Nationalbanken har i februer reduceret sine støtteopkøb, fordi kronen er blevet styrket over for euroen. Det sætter Nationalbanken over for et dilemma, hvis ECB sænker renten, mener Nordea.

Uddrag fra Nordea:

Nationalbanken Watch: Intervention slowed markedly in February

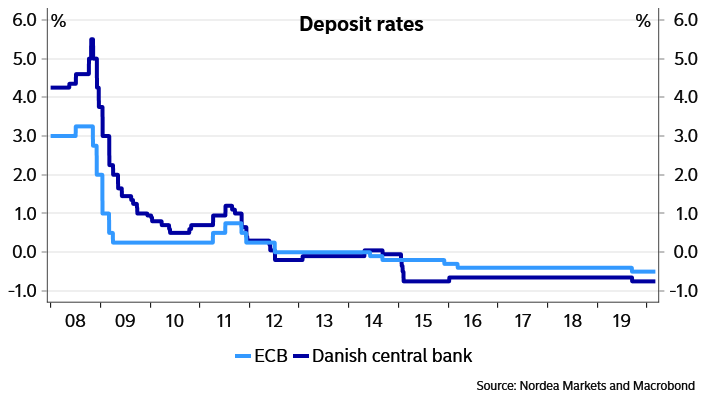

After four consecutive months with acceleration, the Danish central bank’s purchases of DKK slowed markedly in February. However, as the ECB has moved closer to a rate cut, the Danish central bank could soon be faced with a difficult call.

According to the monthly balance sheet the Danish central bank bought a total of DKK 0.9bn in February to prevent a weakening of the Danish krone against the euro. This is significantly lower compared to the previous month when the central bank’s purchases reached DKK 12.1bn.

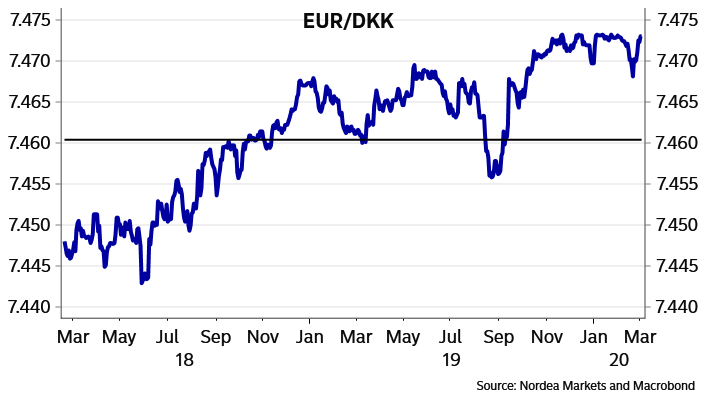

As usual, the Danish central bank has not revealed any information about the EUR/DKK level at which it has intervened. However, looking at recent months’ developments it seems clear that a spot level around 7.473 is the upper limit currently tolerated by the central bank. If correct, this implies that the buying in February mainly took place at the beginning of the month. Afterwards the DKK strengthened against the EUR, which most likely caused the central bank to halt the buying. However, starting last week the DKK has yet again weakened against the EUR as some Danish investors have most likely reduced their USD hedging exposure due to the sharp selloff in US equities.

However, starting last week the DKK has yet again weakened against the EUR as some Danish investors have most likely been forced to buy back both EUR and USD in their hedging programs due to the sell-off in equities.

New ECB call has increased the uncertainty

Yesterday we changed our call on the ECB so we now expect a 10bp interest rate cut at the meeting next week. If correct, this puts the Danish central bank in a difficult dilemma. On the one hand, EUR/DKK has been trading above the central parity since mid-September 2019 and the central bank has been intervening in the FX market for five consecutive months. At the same time, the ECB might decide to increase the facilities in the two-tier system thereby reducing the total effect of the rate cut. This speaks in favour of the Danish central bank staying on hold if the ECB cuts rates.

On the other hand, lower excess liquidity in the Danish money market and the likelihood of the ECB injecting more liquidity could make the Danish central bank follow the ECB lower on the deposit rate. The Danish central bank has clearly signalled that it does not want to do QE in Denmark – at the same time it is probably very reluctant to increase the current account limits for the amounts that each bank can deposit at the central bank at an interest rate of 0%. Therefore the CD rate is the main instrument to match the various initiatives from the ECB.

Based on the arguments above, our main scenario is that the Danish central bank will stay on hold if the ECB cuts interest rates next week. However, it is a close call as both the action from the ECB and the potential reaction from the Danish central bank are subject to unusually high risk.