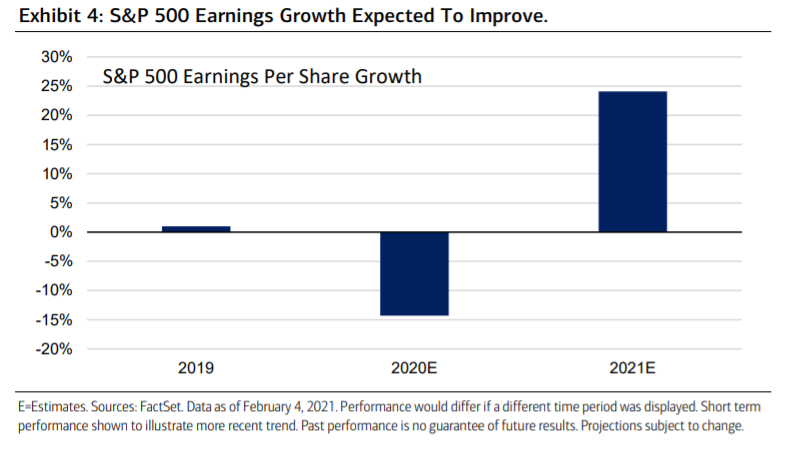

Economists continue to revise their economic growth forecasts up for 2021 with economic data pointing toward a strong recovery. And from an earnings perspective, estimates for 2021 have improved since March 2020, with earnings for the year expected to be up 24% (Exhibit 4).

Expectations could move even higher as the economy continues to recover and as more of the population is vaccinated, allowing for states to ease shutdown restrictions.

Ultimately, what remains core to our bull market thesis for the year ahead is our expectation for corporate profits to surprise to the upside and the strengthening of the economic recovery as vaccine distribution helps to unleash consumer demand. Some nearterm consolidation and volatility may be expected, but we would consider these opportunities to add to risk assets like equities.