Merrill har lavet et sundhedstjek på zombies – selskaber, der kun overlever i kraft af lav rente og stor gæld. Der er typisk mange zombies i sundheds- og energisektoren – og blandt mindre virksomheder, small-cap. De forstyrrer prissætningen på markederne. Der har været en stigning under pandemien, men nu er antallet faldet, og det er en positiv udvikling, mener Merrill, der kun har analyseret de amerikanske zombies. Der er også mange i Europa, ikke mindst i Tyskland, hvor regeringerne har holdt zombies kunstigt i live for at bevare beskæftigelsen, men der er frygt for en bølge af krak, når der sker en normalisering.

Uddrag fra Merrill:

A Health Checkup For Zombies

Since 2018, there has been a growing share of zombie firms in the U.S.; however, this build-up may be in remission as profitability and credit conditions improve.

Generally, zombies are defined as entities that are unable to service their debts from generated cash flow. As a result, these firms must finance operations by burning off cash on their balance sheet or by extending their credit profile. Those quality and solvency stressors typically lead to chronic underperformance and may negatively affect pockets of the market that house a greater proportion of the “walking dead,” such as Small-caps, Healthcare, and Energy. But as the economic recovery powers on, a robust earnings backdrop coupled with benign corporate credit conditions could provide a tailwind.

The pandemic imparted a major shock to the revenues and credit needs of many firms, leading to a spike in the number of companies with interest costs greater than profits, especially amongst small caps.

According to Bloomberg, approximately 566 companies representing 28% of the Russell 2000 Index have trailing 12-month interest costs in excess of operating profits. This compares to 18% of the Russell 1000 Index.

Healthcare, Communication Services and Energy tend to harbor the greatest share of zombies.

But the overall share of zombies is fading, coinciding with an increase in revenues concurrent with a pullback in aggregate leverage. When controlled for more established firms and a look-back across three years of data, Cornerstone Macro Research calculates that the share of zombie firms in the Russell 3000 rose from 4% in 2018 to nearly 6% in the second quarter of 2020, but has since retreated to 5.4%.

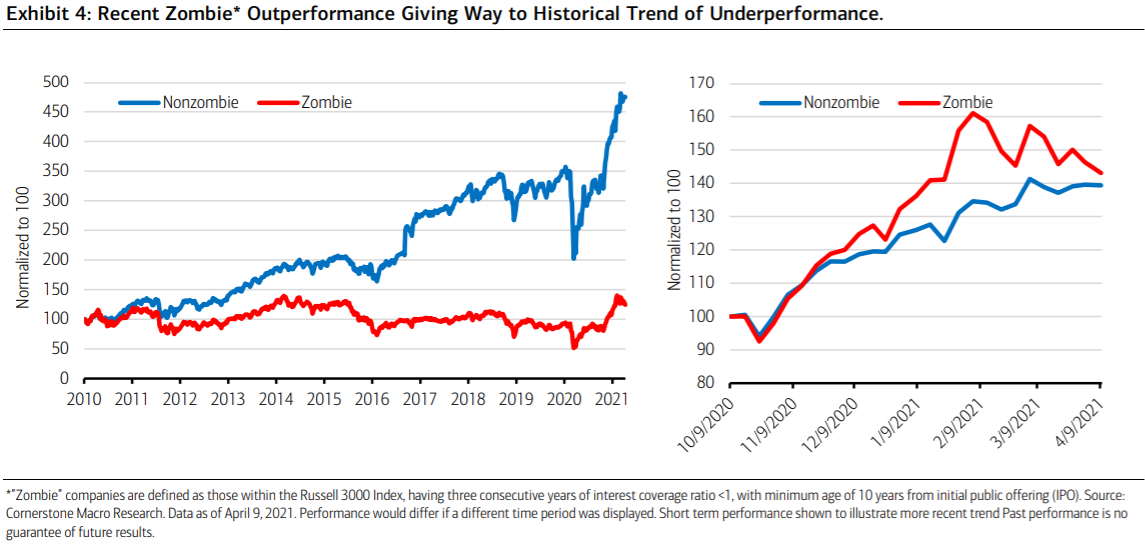

Generally, zombie firms systemically underperform their more profitable and solvent

counterparts, although they can outperform in the beginning of a market recovery as they

did later in 2020 into 2021 (Exhibit 4).

However, that outperformance has since reversed, and we find most importantly that market benefits will likely be accrued via the decline in zombies. As earnings accelerate, credit costs remain low, and corporations deleverage, we find that conditions are ripe for the population of walking dead to recede, which may especially benefit Small-caps, Energy and Healthcare.