Onsdag morgen faldt der en vis ro over de asiatiske markeder efter et par hektiske dage, men nervørsiteten er udpræget. Der er ved at komme gang i den kinesiske økonomi.

Uddrag fra Fidelity/Dow Jones:

Global Markets Calmer After Two Hectic Days

The turmoil in world markets abated, with benchmarks in the Asia-Pacific region steadier on Wednesday after two days marked by a violent global selloff and a sharp rebound.

But U.S. stock futures and Treasury yields both headed lower, pointing to sustained doubts about the ability of governments and central banks to combat the economic headwinds caused by the novel coronavirus.

By late morning in Hong Kong, the Hang Seng Index stood 0.2% higher and the Shanghai Composite had gained 0.3%. Japan’s Nikkei 225 declined 0.8% and Australia’s S&P/ASX 200 dropped 2.2%.

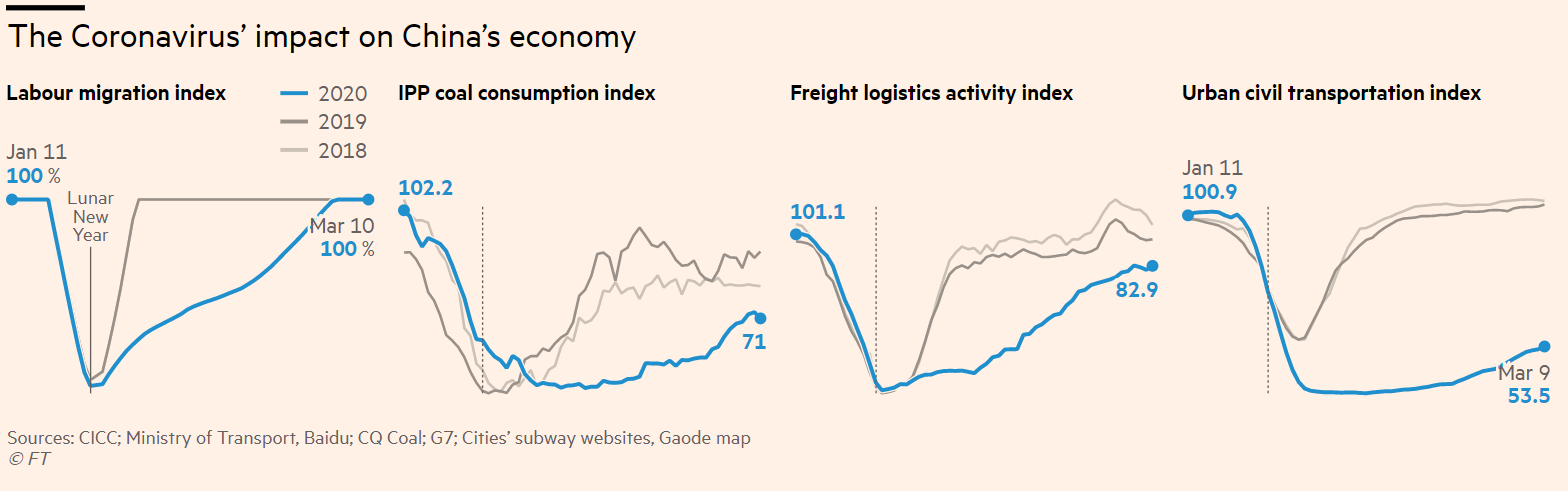

Den kinesiske økonomi er ved atter at komme igang:

Kilde: Financial Times

U.S. stocks had soared in frenetic trading Tuesday, wiping out much of the losses they suffered just a day earlier in their biggest selloff since the financial crisis. The S&P 500 rose 4.9%.

“It’s too early to call this stabilization, and it’s too early to position for a rebound here,” said Mayank Mishra, a global macro strategist at Standard Chartered Bank in Singapore.

“Financial markets will continue to focus on the economic implications from the virus, and right now the global outlook for growth is not rosy. Those are the forces that markets are reacting to,” said Mr. Mishra.

E-mini S&P 500 futures dropped 2.1%, suggesting U.S. stocks could be weaker when they start trading later on Wednesday.

The 10-year Treasury U.S. yield stood at 0.718%, down from 0.743% on Tuesday. Bond yields, which move inversely to prices, have swung wildly in recent days, with the widely watched 10-year yield tumbling from above 1% last Thursday to a record intraday trough below 0.4% on Monday.

Mr. Mishra said while markets had already priced in likely interest-rate cuts and other support from central banks, government action moved at a slower pace. “The fiscal response is a slower-moving beast, so let’s see how that helps stabilize global financial markets,” he said.

The Federal Reserve earlier this month cut its key interest rate by 0.5 percentage point to a range of 1% to 1.25%. Many investors expect a further cut at the Fed’s scheduled meeting next week, which concludes on March 18.

A push by President Trump to suspend the payroll tax to boost the economy fell flat on Capitol Hill on Tuesday, as lawmakers of both parties said they preferred targeted measures to assist hourly workers and the battered travel industry.