Uddrag fra Zerohedge:

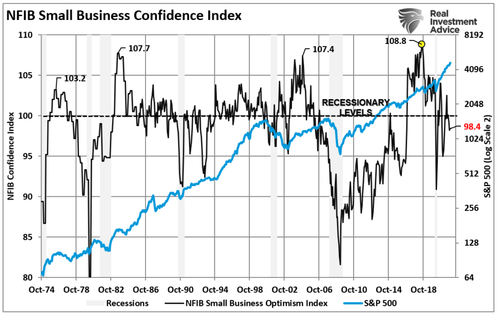

In December, the survey (in NFIB small business survey. red) declined to 98.4 from a peak of 108.8. Notably, many suggest the drop was “politically driven” by conservative-owned businesses. While there was indeed a drop following the election, the decline continues what started in 2018.

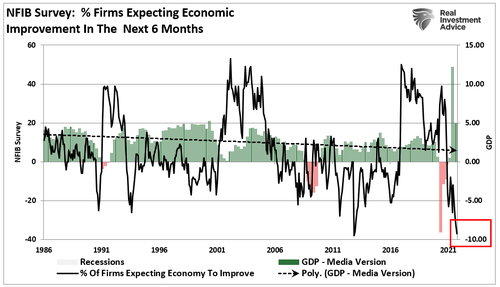

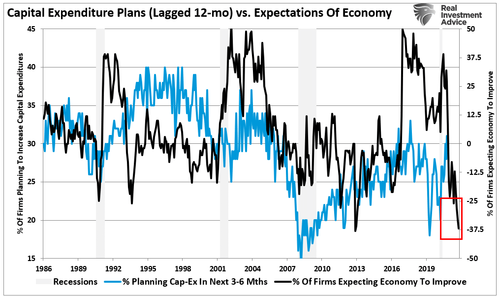

That decline in confidence has much to do with the artificial supports put into the economy following the pandemic-driven shutdown and the subsequent surge in inflation. As a result, the number of firms expecting an economical improvement over the next 2-quarters has steadily declined dramatically.

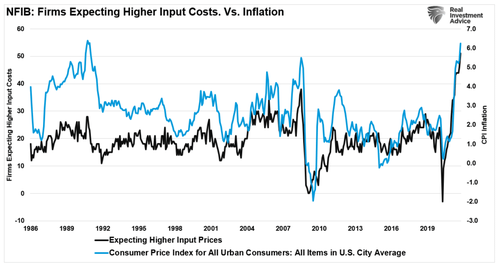

Such should not be surprising given the surge in inflation pressures on input costs. Notably, it isn’t easy for smaller businesses to pass these higher input costs, particularly as waning fiscal stimulus impedes future consumption.

Planning & Doing Are Two Different Things

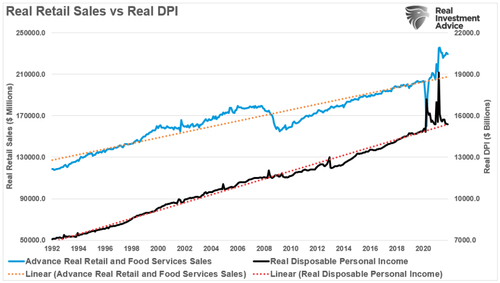

As noted, since the pandemic-driven shutdown, the massive flush of liquidity created a “demand boom” that outstripped manufacturers’ ability to produce “supply.” That imbalance of “pull-forward” consumption created an inflationary surge which offset the benefits of the “free money” given to lower-income households. As shown, real disposable incomes crashed back to the long-term trend, which will slow future consumption rates. (The gap above the trend in retail sales will close)

Small businesses are highly susceptible to economic downturns and inflationary surges since they don’t have access to public markets for debt or secondary offerings. As such, they tend to focus heavily on operating efficiencies and profitability. In other words, when answering surveys, business owners are always optimistic; otherwise, they would not be running a business. However, there is a big difference between “saying” and “doing.”

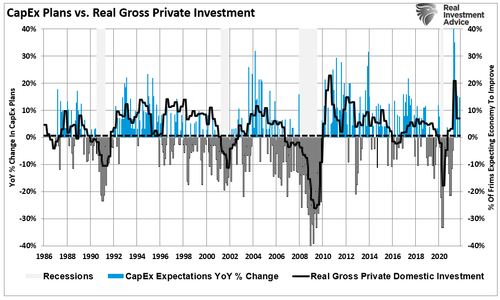

If businesses expect a massive surge in “pent up” demand, they will prepare for it. Such includes increasing capital expenditures to meet anticipated demand, increasing employment, and stocking up on inventories. While CapEx improved modestly from the pandemic shutdown, as would be expected, the downturn in economic optimism suggests a reversal in 2022.

There are important implications to the economy since “business investment” is a GDP calculation component. Small business capital expenditure “plans” have a high correlation with real gross private investment. The plunge in the economic outlook will suppress “CapEx” spending. It should be no surprise to see gross private investment on the decline.

As stated, “expectations” are very fragile; as such, we are seeing important diverges where it will matter the most.

Employment To Remain Weak

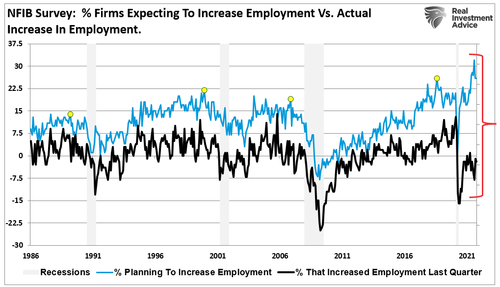

If small businesses think the economy is “actually” improving over the longer term, they would also be sharply increasing employment. Given business owners are always optimistic, over-estimating hiring plans is not surprising. However, reality occurs when actual “demand” meets its operating cash flows.

To increase employment, which is the single most considerable cost to any business, you need two things:

- Confidence the economy is going to continue to grow in the future, which leads to;

- Increased production of goods or services to meet growing demand.

Currently, there is little expectation for a strongly recovering economy. Such is the requirement for increasing employment and expanding capital expenditures. Not surprisingly, actual hiring is running well short of expectations.

Now you can understand the biggest problem with artificial stimulus.

Yes, injecting stimulus into the economy will provide a short-term increase in demand for goods and services. When the funds are exhausted, the demand fades. However, small business owners understand the limited impact of artificial inputs. As such, they will not make long-term hiring decisions, an ongoing cost, against a short-term artificial increase in demand.

Employment gets driven by demand, which we can explore through reported sales.

The Big Hit Is Coming

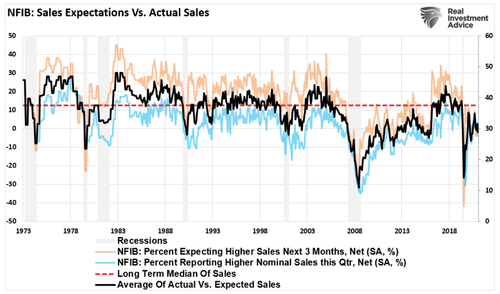

Retail sales make up about 40% of personal consumption expenditures (PCE), roughly 70% of the GDP calculation. Each month the NFIB tracks actual sales over the last quarter and expected sales over the next quarter. There is always a significant divergence between expectations and reality.

As noted, stimulus leads to a short-term boost in consumption; the impact of higher inflation, lack of wage growth, and weak employment growth will suppress consumption longer-term.

The weakness in actual sales explains why employers are slow to hire and commit capital for expansions. As noted, employees are among the highest costs associated with any enterprise, and “capital expenditures” must pay for themselves over time. The actual underlying strength of the economy, despite cheap capital, does not foster the confidence to make long-term financial commitments to anything other than automation.

Despite mainstream hopes, business owners must deal with actual sales at levels more commonly associated with ongoing recessions rather than recoveries.

Of course, this remains our argument over the last couple of years. But, while the media keeps touting the strength of the U.S. consumer, the reality is quite different. If such were indeed the case, there would be no requirement to inject billions of dollars in stimulus to keep individuals afloat.

So what does all this have to do with small-cap stocks?

Small Caps May Disappoint

This background makes it easier to understand why small-cap stocks failed to keep up in 2021 and may continue to underperform in 2022.

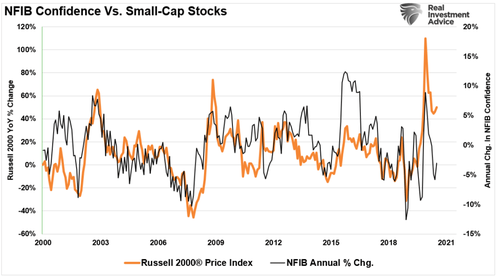

At the beginning of 2021, the expectations were for surging economic growth, and business confidence was high. However, as the reality of deficit-based and non-productive spending set in, confidence waned. The subsequent deterioration in business confidence is not surprising, and importantly, small-cap stocks have a high correlation to small-business confidence.

The reality is that despite media commentary to the contrary, debt-driven government spending programs have a dismal history of providing the economic growth promised. As a result, the disappointment of economic and earnings growth over the next year is almost a guarantee.

Rising inflation, surging labor costs, and concerns over additional socialistic policies and mandates from the White House will continue to weigh on small business confidence. Business owners need stability within which to operate and a constructive environment to make long-term commitments to employment and business development. When those concerns get coupled with weak growth in actual sales, you can understand their caution.