Få fri adgang til alle lukkede artikler på ugebrev.dk hele sommerferien:

Tilmeld dig tre udgaver gratis af aktieanalysepublikationen ØU Formue, der udkommer igen til august

Uddrag fra Morgan Stanleys Fixed Income Research:

Fighting Tariff Fatigue

Another week, another tariff deadline. This time it’s Friday, August 1, the date that tariffs would increase on key US trading partners such as Europe, Canada, and Mexico unless fresh trade deals are announced or deadlines are extended.

Clients we talk to are certainly jaded when it comes to the tariff topic, and we sympathize. Deadlines have come and gone, tariffs have climbed (although not to the highest levels threatened), but economic data and markets have not rolled over. So, it’s tempting to move on from the idea that US trade policy will move markets.

Resist that temptation. The evolution of tariffs can still create pressure and opportunity. Three reasons why:

- We’re likely not yet seeing the full impact of tariffs on economic data.

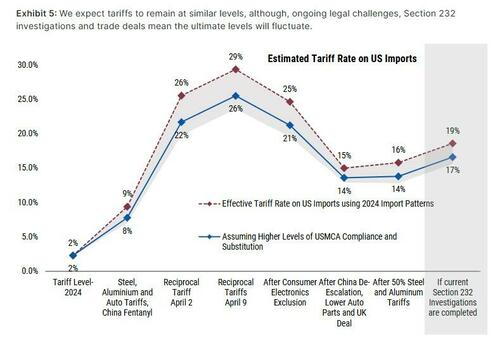

- This week’s tariff deliberations may matter more to the economic outlook – the EU, Canada, and Mexico represent nearly half of all US goods imports. Consider that a five-percentage-point hike in tariffs on these trading partners could double the negative impact on US GDP compared to similar measures against smaller economies.

- Some market effects of tariffs aren’t tied to macroeconomic impacts alone. This might be particularly true in US equities, where there’s important nuance across sectors. In sum, while it’s certainly possible that markets have priced in tariff talk and moved on, there’s good reason to stay focused on US trade policy in investment strategy.

Let’s start with our US economic scenarios:

We still believe the most likely outcome is slow growth and firm inflation: Not a recession, but a backdrop where the adverse effects of trade and immigration controls on growth outweigh the boost from deregulation and fiscal largesse. We assign a 40% likelihood to this scenario.

Second, while we acknowledge room for optimism, we think it would require some de-escalation on restrictive trade and immigration policies or an animal spirits-induced bump from fiscal policy. How likely is this? We pencil in a 20% probability. With some evidence of tailwinds, we cannot fully discount them.

This leaves us with a 40% likelihood of a trade-induced slowdown. Given the current effective tariff rate, ratcheting up tariffs on important trading partners further in August – several of which have responded to past trade threats with policies of their own – could easily tip the scales toward a mild recession.

In sum, we see outcomes for the US economy skewing toward a slowdown, but with more clarity on the fiscal situation and deficits now front-loaded, the risk of a substantial recession is easing. This aligns with our key views across asset classes, though some markets will be more sensitive than others to differences across these outcomes.

For fixed income, we focus on rates. A tariff-induced slowdown should trigger a rally in Treasuries as a dovish Fed turn approaches. We expect that same dynamic will lead the US dollar to resume the weakening trend that began earlier this year, with help from rising incentives for overseas investors to hedge their dollar over-exposure.

Equities, too, face a nuanced landscape. Our US equity strategy team posits that slower growth won’t interrupt the S&P’s rally, crediting such tailwinds as earnings growth driven by a weaker dollar and greater near-term cash flow in key sectors from revived tax breaks. But trade policy sensitivities matter for sectors. Industrials and capital goods firms, for instance, have pricing power and stand to benefit from domestic investment tailwinds, even amid rising costs. Conversely, consumer goods and retail sectors are more exposed given higher imported input costs and limited pricing power, warranting a cautious stance.

Bottom line…fight the fatigue on tariffs. They’re still too important for markets to ignore.

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her