Morgan Stanley har udpeget syv ideer, der kan give gevinst for investorerne i år – enten ved at de satser på ideer eller holder sig fra dem! Mange af ideerne går imod den generelle opfattelse på markedet. Banken fokuserer på, hvad det er, som markedet indtil nu overser. Morgan Stanley tror, at flytrafikken hurtigt kommer tilbage på sporet, især business-rejser. Bitcoin begynder at optræde som banker. Metaverse var en skør idé, men nu er det blevet et gigantmarked. Alle fokuserer på el-biler, men et grønt transportmarked kan overgå alle forventninger, ikke mindst med såkaldte ZEV-lastbiler. Indien er et overset marked, men det står foran en kraftig vækstperiode. Derimod er Morgan Stanley ikke så sikker på, at Kina kommer så kraftigt igen, som mange venter.

7 IDEAS THAT COULD ADD ALPHA IN 2022

From the rise of the metaverse to EV acceleration, these key issues could shape industries and drive asset prices this year. Here’s how our views diverge from the market.

The seven debates range in scope and magnitude, and across industries and regions, but all focus on a single question: What’s the market missing?

Here are seven areas where the views of our analysts, economists and strategists diverge from the consensus.

1. Will Fed Tightening Snuff Out Stocks?

All eyes are on inflation, which came roaring back in 2021. But while the market is bracing for higher inflation, Morgan Stanley’s U.S. economists think inflation will start to retreat after February 2022.

Consumer spending should also remain robust, further supporting their outlook for real GDP growth to reach 4.6% in 2022.

Against that backdrop—and the likelihood of the Fed’s more aggressive removal of accommodation than previously expected—valuations could fall faster than previously expected. “With earnings growth back-end loaded, it raises the risk for equities in first half of the year,” says Chief U.S. Equity Strategist Mike Wilson.

2. Can Global Air Traffic Recover?

Even before Omicron, the market was bearish about the recovery of global air travel, which is fighting the headwinds of COVID-19 testing, vaccines and quarantine requirements.

Having already factored a third wave of COVID-19 into its estimates, Morgan Stanley has not changed course on its view that global air traffic will accelerate through 2022 and recover to pre-pandemic levels by the end of 2023.

“We’ve seen domestic air traffic return to 69% of pre-COVID-19 levels, while international lagged at 20%,” says Kristine Liwag, equity analyst covering Aerospace & Defense. Liwag and her team see improving fundamentals for aerospace. “In our view, this reflects solid demand for travel, but uncertain government travel restrictions and requirements for international travel may have hindered recovery.”

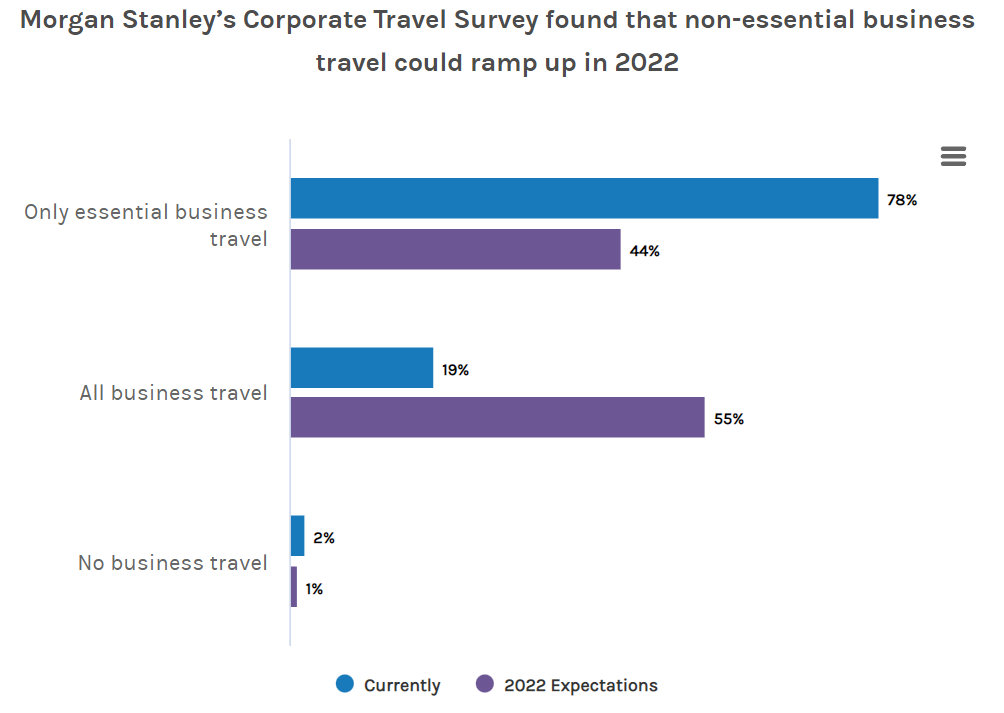

Meanwhile, analysts covering airlines believe significant pent-up demand will propel corporate travel to pre-COVID-19 levels this year. This veers from the market view that the recovery of corporate travel will stall out at 20% to 30% below pre-pandemic levels.

Morgan Stanley’s Corporate Travel Survey found that non-essential business travel could ramp up in 2022

3. Are Crypto Companies Looking Like Banks?

One of the original value propositions of cryptocurrencies is that they removed the middlemen—and the regulators. Now, as many crypto companies begin to offer bank-like products, U.S. regulators could likely require some crypto issuers to register as banks in 2022.

“Crypto companies are becoming more like banks, just as banks have themselves begun to offer crypto products,” says Lead Cryptocurrency Analyst Sheena Shah. “The market is aware that crypto regulation in the U.S. will change in 2022, but it is not clear how quickly that can be implemented or whether alternative regulations may end up becoming law.”

This is most likely to affect companies focused on issuers that offer stablecoins pegged to the U.S. dollar. Recently, many crypto companies have rolled out high-interest stablecoin deposit accounts in the U.S., Shah says, and this isn’t likely to go unnoticed by regulators, many of whom think crypto-dollar lending is a competitor to the current USD banking system.

4. Is the Metaverse a Real Opportunity?

The metaverse has gone from an obscure idea to what many investors equate with the next iteration of the internet. While the metaverse could take many forms, the concept focuses on connecting our digital and physical worlds using highly realistic customizable avatars and virtual reality.

It sounds like science fiction but “In some ways, we already live in a metaverse, as shown by the total time spent by daily active users in the U.S. on digital platforms,” says Internet analyst Brian Nowak.

U.S. daily users of social media, streaming and gaming already spend the total equivalent of about 11 billion days per year consuming digital media and about 14 billion annual days watching linear television—and that time that could move to the metaverse.

How the trend will play out remains to be seen—and it will need to overcome hurdles ranging from computing power to privacy concerns. Nevertheless, this could be an $8.3 trillion opportunity in the U.S. While the market is still debating how long the metaverse will take to develop and what it will feature/use cases may be, “We think the metaverse is most likely going to be a next-generation social media, streaming, gaming and shopping platform,” says Nowak.

The metaverse has a potential $8.3 trillion total consumer expenditure TAM in the U.S. depending on the level of disruption

5. Are Investors Underestimating the “ZEV” Adoption Curve?

Investors have a healthy appreciation of the passenger EV trend, but the market may be underestimating the significance of zero-emissions commercial vehicle (ZEV) adoption for freight transportation and machinery over the next three to five years.

While supply chain disruptions and associated impacts hampered ZEV adoption in 2021, those impacts should reverse in 2022. Improving the total cost of ownership, accentuated by potential “Build Back Better” subsidies, should further improve operator economics that should accelerate adoption.

“With an increasing number of ZEV new market entrants set to ramp up manufacturing capacity in 2022, and incumbents undertaking similar manufacturing ramps, we expect a dramatic increase in ZEV truck sales in 2022,” says Airline and Freight Transportation analyst Ravi Shanker, who estimates that ZEV sales in 2022 will be two to three times that of the prior year.

6. Are Indian Stocks Overvalued?

India’s stock market has had an impressive run in 2021. Yet, rich headline valuations and other concerns have prompted both investors and sell-side analysts to downgrade India.

While it’s true that India’s outperformance may take a pause in the near term due to high valuations, the world’s second-most populous country offers plenty more runway for growth, according to Morgan Stanley’s India Equity Strategist, Ridham Desai.

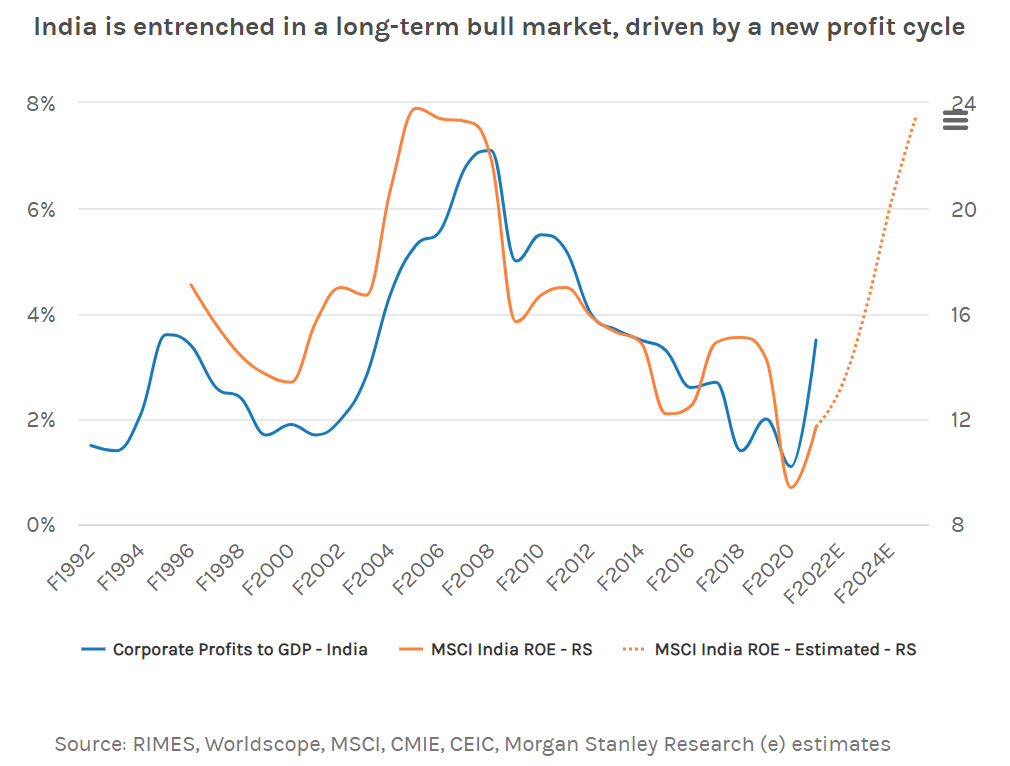

“We think India is entrenched in a long-term bull market, driven by a new profit cycle,” says Desai. “The positives appear to outweigh the risks for those willing to take a view to the end of 2022.”

This new profit cycle is driven, in part, by the government’s shift to support profit growth, which in turn drives investment, job creation and higher wages. “Indeed, higher profits feed into real GDP growth and back into profits so that a virtuous cycle unfolds with a concomitant positive impact on share prices,” says Desai. His team expects earnings to compound at 27% annually over the next couple of years and for the Sensex to rise 16% in their base case to 70,000 by December 2022, albeit mostly in the latter half of the year.

India is entrenched in a long-term bull market, driven by a new profit cycle

7. Can Chinese Equities Make a Comeback?

In 2021, China equities experienced their worst underperformance relative to emerging markets since the global financial crisis. But with foreign investor sentiment toward China equities broadly negative, and monetary and fiscal policy set to ease, many in the market think China is poised for a comeback.

Morgan Stanley strategists aren’t so sure. “We do not think there is a clear path to China equities resuming their long-run pattern of outperformance,” says Jonathan Garner, Chief Asia & Emerging Market Strategist. He and his team have an equal weighting on Chinese stocks based on their outlook that the MSCI China and Hang Seng will increase 10% and 4% respectively in 2022.