Morgan Stanley mener, at investorerne nu skal se ud over finanspakken i USA på 1900 milliarder dollar og fokusere på Bidens næste skridt: “Build Back Better” – nemlig et gigantisk investeringsprogram på 3000 milliarder dollar for at forbedre infrastrukturen og for at satse mere på klimaet. Det vil føre til skattestigninger for ervervslivet, men det afgørende for virksomhederne – og investorerne – er, at der pumpes gigantiske beløb ud i projekter, der gavner traditionelle erhverv som producenter af maskiner, cement, stål – samt bankerne, der skal være med til at finansiere projekterne. Handelsstriden med Kina bliver sat på hold, for nu skal USA først gøres stærkere, inden der tages livtag med Kina.

3 Potential Impacts of “Build Back Better”

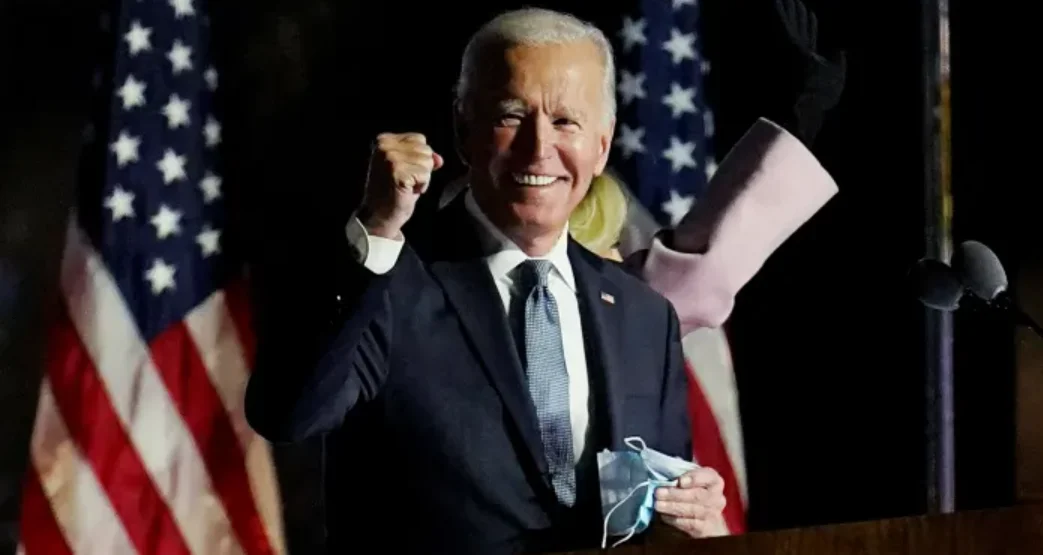

The stage is set for the Biden administration’s major infrastructure and environment initiative. Here’s what investors need to know about the road ahead.

Markets are paying attention as Congress appears close to completing its work on a COVID relief package. But we think the drama around that event is largely over, and markets will quickly shift focus to the next legislative battle: the Biden administration’s proposed ‘Build Back Better’ plan.

Expect headlines to start swirling about the proposal, which could include trillions of dollars of spending to address infrastructure and environmental issues, as well as substantial tax increases. Here’s what we think investors need to know about its potential impact.

First, expect the bill to take most of the year to be enacted and for its size and makeup to appear to change throughout the negotiation, but when enacted, expect it to be supportive of the ongoing economic recovery and reflation trades in the market. Early templates for the bill suggest spending of at least $1.5T.

In our view, that spending will only be partially funded by tax increases, hence adding another dose of fiscal support to the economy. This approach is incentivized by public opinion polls, suggesting voters won’t punish Congress for deficit expansion, and a consensus among Democratic leaning economists that deficit expansion should not be a constraint in the near term.

This is good news for our economists’ view of the ongoing economic recovery, and our Equity Strategy team’s view that the stock market’s reflation trade should continue to do well – namely industrials, materials and financials.

Second, the bill could set the stage for a super cycle on infrastructure spending, which could support stocks in the steel and cement industries. Our colleagues on the U.S. Construction Sector Research team, together with our AlphaWise team, mapped this out in a recent Insight report, finding about $3T of clearly needed infrastructure repair, including $700B for concrete highways, $1.6T for asphalt roads, and $600B for concrete and steel bridges. This suggests any congressional appropriation of infrastructure money could be quickly put to work.

Finally, expect the legislative process to defer tensions with China. That’s not because we expect the U.S. to reach a resolution with China on its various trade policy disagreements. Rather, this Build Back Better plan is part of the Biden administration’s attempt to build leverage ahead of engagement with China.

In addition to increasing coordination with allies, the Biden administration has been open about its view that domestic investment in economic growth capacity is key to incentivizing China to modify its behaviors so it can sustain engagement with the U.S. economy for its companies. While we still think further tension with China is unavoidable, and would expect nontariff barriers between the countries to continue to rise, the US appears to be taking its time to first build its leverage, and that limits the risk that tensions get in the way of building a sustainable economic recovery this year.

So the bottom line, while the press may focus on the downside impact of higher taxes, stay focused on the big picture: more fiscal support for the economic recovery beyond this year.