For et år siden talte alle om, hvor hurtigt krisen kunne blive overstået. Det gik ualmindelig hurtigt, og vi er tilbage på før-kriseniveauet. En graf viser, hvor hurtigt økonomien har rettet sig i forhold til finanskrisen. Men nu er spørgsmålet, hvordan vi kommer videre. Ifølge Morgan Stanley bliver drivkraften investeringer i erhvervslivet. Derfor kan opsvinget holde. MS venter en global stigning i væksten i år på 6,5 pct. – med Indien og Kina i spidsen med henholdsvis 10,5 og 9 pct. samt USA med 7,1 pct. EU halter efter med 4,3 pct. Investeringerne vil bygge på fire faktorer: Den høje pivate opsparing, virksomheders egne investeringer, høj vækst i industrilandene efterfulgt af Emerging Markets samt en forholdsvis lav inflation på sigt.

A Business Investment Surge Ahead

With the global economy on track to pass its pre-pandemic growth trajectory this year, Morgan Stanley economists say that next stage of growth will be driven by a red-hot cycle of business investment.

A year ago, the biggest question for investors was how quickly the global economy would recover from the depths of the COVID-19 recession. Today, the answer is clear: After the single largest drop in quarterly gross domestic product on record, GDP is already back on its pre-COVID-19 path.

Now, the debate is whether the strong recovery and pick-up in inflation are part of a short-lived spurt, driven by policy support and economic reopening.

In their 2021 midyear economic outlook, Morgan Stanley economists outline why they think this recovery has staying power, with forecasts for 6.5% global GDP growth for 2021—led by the U.S. economy’s 7.1% growth—followed by 4.8% globally and 4.9% for U.S. in 2022.

Morgan Stanley Real GDP Growth Forecasts

| 2020 | 2021E | 2022E | |||

|---|---|---|---|---|---|

| Actual | MS | Consensus | MS | Consensus | |

| GLOBAL | -3.2 | 6.5 | 6.1 | 4.8 | 4.3 |

| DM | -5.1 | 5.5 | 5.2 | 4.6 | 3.9 |

| U.S. | -3.5 | 7.1 | 6.5 | 4.9 | 4.0 |

| Euro Area | -6.7 | 4.3 | 4.1 | 4.8 | 4.2 |

| Japan | -4.8 | 2.5 | 2.9 | 2.9 | 2.1 |

| UK | -9.8 | 6.4 | 5.8 | 5.2 | 5.5 |

| EM | -1.8 | 7.3 | 6.9 | 5.0 | 4.6 |

| China | 2.3 | 9.0 | 8.5 | 5.8 | 5.5 |

| India | -7.0 | 10.5 | 10.3 | 6.5 | 5.6 |

| Brazil | 4.1 | 2.8 | 3.4 | 2.7 | 2.4 |

| Russia | 3.0 | 3.6 | 3.2 | 3.0 | 2.5 |

Three key factors drive this outlook for a sustained recovery. “First, COVID-19 was quite different from the Global Financial Crisis, which was born out of excessive private-sector leveraging,” says Chetan Ahya, Morgan Stanley’s Chief Global Economist.

Second, policymakers responded to the pandemic’s economic impact actively and aggressively.

Finally—in the biggest departure from the prior recovery—policymakers want to see inclusive growth before they put the brakes on support. “After the last recession, the Fed tightened rates at a much higher rate of unemployment than it is targeting now,” says Ahya.

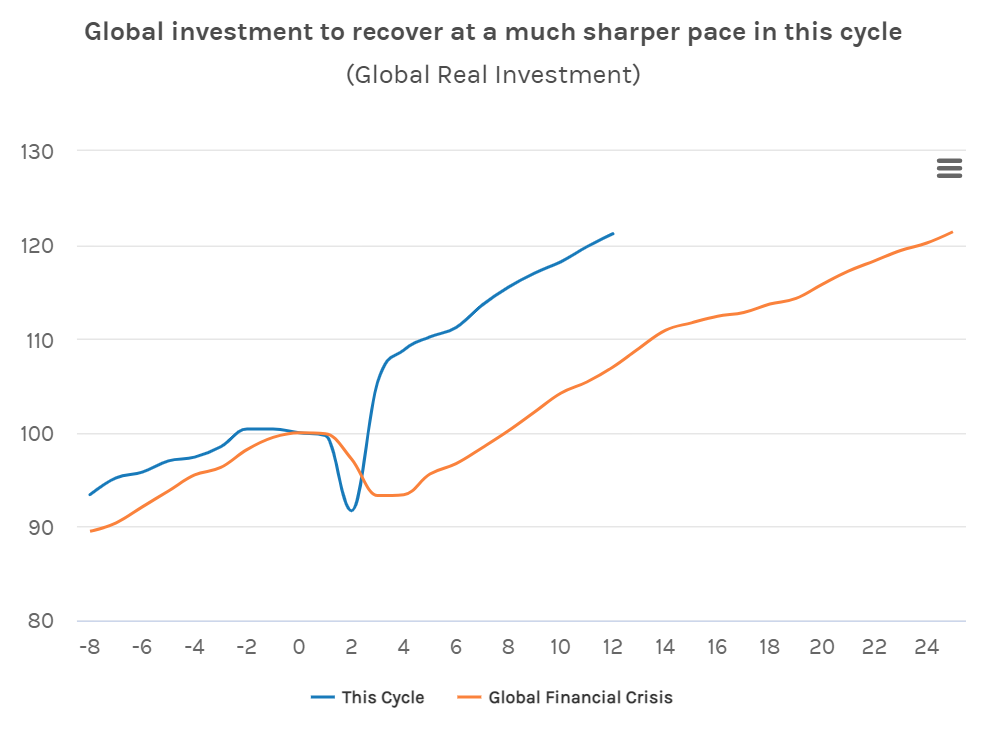

Global investment to recover at a much sharper pace in this cycle

(Global Real Investment)

Here are four points for investors to ponder on the economic road ahead:

1. Consumers Have Money to Spend

The sharp rebound in consumption lifted global growth, and Morgan Stanley economists project that this surge in spending will continue.

Despite higher levels of unemployment over the past year, average U.S. household income—bolstered by economic-impact payments and supplemental unemployment benefits—has already exceeded its pre-COVID level.

In addition, many households, perhaps surprisingly, have excess savings due to the pandemic. “COVID-related spending limitations on service-sensitive parts of the economy have resulted in an impressive accumulation of savings, which can be deployed to fund pent-up demand,” says Chief U.S. Economist Ellen Zentner. She and her team estimate that, between March 2020 and April 2021, U.S. households built up about $2.2 trillion in total excess savings.

2. Corporate Capital Spending Will Sustain Growth

Companies are also looking to spend. “With growth prospects brightening, as we move deeper into the recovery, companies are investing again,” says Ahya. “We think capital expenditures will be comparable to what we saw post-World War II.”

This would set up the world economy for a red-hot capex cycle that could lift global GDP above its pre-COVID-19 path, starting in the third quarter of 2021. Morgan Stanley economists believe that global investment could reach 115% and 121% of prerecession levels, by the end of 2021 and 2022, respectively. Historically, it’s taken twice as long to reach those levels. Indeed, capex took 10 years to recover after the Global Financial Crisis.

2021 U.S. Economic Outlook: Bull and Bear Scenarios

| 2019 | 2020 | 2021 | 2022 | |||||

|---|---|---|---|---|---|---|---|---|

| % Y | Actual | Base | Bear | Base | Bull | Bear | Base | Bull |

| Real GDP | 2.2 | -3.5 | 6.5 | 7.1 | 7.8 | 2.4 | 4.9 | 7.3 |

| CPI | 1.8 | 1.2 | 3.0 | 3.3 | 3.6 | 1.1 | 2.3 | 3.2 |

| Unemployment Rate | 3.5 | 6.7 | 5.0 | 3.9 | ||||

| Policy Rate (EOP) | 1.625 | 0.125 | 0.125 | 0.125 | 0.125 | 0.125 | 0.125 | 0.125 |

3. DMs Leading, EMs to Follow

The U.S. economy is playing an outsized role in driving the strong global growth story in this cycle; but other markets should benefit from similar dynamics, as vaccination rates and reopening progress.

“In developed markets, the surge in domestic demand should lift output and corporate confidence,” says Ahya, whose team is forecasting 5.5% and 4.6% GDP growth in 2021 and 2022, respectively, for developed markets. The 2021 outlook includes 4.3% growth for Europe, 6.4% for the UK and 2.5% rebound for Japan.

Emerging markets, meanwhile, are already benefiting from strong external demand. Morgan Stanley believes GDP growth in these markets could reach 7.2% this year, led by China and India. While slower vaccination rates are hampering domestic demand there, these countries will eventually see their own spending rebound.

4. Inflation Is More Than Just a Number

Finally, the inflation question. Although Morgan Stanley thinks U.S. inflation may have peaked in May, transitional factors, such as supply constraints and pent-up demand, are likely to lead to large swings in inflation data. All told, Morgan Stanley economists see U.S. core inflation settling above 2% for this forecast period.

Still, higher inflation may not portend higher rates. “We see the Fed on track to deliver the first rate hike in the third quarter of 2023, with a gradual removal of policy accommodation thereafter,” Zentner says.

This is all to say that the macro environment is shaping up to look very different from that of the post-2008 recovery. “After the financial crisis, fears of secular stagnation resurfaced,” says Ahya. “But this time around, active and aggressive fiscal and monetary policies have limited the scarring effects and kept private-sector risk appetites buoyant.”