Natixis har analyseret den voksende betydning, som produktionen og brugen af semiconducters (chips) har og pointerer, at chips er blevet den nye olie, og at markedet for investorerne ligger i Asien. Men det er også et geopolitisk omstridt marked, da USA vil hindre Kina i at blive en dominerende spiller. Det kan ende med en todeling af den teknologiske verden mellem USA og Kina. Kendsgerningen er blot, at chips og især de mest avancerede former vil indgå i al fremtidig elektronik, især i kunstig intelligens, og derfor bliver chips et vitalt område for investorer, også fordi det kan blive risikabelt.

Semiconductor is the new oil

From artificial intelligence (AI) to electric vehicles, the world is heading towards a new era and semiconductor is central to such development, which is as important as oil in the previous industrial revolution. As a consequence, chips have taken a critical role in the narrative on supply chain security in this intensified strategic competition between the US and China.

Therefore, building the linkage between the semiconductor industry and geoeconomics is increasingly relevant for the world and Asia, which is the largest source of chip demand but with some constraints on supply, especially in China.

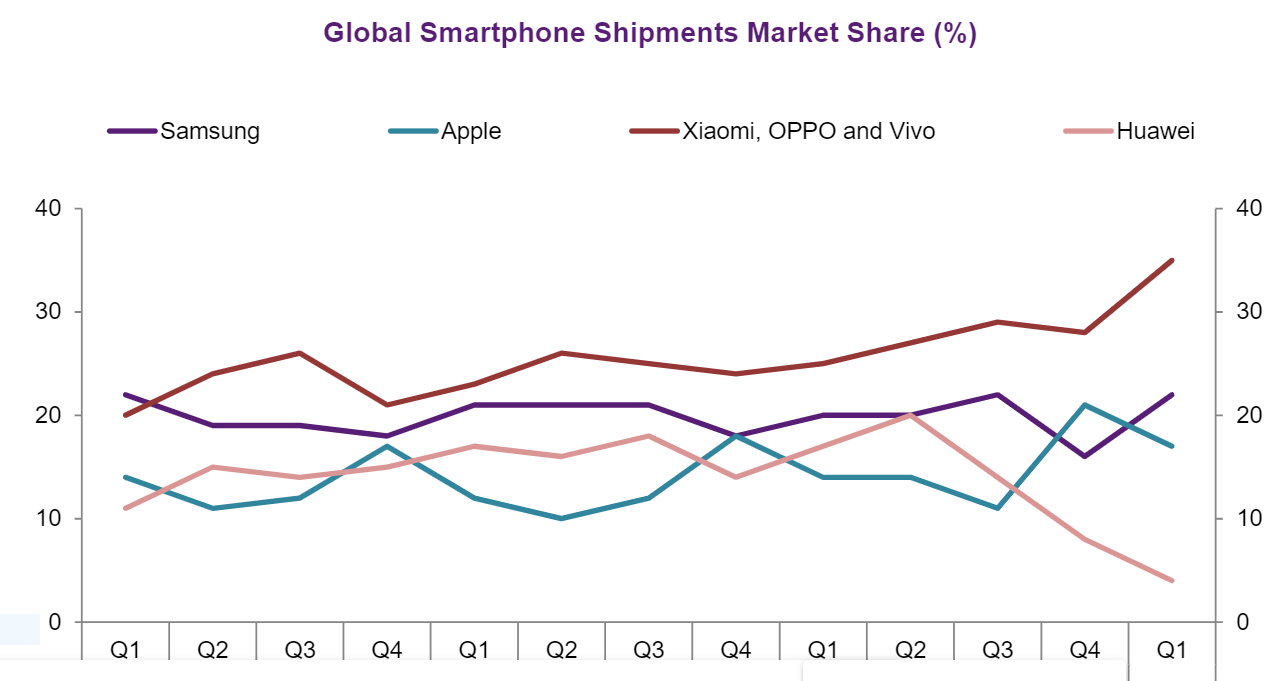

With the emergence of new technologies, cyclical and structural demand for chips will continue to be strong. In the short run, the demand driven by the pandemic, the US-China trade war, and the shortfall of supply have all contributed to the chip shortage, leading to spikes in prices. An important question for producers planning for future capacity and global inflation trends is whether the burst in demand is temporary.

While part of the chip shortage is driven by temporary pent-up demand and more investments are made to boost supply, we cannot forget that medium-term growth in 5G technologies, electric vehicles, and cryptocurrencies all point to a structural increase in demand with potential implications for inflation.

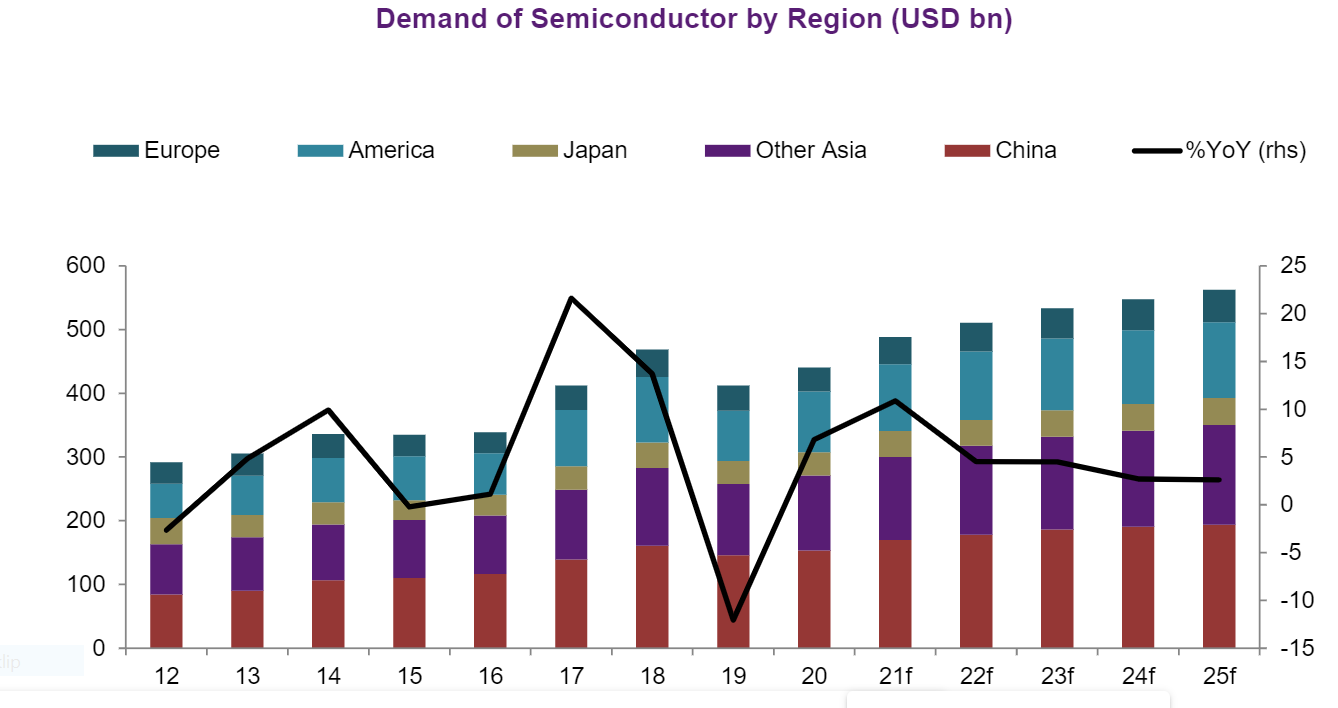

Oversupply is likely at the lower end, and China is a wild card for higher-end disruption. In the light of the massive investment announced by several governments and companies, a potential worry is whether supply could exceed demand at some point in time. If we use the example of memory chips, overcapacity was a final consequence of heavy capex as a response to the potential massive demand.

As a result, prices for memory chips collapsed by 50% in 2018. This time around, the huge investment in China could make overcapacity a likely outcome at the lower end of the semiconductor spectrum but much less the case at the higher end.

However, China will remain as a wild card in the medium term, which may mark a new era for more competition after the chip industry embraces numerous booms and busts and hence consolidation to drive out inefficient players in the past decades.

For high-end chips, a potential shield is the bottleneck held by Taiwan Semiconductor Manufacturing Company (TSMC)and ASML, which is the sole producer for extreme ultraviolet (EUV) lithography equipment. The tool is important as the supply is very limited and forms a core part in the race to the smallest nano scale, which is important for the highest-end industries, such as artificial intelligence (AI), data centers, advanced driving assistance systems (ADAS), high-performance computing, 5G communications, and smartphones.

This is more so given the entry barriers for newcomers and the uncertainties on supply chain stability, especially with water and electricity shortages in Taiwan.