2021 kan se en bølge af fusioner og overtagelser efter et 2020, hvor virksomhederne var bange for M&A. Men netop coronakrisen har skabt potentiale for strategiske konsolideringer, mener Morgan Stanley, fordi krisen har skabt grundlæggende forandringer i erhvervslivet. M&A-markedet kan eksplodere i slutningen af året. Vi kan se udviklingen, ingen kunne forestille sig, ligesom ingen kunne forudse coronakrisen og dens økonomiske konsekvenser, f.eks. med hjemmearbejde og high-tech selskabernes fremmarch. Derfor kan M&A i 2021 udvikle sig helt uden for de historiske normer, også fordi der er enorme kapitalmængder til rådighed. Morgan Stanley venter, at der især vil blive megen M&A-aktivitet i de sektorer, der blev ramt hårdt af coronakrisen.

M&A in 2021: An Accelerating Rebound?

Will an M&A rebound gain steam in 2021? Morgan Stanley bankers see potential strength fueled by strategic consolidations, cross-border activity and a rebound in deal-making for COVID-affected sectors.

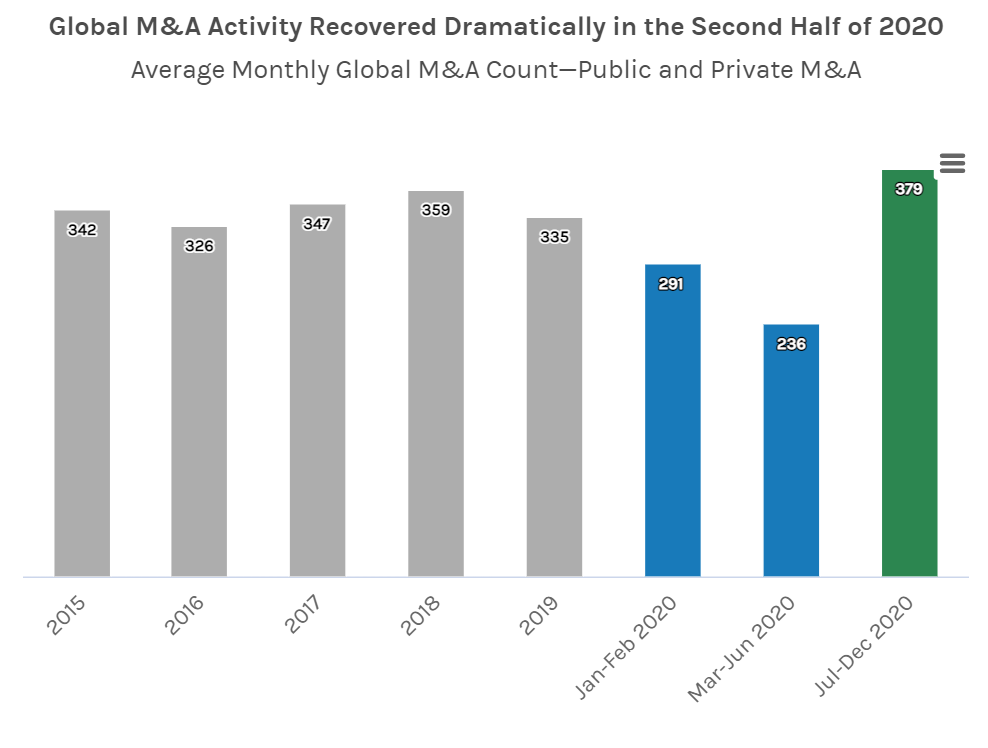

This year, the M&A market couldn’t be more different. It’s already begun by carrying over momentum from a flurry of deals in the latter half of 2020 and stands poised to accelerate, according to Morgan Stanley’s M&A bankers. “All the elements are there for an active M&A market in 2021, from corporations looking for scale and growth to private equity firms and SPACs looking to invest capital,” says Rob Kindler, Global Head of M&A at Morgan Stanley.

To be sure, plenty of uncertainty lingers, including the pace of COVID-19 vaccinations and a new political administration in the U.S. Nevertheless, several factors are expected to drive strength in M&A activity in 2021.

A Year Unlike Any Other

Brian Healy and Tom Miles, Co-Heads of Americas M&A, say that if they could sum up 2020 in one sentence it would be: “Wow, didn’t see that coming.” Indeed, nothing about the year was predictable, from beginning to end. “No one expected the pandemic, of course,” Healy says, “but I don’t think we expected that the M&A market wouldn’t just recover, but actually go into overdrive with activity by the end of the year, far beyond the historical norm.”

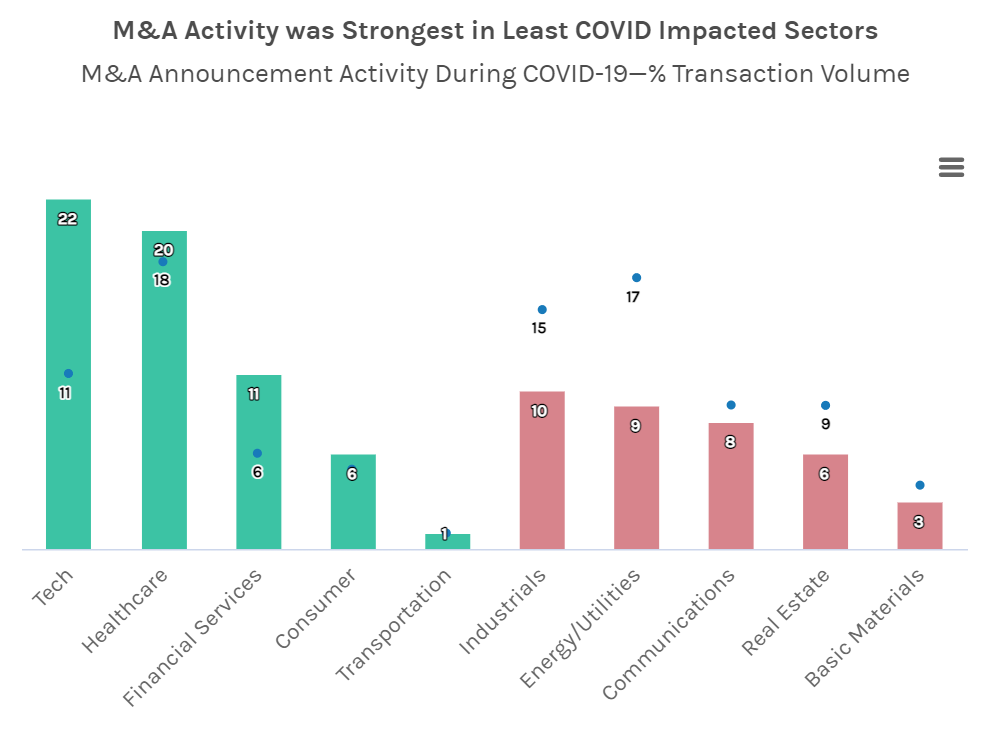

Green bars refer to transaction volumes that totaled more than their historical percent contributions.

Red bars refer to transaction volumes that totaled less than their historical percent contributions.

Blue dots refer to historical percent transaction volumes from 2017 to 2019.

Looking Ahead

Several tailwinds can support robust activity in 2021: Companies will focus more on deploying capital to accelerate growth, gain scale and digitize their businesses; markets are supportive with a historically low cost of capital; and business conditions in COVID-impacted sectors can improve as vaccinations increase.

These key trends may characterize a strong M&A market this year:

1. Supportive markets with low capital costs

Access to inexpensive and plentiful capital fed the M&A market in the second half of 2020, which may still provide a tailwind for deals in 2021. As the global economic rebound reaches for a higher gear of growth this year, persistently low interest rates are expected to keep the cost of borrowing down. Those conditions, combined with the prospect for companies’ renewed confidence to deploy capital, could fuel increased deal flow.

“Companies are more comfortable allocating capital now than earlier in the pandemic,” Healy says. “And M&A remains one of the most attractive ways for them to achieve growth, making 2021 another potentially busy year for M&A funded by the historically low cost of capital.”

At the same time, with equity market valuations at relative highs, an increase in stock-for-stock transactions could be likely. “When market valuations are elevated but transactions have compelling industrial logic, stock-for-stock mergers can help address issues of relatively high valuations while allowing the shareholders of both companies to unlock value from the combination,” Healy adds.

2. Rebound in sectors impacted by COVID-19

M&A across industries diverged in 2020, with activity strongest in sectors least impacted by COVID-19. Meanwhile, deals were scarcer in areas that lacked a near-term path to recovery, such as commercial aerospace, energy, real estate and retail. “The sectors that offered greater visibility and predictability for balance sheets, revenue and earnings were where the deals got done,” Miles says. “But if there was significant uncertainty about the near- or medium-term outlook, companies preferred to wait.”

While sectors more sheltered from COVID-19 may continue to contribute strong deal volume to overall transactions this year, industries more affected by the pandemic may release their pent-up M&A demand in 2021.

Indeed, more businesses are now emerging with better line of sight into how they can rebound, which means more clarity on valuations and pricing for purchases or sales. “We see a return to more normal operating conditions for some sectors that were impacted from an M&A perspective in 2020, such as industrials, consumer discretionary or natural resources,” Miles says.

3. Companies increasing scale and acquiring technology

Amid a turbulent business environment last year, companies pursuing stock-for-stock mergers to gain scale comprised many of the largest corporate M&A transactions. “It has always been true that scale matters,” says Miles, “and if the pandemic has proven anything, it’s that you have to be large enough in order to survive these market upheavals. Operational scale and greater access to capital markets has been a big benefit for larger companies across the board.”

As the pandemic lingers and corporates remain focused on accessing capital, strengthening their positions and investing in scale, consolidations may continue in sectors including technology, healthcare and financial services. As technology drives growth, efficiency and innovation and digitization of the economy continues across industries, tech companies will remain in-scope as M&A targets across sectors this year.

4. Recovery in cross-border M&A

International M&A activity declined for a second straight year in 2020. For companies looking to engage in cross-border transactions, COVID-19 only added to the uncertainty from global geopolitical tensions, Brexit, the U.S. presidential election and continued regulatory scrutiny in certain sectors. With limitations on global travel, corporates were more hesitant to do virtual due diligence on targets in foreign jurisdictions.

However, international targets remain a focus for corporates looking to increase global scale and strengthen supply chains, which could drive a recovery in cross-border deal-making, despite regulatory scrutiny in certain sectors.

5. Abundant capital from private equity and SPACs

Private equity firms may also continue to contribute significantly to 2021 M&A volume. Sponsor-backed transactions comprised 26% of overall M&A activity in 2020, the highest proportion since before the global financial crisis.3 By the end of 2020, financial sponsors were sitting on a record $2.9 trillion of available capital.4

In addition, special purpose acquisition companies (SPACs)—shell companies created for the sole purpose of taking a private company public—may continue to be a significant presence among bidders in the 2021 M&A market, as their finite window to identify transaction targets creates urgency and public market valuations exceed that of private companies in many sectors. In 2020, 248 new SPACs raised $82 billion in the U.S.—more than five times 2019’s total volume.5 As of early February 2021, approximately 300 SPACs remain in search of acquisition targets.