| This is the 12th worst month for NASDAQ ever | | A negative 13.3% qualifies for a 12th worst ever. You would have needed -15% to make it into the “worst 10” list (beating November 1973). To be the worst month ever you have to beat October 1987 that has a 27% decline. Our poster-child of this bear, ARK Innovation, actually managed to (-28% in April). |

|

|

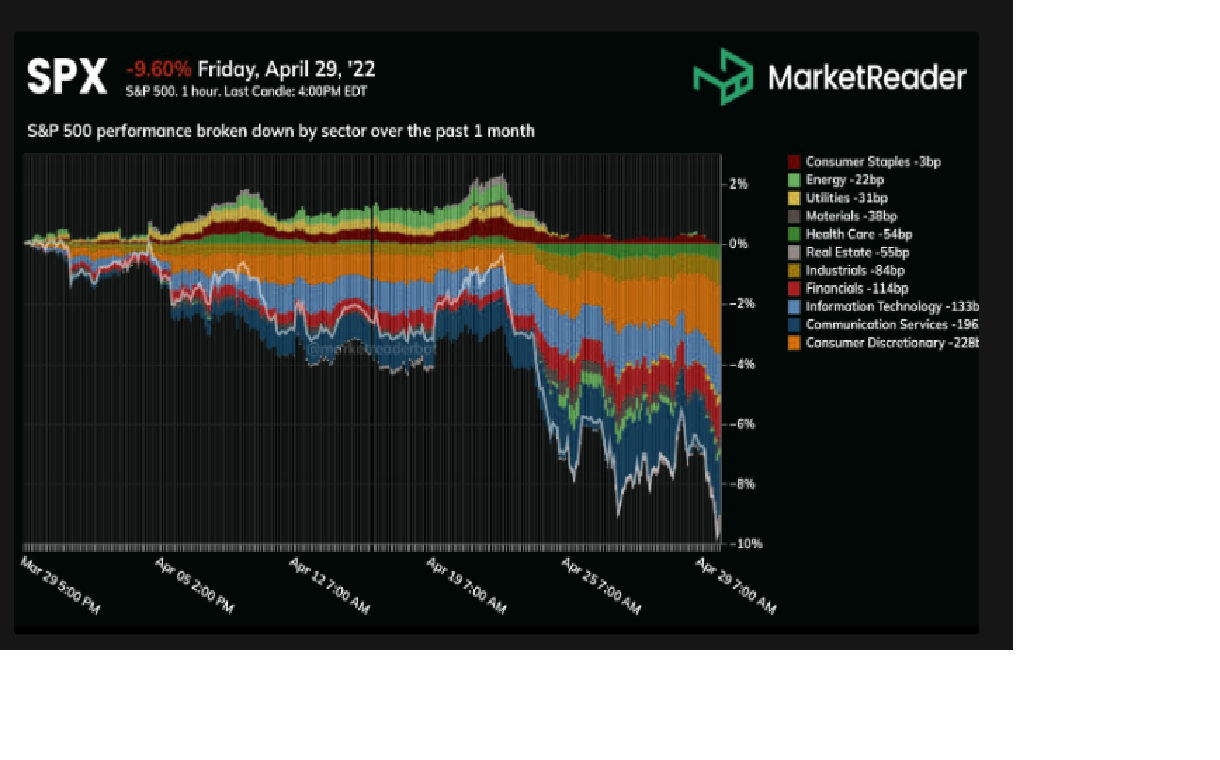

| S&P500 worst month since March 2020 | | The S&P 500 slipped -9.60% in April, marking its worst month since the COVID-19 shock in March 2020 (-12%). And tech was not even the worst drag. The most significant sector drivers were: Consumer Discretionary (-2.28% drag), Communication Services (-1.96% drag) and Information Technology (-1.33% drag).

| ![]() MarketReader MarketReader |

|

| Adjust SPX for inflation… | | …and we are down around 18% YTD, the biggest real terms fall since 1974. After Friday’s horrible price action this is looking even worse. Go figure… | ![]() BofA BofA |

|

| Worst start to the year: but anything can happen | | Worst start to the year: the best buy opportunity…? The S&P 500 is down 13.3% in the first 82 trading days of 2022, the 3rd worst start to a year in history. The 4 other “top 5 worst starts” all then rallied 13-28% for the remainder of the year. | ![]() Compound Compound |

|

|

| Internal emotional damage | | More than 45% of stocks down 50% More than 22% of stocks down 75% More than 5% of stocks down 90%. The only comparisons are Oct 2000 – Oct ’02 and Nov 2008 – Apr ’09 | ![]() Jason Goepfert Jason Goepfert |

|

|

| Bill Gurley on buying drawdowns | | The legend Bill Gurley weighs in: “An entire generation of entrepreneurs & tech investors built their entire perspectives on valuation during the second half of a 13-year amazing bull market run. The “unlearning” process could be painful, surprising, & unsettling to many. I anticipate denial. Previous “all-time” highs are completely irrelevant. It’s not “cheap” because it is down 70%. Forget those prices happened.You may be shocked to learn that people want to value your company on FCF and earnings. Facebook trades at 14X GAAP EPS, & is growing 23%. What earnings multiple are you assuming?” (Bill Gurley) |

|

| Largest bond drawdown in 42 years | | At -11%, this is the largest drawdown in the US bond market since 1980. Back then the 10-year treasury yield was at 12.6%. Today it’s at 2.9%. | ![]() Compound Compound |

|

| Never ever | | The Treasury market has never experienced a start of the year like this since the inception of the JPM Government Bond Index in 1986 | ![]() JPM JPM |

|

|

|

| Outflows from “everything” | | Net flows into global equity funds were negative for a third consecutive week (-$1bn vs -$17bn the prior week). Outflows from global fixed income funds continued (-$8bn vs -$9bn the prior week). Bond funds have seen net outflows for 15 of the last 16 weeks, totaling $116bn over that period. | ![]() EPFR EPFR |

|

| Outflow mania | | It is actually rather impressive that the market is holding up given the poor flow picture. We just printed the lowest 3 week average equity outflow reading since March 2020. Guess somebody is buying… | ![]() BofA BofA |

|

| Remember the world’s best trader and the dot.com bubble? | | Druckenmiller is one of the world’s best traders. Time to review his quote from the 2000 crash: “I bought $6 billion worth of tech stocks, and in six weeks I had lost $3 billion in that one play. You asked me what I learned. I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basketcase and I couldn’t help myself. So maybe I learned not to do it again, but I already knew that.” |

|