Merrill venter, at de amerikanske investeringer vil stige i år, men med moderate én-cifrede vækstrater. Teknologi-investeringer vil føre an, men moderat vækst i forbruget og husbyggeriet vil også styrke erhvervstilliden.

Uddrag fra Merrill:

We think business investment spending could grow at a low- to

mid-single-digit pace in the U.S. in 2020 despite headwinds from the retail, energy and

air transportation sectors. Technology spending should likely continue to lead the way

and gain share. Moderate growth in domestic consumer spending and housing plus a

slight pickup in global growth should reinforce business confidence.

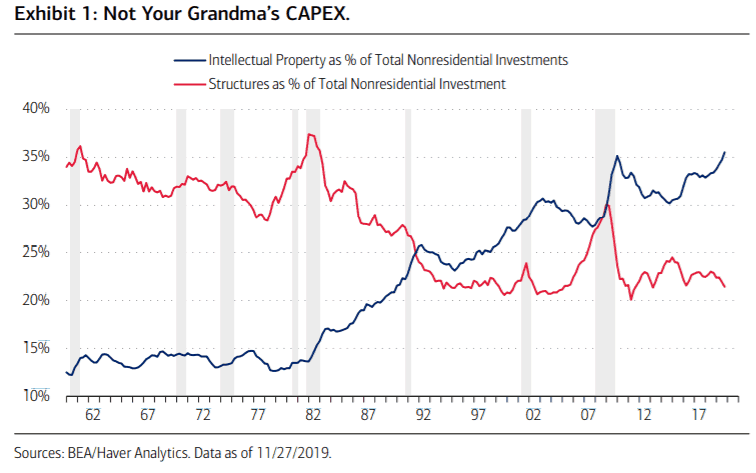

Painting calendar year 2019 broadly as a year with weak capital expenditures (CAPEX) is

misleading. Similarly, the blanket statement that U.S. CAPEX is likely to be weak in 2020

because of issues in the energy, retail and air transportation sectors, for example, ignores

a major structural shift in U.S. business spending dynamics. More than half of business

investment spending now comes from technology spending, including both information

processing equipment and intellectual property products (IPP). The latter (IPP) has been

consistently growing at a high-single-digit pace and makes up more than a third of

total business spending (Exhibit 1). This has been at the expense of more traditional

areas of CAPEX like retail and energy structures. For example, fixed investment in

multimerchandise shopping is about one-quarter of what it was before the financial

crisis. Nominal tech investment at around $1.5 trillion dollars is well over twice the size

of structures investment in nominal terms. Shopping malls are out. The cloud is in.

2 of 9 January 27, 2020 – Capital Market Outlook

A key reason for maintaining our mildly positive outlook for CAPEX in the U.S. is the Federal

Reserve’s (Fed’s) pivot to lower-for-longer interest rates. The interest rate effect should

work through a number of channels. Directly, firms are already seeing lower borrowing

rates as policy rates have moved lower and spreads have narrowed. This was timely as

nonfinancial corporate balance sheets look “late cycle” in terms of leverage ratios. From a

corporate margin perspective, lower interest rates help to offset the pressure on margins

from a tight labor market and moderate wage growth. More indirectly, lower rates have

had a positive impact on housing and other interest rate sensitive sectors that should

ultimately lead to higher levels of business spending via the “accelerator effect.”

The stabilization and potential for a pickup in global growth is also a reason for

optimism. Firms invest for the future in response to past demand but also in anticipation

of future demand. For multinational firms, much of this demand comes from outside the

U.S. According to BofA Global Research, 24 of the 39 central banks covered cut rates in

2019, a synchronized reflation effort. The lagged effects of this global monetary easing

should support global growth and inflation in 2020. They also see a strong case for fiscal

expansion in a number of countries. With both real global gross domestic product (GDP)

growth and global inflation expected to pick up, the acceleration in global nominal GDP

should mean multinational firms see stronger sales growth. This is a positive for CAPEX