Ukraine-krigen, sanktionerne, rentestigninger og prisstigninger har skabt usikkerhed blandt investorerne. Hvad skal de gå ind i? Men Morgan Stanley har fundet ét område, hvor der er temmelig sikre muligheder for investorerne: Den gode gammeldags kødproduktion. Den globale efterspørgsel er steget kraftigt, især fra Kina, og det gavner især sydamerikanske producenter. Hidtil har kødproduktionen været overset, også på grund af mange forbrugeres modstand af hensyn til klimaet. Men kød er i denne tid et godt investeringsmål, mener Morgan Stanley. Priserne kan i år og næste år drives i vejret med 80 pct., og Kina er på vej til at aftage en tredjedel af verdens kødhandel. Traditionelt ligger sydamerikanske bøf-priser under de nordamerikanske, men den nye udvikling kan føre til en udligning og dermed stigende globale kødpriser.

Bullish on Beef

Global demand for beef is growing significantly faster than supply—and that’s particularly good news for both investors and Latin American beef producers.

Long-term investors have traditionally dismissed the beef industry as highly cyclical and at odds with changing consumer preferences and environmental concerns.

While it’s true that Americans are eating less meat, global demand for beef is growing faster than supply—driven in no small part by China. This has prompted Morgan Stanley to take a bullish view on the Latin American beef industry—led by Brazil, Argentina and Uruguay—which is second only to the U.S. as the world’s top beef producer.

“Our in-depth supply and demand analysis shows that there’s just not enough beef in the world right now with the biggest beef industry producer, the U.S., set to lower production and the largest buyer, China, increasing imports aggressively,” says Ricardo Alves, the lead analyst with Morgan Stanley’s Food & Beverage team for Latin America. “We think the market is missing the strength and secular drivers of top-line growth.”

In a recent report, Alves and analyst Victor Tanaka explain how these supply-demand dynamics could drive beef prices higher in 2022 and 2023—and why their price targets suggest an average ~80% upside for LatAm beef stocks.

“We think very compelling risk-rewards, coupled with a more appealing long-term narrative, may attract investors who are willing to play protein stocks beyond quarterly short-term volatility,” says Tanaka.

Chinese Demand Changes the Dynamics

The beef industry has traditionally been influenced by cattle cycles, which are fluctuations in the herd sizes that typically peak and trough over a 10-year period.

That dynamic will become less important as a driver of sector performance in the coming years, say Morgan Stanley analysts, thanks to a combination of growing demand from emerging markets—China in particular—and lower production in the United States.

“Cattle cycles are important, of course, but we think the industry has changed, with packers taking a bigger share of the beef value chain,” says Alves. “We see a scenario where China imports are up 10% while supply from the U.S. beef industry is down 1%.”

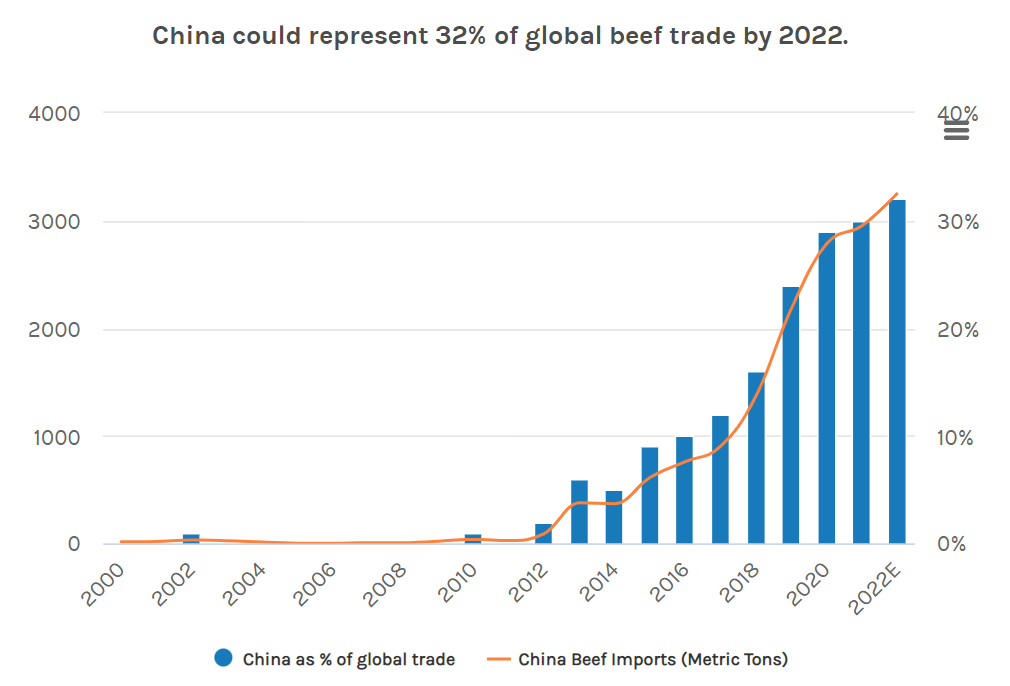

Why is China eating more beef? In addition to the rapid rise of its middle class in the 2010s and other structural drivers, the pandemic unlocked higher consumption per capita as families who were unable to spend on things like vacations and restaurants had more budget available for groceries. In fact, the China beef market could end up representing 32% of the global beef trade in 2022, up from about 12% five years ago and nearly zero a decade ago.

Why LatAm Producers are Well-Positioned

Major Latin American beef producers are particularly poised to benefit, for two reasons:

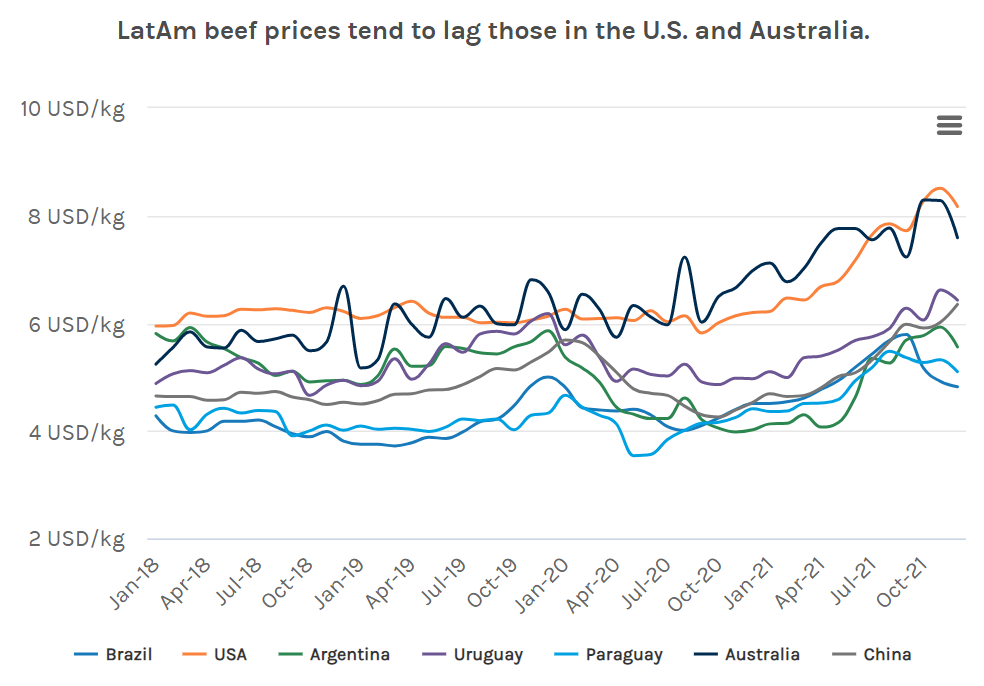

- Latin American beef prices historically trail those of the U.S. and Australia, giving beef exporters in Brazil, Argentina, Uruguay and Paraguay room to increase top-line performance.

- In addition to a reduction in U.S. beef production, smaller Latin American packers overexposed to domestic markets may struggle with cost inflation. This could tighten the already constrained global beef supply, benefiting major Latin American exporters even more.

Bottom line: The market is missing the top-line strength of major Latin American beef producers, ignoring the earning power that could come from changing supply-demand dynamics. As a result, major Latin American producers are trading ~35% below historical multiples.