En analyse fra Morgan Stanley viser, at verden er ved at blive langt mindre globaliseret og mindre sammenhængende. Men lande som Mexico, Indien, Vietnam og Tyrkiet kan få gavn af den udvikling. De får gavn af, at virksomheder i USA og Europa vil sprede deres indkøb og produktion på flere end de traditionelle markeder. Pandemien og krigen i Ukraine har forstærket den udvikling. Men det vil tage flere år med et sådant skifte, og det kan blive en dyr omkostning for virksomhederne. De kan ikke uden videre flytte produktionen fra f.eks. Kina, og en omlægning fra global til lokal produktion kræver investeringer og udgør en forsyningsrisiko. Analysen viser, at ledere i USA og Europa slet ikke er særligt forhippede på omlægningen.

Can Thinking Local Fix Global Supply Chains?

The global economy is becoming increasingly decentralized as part of a trend dubbed “slowbalization.” A look at what that means for supply chains and which countries and sectors may benefit from the shift toward a multipolar world economy.

As anyone who has shopped for basic consumer goods or tried to source materials for manufacturing knows, today’s supply chains are broken. Certainly, the pandemic and the Russia-Ukraine war have underscored that reality.

But what will the supply chain of the future look like?

According to new analysis from Morgan Stanley Research, a far less global and less deeply interconnected model is emerging, one more focused on trade among regional players and allies, and characterized by a shift from a few global economic powers toward multiple political and economic centers.

And while the full effects of this “slowbalization” will take years to emerge, the process is well underway. Countries like Mexico, India, Vietnam, and Turkey could benefit, as could several key sectors, including defense and cybersecurity.

The Shifting Tides of Trade

Since the late 20th century, globalization—the interweaving of world economies through cross-border flows of ideas, goods, services and capital—has been the prevailing trend. Rapid improvements in technology, transportation and communication suggested that this trend would always move in one direction—toward greater interconnectedness. At the same time, companies innovated to streamline supply chains and “just-in-time” logistics—a lean manufacturing approach emphasizing low inventory levels that helped alter trade patterns.

But even before Covid-19, a combination of trends, such as changes in consumer preferences, increased purchasing power in emerging markets, and geopolitical shifts such as tariffs, increased foreign investment reviews and heightened national-security sensitivity in tech trade began conspiring to slow globalization—and even reverse it.

This year, the Russia-Ukraine war and its effect on supply chains further revealed the pitfalls of economic interdependence—and reinvigorated the conversation about moving supplies and production home or to closer locales and securing goods from economic allies.

“We expect these forces to drive governments and corporations to invest substantially in on-shoring, near-shoring, and friend-shoring for value chains,” says Michael Zezas, Head of U.S. Public Policy Research and Municipal Strategy at Morgan Stanley Research.

“Mexico, India, Vietnam, and Turkey stand out as countries that could benefit from U.S. and EU companies diversifying value chains.” he adds.

Here’s Why:

- Mexico: Proximity to the U.S., low labor cost and free-trade agreements with the U.S. and EU

- Vietnam: Low labor costs, a bilateral trade agreement with the U.S. and free trade agreement with the EU; less labor availability and distance to the U.S. are challenges

- India: A large labor force, low labor cost and relatively close proximity to the EU core; no free-trade agreement and distance to the U.S. are challenges

- Turkey: Proximity to EU, below average labor costs and a free trade agreement with the bloc

A Costly Conversion

But how hard will the transition be—and are companies up for the task?

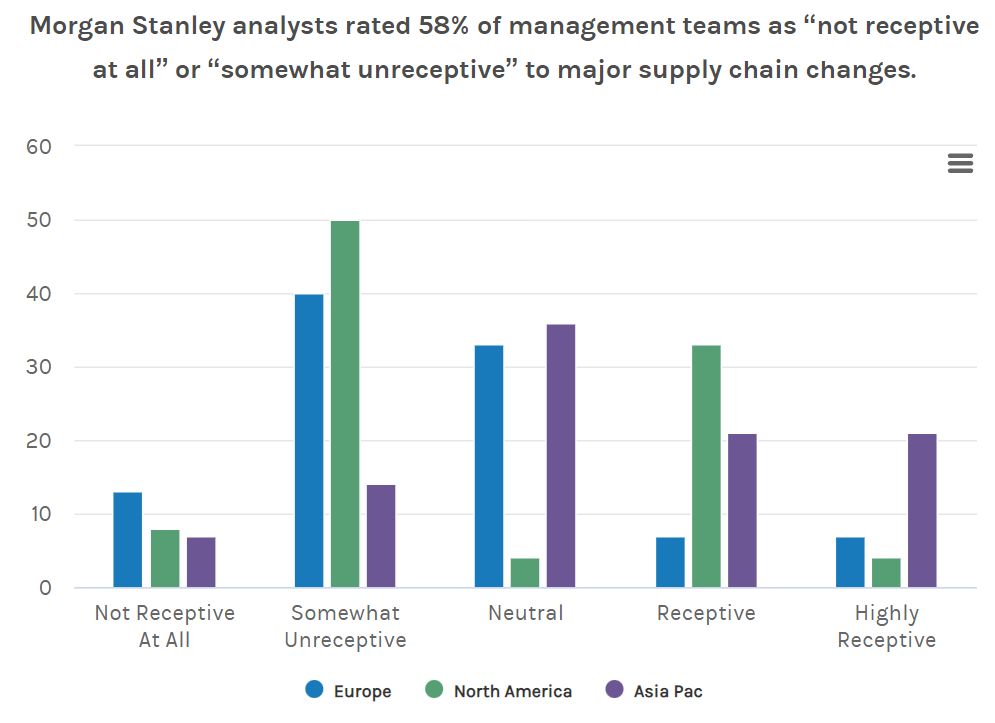

Uncertainty surrounding government trade policies and the significant cost of moving supply streams closer to home may be making some companies less eager to change. In fact, Morgan Stanley research found that only 4% of North America management teams were highly receptive to making major changes to their supply chains, versus 7% in Europe and 21% in Asia Pacific.

Most companies will need to find several geographic options to replicate the scale of say, China, which for some sectors isn’t realistic in the near- to medium term, while determining whether they are truly reducing geopolitical risk in making the moves. They also face execution risks including lack of necessary infrastructure such as labor and logistics in new locations, keeping supply from old sources flowing during the transition and potential competitive disadvantages if competitors don’t alter their approaches.

While the amount of time needed to rejigger supply chains varies by industry, most Morgan Stanley analysts expect three to five years for the conversion. For semiconductors, though, it could take 10 years or more mainly due to lack of a concentrated skilled labor force outside of Taiwan.

Indeed, the transition may weigh heavier on certain sectors. Because of the supply-chain bottlenecks of the past few years, analysts flagged semiconductors, tech hardware, machinery and autos as sectors where supply-chain realignment needs to happen the quickest.

“The sectors we’re watching that may benefit from spending on supply chain realignment include semiconductor capital equipment, automation, clean tech, defense and cybersecurity, industrial gases, capital goods, and metals and mining,” Zezas notes.

Others could be see profits pressured as they have to devote more capital toward securing supply chains, including semis (especially commodity products), European chemicals, midstream and downstream natural gas utilities in Europe and Asia, automotive original equipment manufacturers and some portions and leisure and transportation.

And while the discussions for companies in the U.S. and Europe center around decreased reliance on China in particular for goods, services and production, Zezas and team say investors shouldn’t rule out the potential upsides for the super power as the forces driving slowbalization continue to unfold.

“We see the transition to a multipolar world creating opportunities in parts of the Chinese economy and equity market–with industry policy looking to increase self-sufficiency in areas including commodities, new energy materials, semiconductors and capital markets.”