Uddrag fra Morgan Stanley

Thematic work has long been a focus of Morgan Stanley Research. We launched Blue Papers and Insights as part of our rebranding in 2016, and in 2021 we established Thematics as a Research discipline. Last year, seven of our ten most-read reports fell under this rubric and, according to our calculations, ten companies levered to our themes arguably contributed more than half of the S&P 500’s total return of 25% in 2024. These numbers underscore the importance of the annual gathering of analysts, strategists, and economists that our Global Head of Research Katy Huberty highlighted in What’s Next in Global Macro: Asking the Big Questions.

Let’s drill down into the four key themes for 2025 that emerged from our global collaboration. While none are completely new, all are ‘evolved’ in their application to investment strategy.

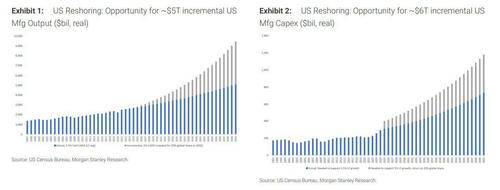

- Rewiring commerce for a ‘multipolar world’: This returns to our list of key themes after a hiatus in 2024. Why? In short, it’s clear that policymakers in the US and globally are poised to implement policies that will speed up the devolution of the globalization which marked much of the post-Cold War period. Said more simply, policymakers are keen to promote their visions of national and economic security through less open commerce and more local control of supply chains and key technologies. Multinationals’ and sovereigns’ adaptation to this reality may have to accelerate. Some will face tougher choices than others, while there are some who may still benefit from facilitating this transition. Knowing who fits into which category will be critical for investors.

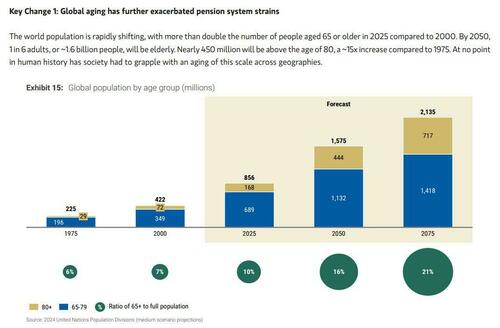

- Longevity: This theme carries over from 2024, but with more attention to measurable impacts. The ripple effects of an aging population, the drive for healthy longevity, and challenging demographics across many geographies will continue to matter for governments, economies, and corporates. In 2025, we see investors focusing on multiple longevity debates: (1) innovation across healthcare, especially in an AI world, with obesity medications remaining front and center (on access, the launch of oral variants, and implications for other therapeutic categories); (2) impacts on consumer behavior, including the drive for affordable nutrition; (3) the need to reskill aging workforces, especially if retirement ages move higher; and (4) implications for financial planning and retirement, with a bull market for advice just starting.

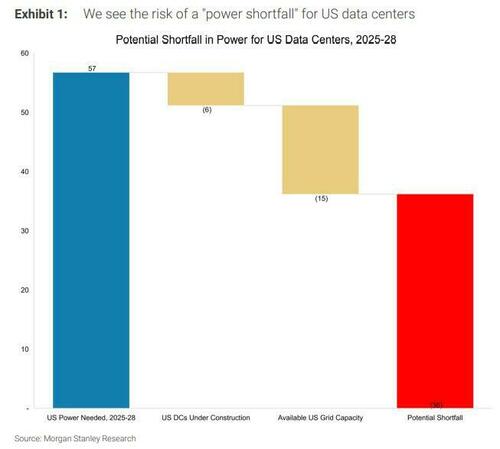

- Future of energy: In 2025, our focus shifts from decarbonization to the wide range of factors driving the supply, demand, and delivery of energy across geographies. The common thread is the potential for rapid evolution. Four key dynamics: (1) an increasing focus on energy security; (2) the massive growth in energy demand driven by trillions of dollars of AI infrastructure spend, to be met by both fossil fuel-powered plants and renewables; (3) innovative energy technologies such as carbon capture, energy storage, nuclear power, and power grid optimization; and (4) increased electrification across many industries. Relatedly, we continue to believe that carbon emissions will likely exceed the targets in various nations’ climate pledges. Hence, we expect focus to shift toward climate adaptation and resilience technologies/business models.

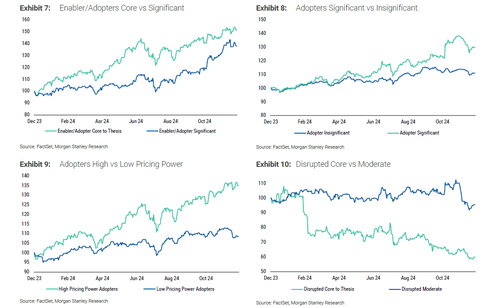

- AI tech diffusion: Artificial intelligence (AI) continues to reshape industries, economies, and our daily lives. Though it’s been two years since the launch of ChatGPT, we’re still in the early innings of AI’s diffusion across sectors and geographies. However, while 2024 was driven by AI enablers and infrastructure companies, in 2025 we expect the market to focus on early AI downstream use cases that drive efficiency and market share. As our colleague Ed Stanley showed recently, there’s alpha in understanding this rate of change. Agentic AI will be center stage, with robust enterprise adoption, stock outperformance for early adopters, positive surprises in model capabilities, greater breadth of monetization, and thus less attention to ROI debates.

And what if we’re wrong? We’ll evolve our list and research focus. Along the way, we’d love your questions, feedback, and pushback

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her