Morgan Stanley har en interessant tese: For de investorer, der vil investere her-og-nu på grund af valgresultatet eller tendenserne på selve valgaftenen, kan markedets vurdering af udfaldet være vigtigere end vælgernes dom. De første reaktioner på markedet kan lynhurtigt skabe en tendens, der ikke nødvendigvis har noget med det endelige resultat at gøre, og det kan rive investorerne med. Det endelige valgresultat kan komme mange dage senere end den 3. november. Investorerne skal holde øje med obligationsmarkedet, der handles om natten i Asien. Hvis der er udsigt til en demokratisk sejr, vil renten på T-bonds stige hurtigt i forventning om voksende statsunderskud. Hvis der er en uklar tendens på valgnatten, vil virkningen på obligationerne være behersket, fordi det kan tyde på en svækket regering, mener Morgan Stanley.

Election Night Strategy for Investors

For investors, election night could hinge on moments when markets conclude who has won, not necessarily on when media networks call a winner.

I’m Michael Zezas, Head of Public Policy Research and Municipal Strategy for Morgan Stanley. I’ll be talking about the intersection between U.S. public policy and financial markets.

At this point our listeners are probably familiar with all the policy and market implications of various outcomes. What they may not be familiar with is how to understand the news flow on election night, which might be particularly confusing this time around. That’s because the record-shattering growth in vote by mail is likely to distort the pattern of vote counting and reporting that we’ve become accustomed to.

For investors, this is all about when markets will conclude who has won, not necessarily when a candidate has conceded, or when media networks call the winner.

The road to knowing a result on election night likely goes through Florida and North Carolina. 65% of Florida mail in ballots have been returned, so have 56% of North Carolina ballots. And both states can already count those votes, and have stated publicly those counts will be quickly released upon poll closing.

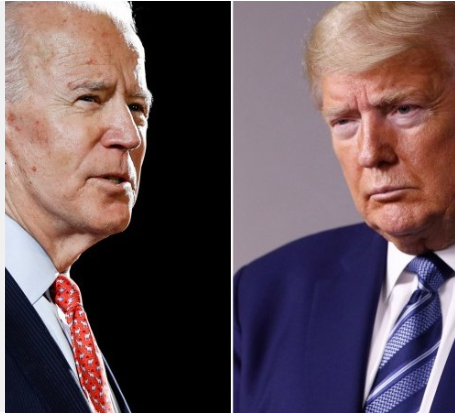

So, both states could return quick results, and this opens up the possibility of knowing the election outcome early in the night. For example, President Trump very likely needs to win Florida. If he appears to have lost, he has probably lost the presidency. Similarly, if the North Carolina Senate race is won by Democrats, then that’s probably an indicator that Democrats have taken control of the Senate by also winning seats in other close races.

Again, networks probably won’t call it that early because you’d have slow counting states with enough electoral votes still outstanding – namely Michigan, Wisconsin and Pennsylvania – but we think markets would bake it in pretty quick.

However, if President Trump wins Florida or keeps it close, then the Electoral College outcome may depend on those slow counting states. And while they have substantial amounts of mail in ballots already returned, they can’t count these votes until Election Day. So those results could take a few days to come in reliably.

And what else should investors be watching? The Treasury market, of course. Treasury yields will trade throughout the night overseas, and we expect will be a good bellwether for election outcomes, which, as we’ve cover before, could drive fiscal policy in different ways.

An early night outcome, which would probably coincide with a Democratic sweep, could lead yields to rise quickly, to pricing substantial deficit expansion. If the race is close, and we’re waiting into the morning or longer for cues from slower counting states, Treasury yield moves could be more muted, accounting for the possibility of a divided government and fiscal gridlock.