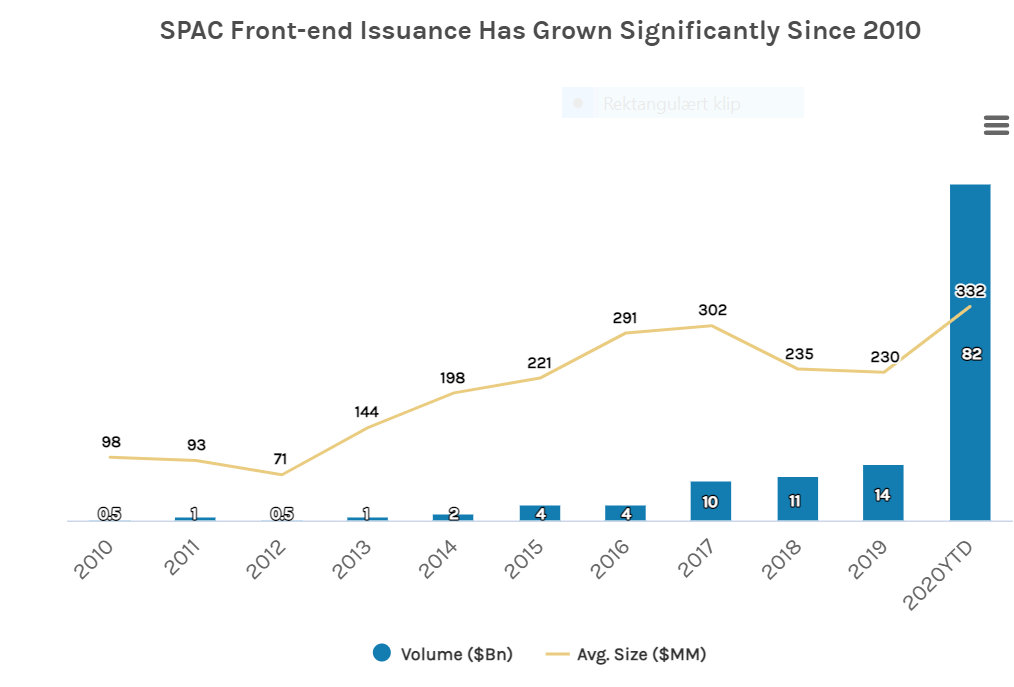

For investorerne er et nyt ord – SPAC – kommet på dagsordenen. Det er betegnelsen for et alternativ til den traditionelle børsnotering, IPO. Morgan Stanley gennemgår og forklarer alternativet. SPAC – special purpose acquisition companies – er en slags skaldyr, nemlig en skal uden indhold. Indholdet kommer først, når skallen køber et selskab for at børsnotere det. Fordelen ved en SPAC er, at det kan skaffe større mængder kapital og har en ledelse med stor finanserfaring, der overtager selskabet i en periode. SPACs har udviklet sig meget langsomt de seneste ti år, men de eksploderede sidste år, hvor de har børsnoteret 332 selskaber til en værdi på 82 milliarder dollar.

SPACs, an IPO Alternative, Explained

A Morgan Stanley banker explains special purpose acquisition companies, their gaining popularity and why more issuers and investors are considering this alternative to IPOs.

Companies and investors have shown growing interest in special purpose acquisition companies (SPACs)—shell companies started for the sole purpose of bringing a private operating company public. In 2020, 248 new SPACs raised $82 billion, more than quintuple 2019’s total volume.1 Recent examples undewritten by Morgan Stanley include Reinvent Technology Partners, formed by LinkedIn Founder Reid Hoffman and Zynga Founder Mark Pincus, and Dragoneer Growth Opportunities Corp. II, sponsored by Draongeer Investment Group.

A special purpose acquisition company is a ‘blank check’ shell corporation that’s raised for the sole purpose of bringing a private operating company public.

To explain how SPACs work—their benefits and why they are gaining popularity—we asked Bennett Schachter, Morgan Stanley’s Global Head of Alternative Capital Solutions, which is responsible for equity private placements, private credit placements, structured capital raising solutions, private investment in public equity (PIPE) and, of course, SPACs.

Q: What is a special purpose acquisition company? How do special purpose acquisition companies work?

Bennett Schachter: A special purpose acquisition company is a “blank check” shell corporation that’s raised for the sole purpose of bringing a private operating company public. SPACs are referred to as “blank check” because when they’re formed, they haven’t yet identified a private company to merge with and take public. When the SPAC identifies and merges with the private company, the merged company becomes public.

Q: Who would form a SPAC and why?

Schachter: Former public-market executives, private equity investors, hedge fund investors and growth equity investors might all be interested in forming a SPAC. What they all have in common is a degree of public-market experience in guiding companies.

For former public-market executives, SPACs offer a way to bring in capital to a company and to potentially take a leadership role as a chairperson or board member. For private equity investors, SPACs are another way for their fund to hunt for acquisitions that may be tangential to their typical target profile. A growth equity or hedge fund may see SPACs as a vehicle to aggregate capital from other public market investors and deploy it into proprietary late-stage private company deal flow—alongside what they would do normally.

Q: What attracts investors to SPACs?

Schachter: Investors invest in SPACs to get a look at the SPAC sponsor’s deal flow and hopefully participate in a transaction that will bring a new and exciting private company to the public markets.

In addition, SPAC investors typically receive fractional warrants that can convert into additional IPO shares, a small amount of interest on cash while it sits in trust until the SPAC sponsor acquires a target, and redemption rights on every invested dollar in the SPAC at IPO in the event the investor doesn’t want to roll their ownership into shares of the SPAC’s target acquisition.

The SPAC warrants are not linked to investors’ redemption rights, meaning investors can redeem all invested capital and get their money back plus interest, and still keep their warrants.

Q: Why would a company use a SPAC vs. IPO?

Schachter: Because of the SPAC’s capital uncertainty (as I mentioned, the investors in the SPAC have redemption rights on the full amount of capital the SPAC raised in its IPO) and the cost of the SPAC’s capital (SPAC sponsors receive a “promote,” which typically grants them equity in the SPAC equal to 25% of the capital raised, or 20% of the fully-diluted SPAC shares), the SPAC has to offer something to the company that the IPO does not.

That thing may be size—a SPAC can allow a company to raise a larger percentage of its equity than a typical IPO. Or that thing may be affiliation with a highly credentialed executive, executive team and/or financial investor that can bring others to invest in the combined company. A SPAC can also offer a high degree of flexibility for sellers to the extent that they want to cash out or roll into equity.

Q: Why are SPACs so popular?

Schachter: In 2020, SPACs executed a number of high-profile mergers that brought exciting companies to the public markets. That, of course, attracted interest. In addition, the quality of SPAC sponsorship shifted to include a higher percentage of world-class CEOs and some very exciting growth equity investors.

Against the backdrop of a constructively-priced equity market, low interest rates and liquidity flush throughout the system, investors see parking their money in SPACs as having small opportunity costs, with the potential for generating alpha.

SPAC Front-end Issuance Has Grown Significantly Since 2010

Given the increase in SPAC issuance and higher quality of SPAC sponsors, competition among outstanding SPACs has led to evolution of the structure.

Q: What’s your outlook on SPACs going forward?

Schachter: Given the increase in SPAC issuance and higher quality of SPAC sponsors, competition among outstanding SPACs has led to evolution of the structure, to make it more aligned with the interests of all stakeholders, including the SPAC itself, the company that sells to the SPAC and the investors. Part of the product’s evolution is a new “promote” that SPAC sponsors receive.

In fact, Morgan Stanley has developed a new structure called a Stakeholder Aligned Initial Listing (SAIL) vehicle, which changes the entire “promote” and cost structure of a traditional SPAC. Instead of the SPAC sponsor receiving 20% of the equity of the vehicle (which results in immediate dilution for the target-company shareholders) irrespective of post-transaction share price performance, the SAIL promote is entirely performance based.