Der er 5 gode grund til at kaste et friskt blik på europæiske aktier, mener Morgan Stanley. Den nye EU-fond styrker væksten med op til 1 pct. Europa består ikke kun af “gamle” selskaber, men der er mange tech- og sundhedsaktier med potentiale. Over en lang periode har europæiske aktier klaret sig dårligere end amerikanske, men der er sket en fornyelse i europæisk erhvervsliv med større fokusering på vækst-aktier, især inden for high-tech og sundhed, og som gør det værd at se nærmere på Europa, mener Morgan Stanley. De danske aktier har klaret sig bedre end f.eks. sydeuropæiske aktier. Enkelte lande og sektorer har klaret sig bedre end Nasdaq.

Fresh Look at European Equities

It may be time to toss out “old economy” notions about European equities, as tech and healthcare stocks help the region update its sector mix.

After a decade of underperformance, investors have become a bit wary of European stocks.

Who can blame them? The MSCI Europe Index just clocked its worst 10-year stretch against the S&P 500 since the 1930s, with European stock prices hovering at 100-year lows relative to their cross-Atlantic peers. But, tempting as it is to dismiss the region, recent analysis from Morgan Stanley Research finds that European equities may be worth a fresh look.

“Investor sentiment and positioning toward the region is structurally low, in our opinion,” says Graham Secker, Head of Morgan Stanley’s European and UK equity strategy team. “However, we think the relative investment case for the region is starting to improve from both a top-down and bottom-up perspective.”

European equities are now at a 100-year low relative to U.S. stocks

A New Take on the Earnings-Surprise Strategy

That translates into policy stimulus from central governments and different market leadership on the European Street. Morgan Stanley economists believe that the EU Recovery Fund enacted in July could add 0.6% to 1.0% per year to GDP over the next five years.

Meanwhile, today’s European stock market leaderboard boasts more tech and healthcare companies than “old economy” names in sectors like banking and energy. This transition to a superior sector mix could deliver overall higher and more stable earnings growth and lead to a higher valuation.

To that end, here are a handful of surprising facts that highlight the breadth of changes afoot on the continent.

1. Healthcare has become the largest sector in MSCI Europe.

At 16% of the MSCI Europe Index, healthcare is now the largest sector in Europe, with the biggest increase in weighting of any sector in the past decade. Consumer Staples is close behind at 15%, followed by Industrials at 14%.

To illustrate how “old world” sectors have receded in relative significance, consider that the three sectors of healthcare, consumer staples and industrials combined now account for 45% of MSCI Europe—or three times the share of banks, energy, autos and telecoms combined.

2. Tech now anchors the EURO STOXX 50 Index (SX5E)

Europe is dogged by the perception that it lags the U.S. and Asia in tech, but a look at the SX5E Index tells a different story. Today, tech stocks make up the heaviest weighted sector in the index, ahead of personal and household goods, industrial goods and services, and chemicals.

Tech also leads the MSCI Germany Index with its 14% weighting, ahead of insurance (11%) and capital goods (11%).

Current sector weight of the SX5E Index

3. Financials have declined dramatically since 2010

Europe is also no longer overweight banks. At 6% of MSCI Europe, banks are weighted on par with MSCI’s All Country World Index, which tracks equities globally. That’s down more than half from a decade ago, and only slightly larger than insurance (6%) and diversified financials (4%) today.

A similar story is playing out in the SX5E, where banks (6.6%) are now materially smaller than chemicals (9.8%) and half of household and personal goods (12.3%).

4. The UK as a share of MSCI Europe is down 10% since 2010, but it’s still the largest

At 22% of the wider MSCI Europe index, the UK remains the region’s largest single-country component, despite suffering the steepest decline in relative weighting over the past decade. On the other hand, Switzerland logged the largest increase, up more than five points (16.6%) to slot in just behind France (17.3%).

5. MSCI Denmark is bigger than MSCI Spain, MSCI Italy

MSCI Denmark has been the best-performing country index in Europe by far over the past decade, ranking among the top three performers seven times since 2010. Today, MSCI Denmark is bigger than banking- and utilities-heavy MSCI Spain and MSCI Italy, both of which were four to five times larger, respectively, in 2010.

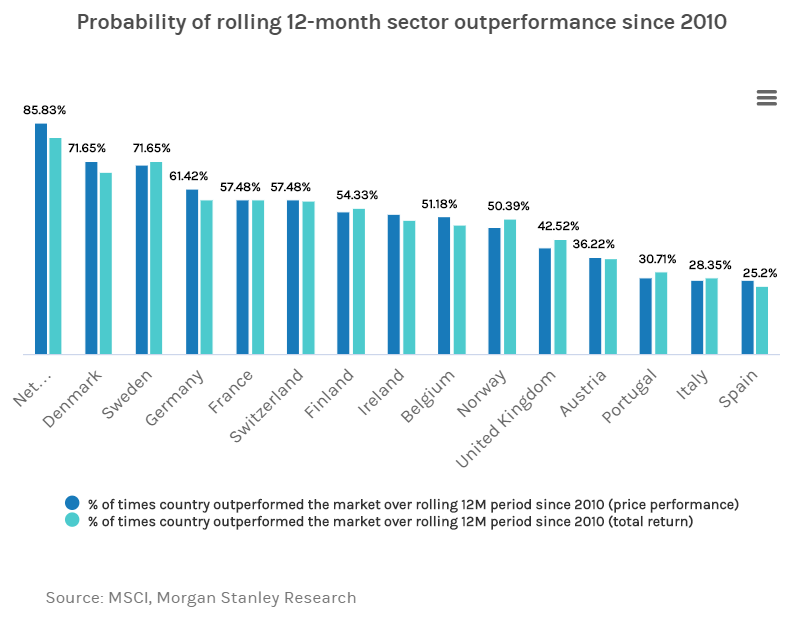

The Netherlands and Sweden have also been consistent top performers, while the UK, Austria and the periphery have consistently underperformed.

Probability of rolling 12-month sector outperformance since 2010

6. Netherlands has the highest correlation to the Nasdaq

The Netherlands has a higher correlation to the Nasdaq than any European sector in the MSCI, including tech. One reason for outstanding Dutch performance over the last decade: increased weight in growth-heavy industries like semiconductors and retail.

Country and industry group relative performance correlations with Nasdaq vs. S&P

7. Semis outweigh autos in market cap

For all the focus on autos as Europe’s bellwether, the sector’s relative market capitalization has been remarkably low for the past decade, fluctuating between 2% and 3%. The sector’s latest 2.2% weighting in MSCI Europe is lower than even semiconductors, at 2.4%. Healthcare, telecoms, software and energy are also bigger. And in MSCI Germany, auto stocks don’t even crack the top five now.

While it may seem hard to be enthusiastic about European stocks when investors remain focused on U.S. and global tech behemoths, Europe’s sector-mix shift toward growth-orientated sectors now makes a relatively stronger investment case for European stocks.