2% target – 3% reality

After easing from its peak, U.S. inflation has remained stuck near 3% for more than two years. Recent moves in breakevens, commodities, and growth-sensitive sectors suggest inflation risks may be drifting higher again, even as markets continue to price stability rather than stress.

Is inflation risk creeping back in?

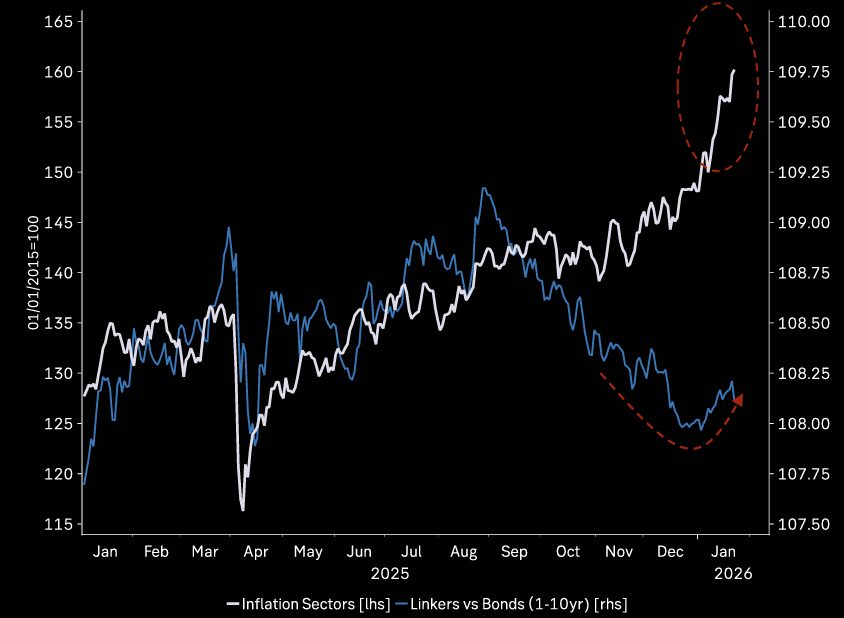

Chart shows Linkers vs. bonds and inflation sectors.

Source: Macrobond

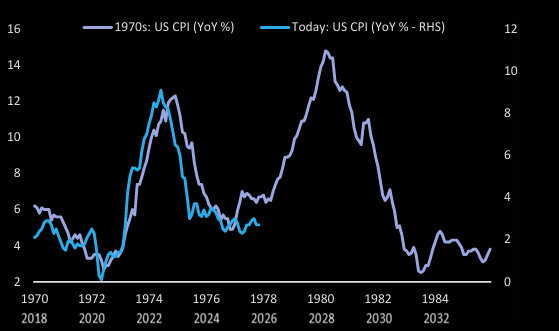

2nd wave

She moves in mysterious ways / waves. Hartnett says 2nd wave of inflation future possibility. This chart for sure is something special…

Source: BofA

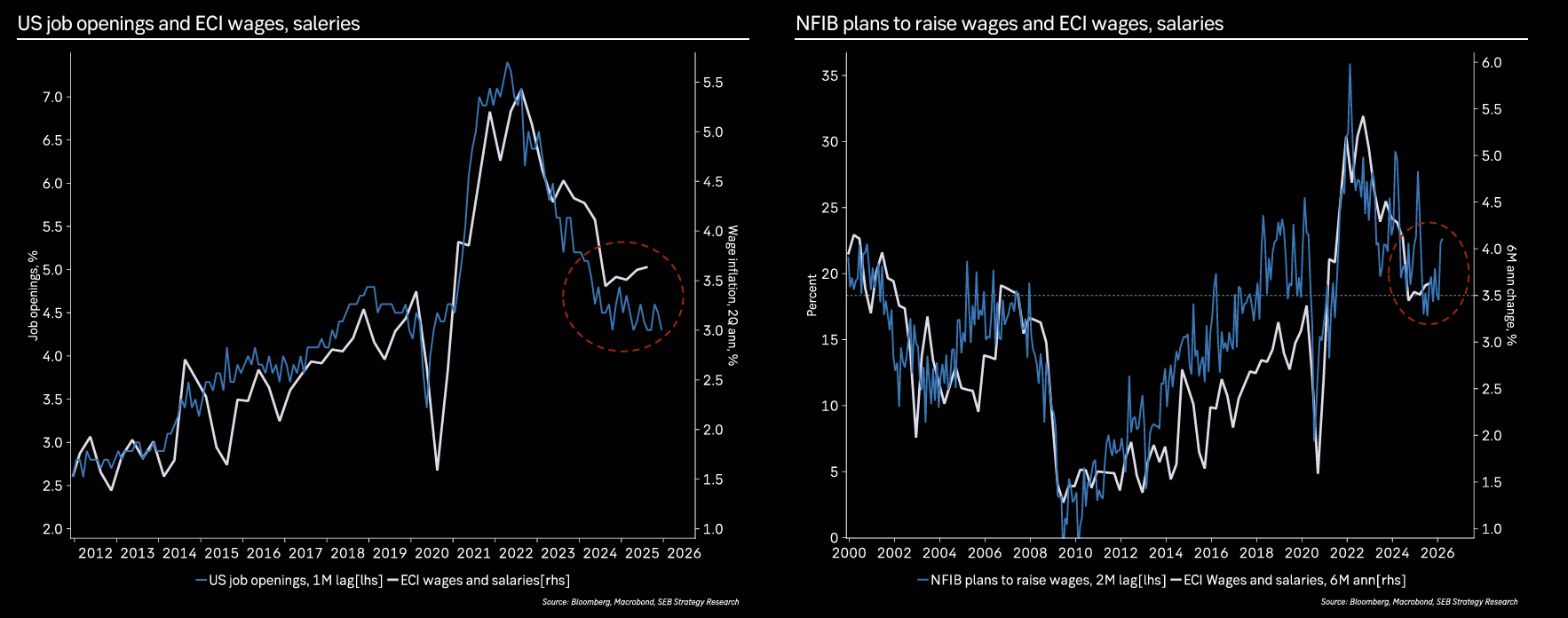

Perhaps understandable

Perhaps it is understandable that FOMC members remain worried about inflation.

Source: Macrobond

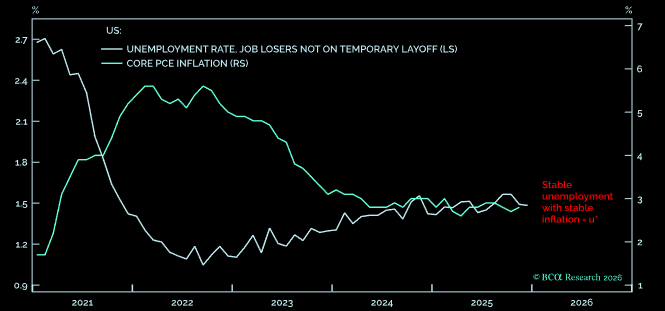

3%

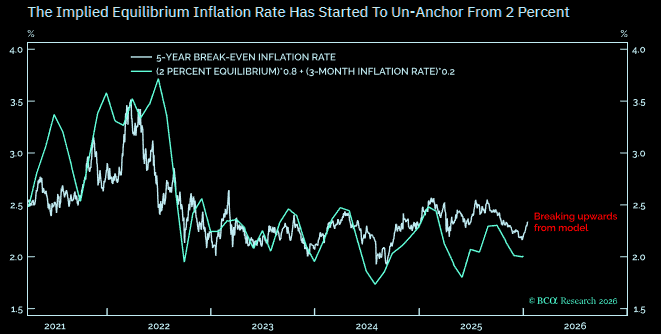

US inflation has hovered around 3% for more than two years, while long-term inflation break-evens remain near 2%. The longer inflation stays stuck at 3%, the greater the risk that expectations reset higher writes Dhaval Joshi. With both inflation and unemployment stable, the economy appears to be operating at a new u-star, and the kicker is that this equilibrium implies inflation closer to 3%, not 2%.

Source: BCA

Source: LSEG Workspace

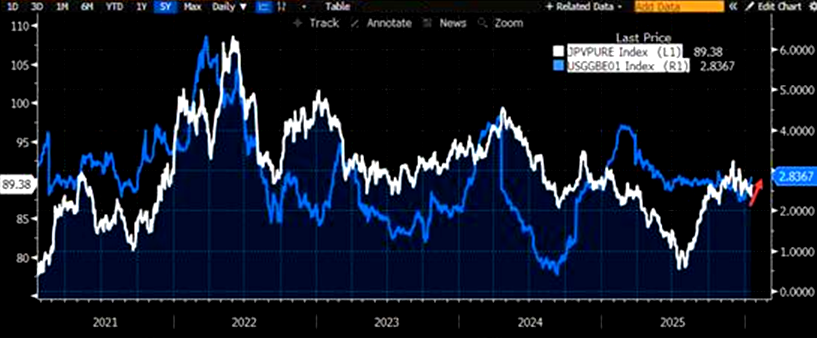

Breakevens

US 10 year breakevens moving higher lately…

Source: LSEG Workspace

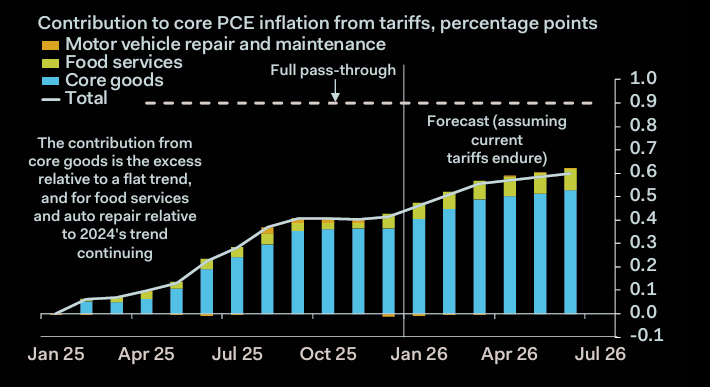

Tariff pass-through

Is there more pass-through from tariffs coming?

Source: Pantheon

Accelerating economic growth

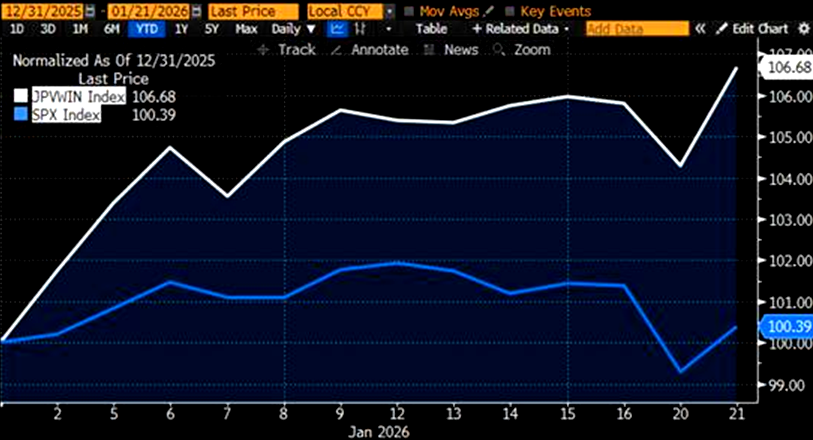

Accelerating economic growth and a strong labor market, combined with policy uncertainty around tariffs, point to a potential rise in inflation. One-year breakeven inflation is up 60 bps YTD and could break out further with upcoming inflationary data.

JPM trading desk: “To capture or hedge against this inflation risk, favor long positions in Value (JPVPURE) or Value Winners (JPVWIN), which have outperformed the SPX by 6% YTD. o Key sector beneficiaries of rising inflation include Homebuilding, Regional Banks and Autos.”

Source: JPM

Source: JPM

Source: LSEG Workspace

Intro-pris i 3 måneder

Få unik indsigt i de vigtigste erhvervsbegivenheder og dybdegående analyser, så du som investor, rådgiver og topleder kan handle proaktivt og kapitalisere på ændringer.

- Fuld adgang til ugebrev.dk

- Nyhedsmails med daglige opdateringer

- Ingen binding

199 kr./måned

Normalpris 349 kr./måned

199 kr./md. de første tre måneder,

herefter 349 kr./md.

Allerede abonnent? Log ind her