Uddrag fra Authers

Land of the Rising Yields |

They say the Bank of Japan likes to take the market by surprise. That’s happened in the last few hours, generating great and unnecessary confusion. But as far as I can tell, writing a matter of minutes after the decision to significantly step down intervention in the bond markets was announced, it marks a turning point for the world and its attempt to escape inflation.

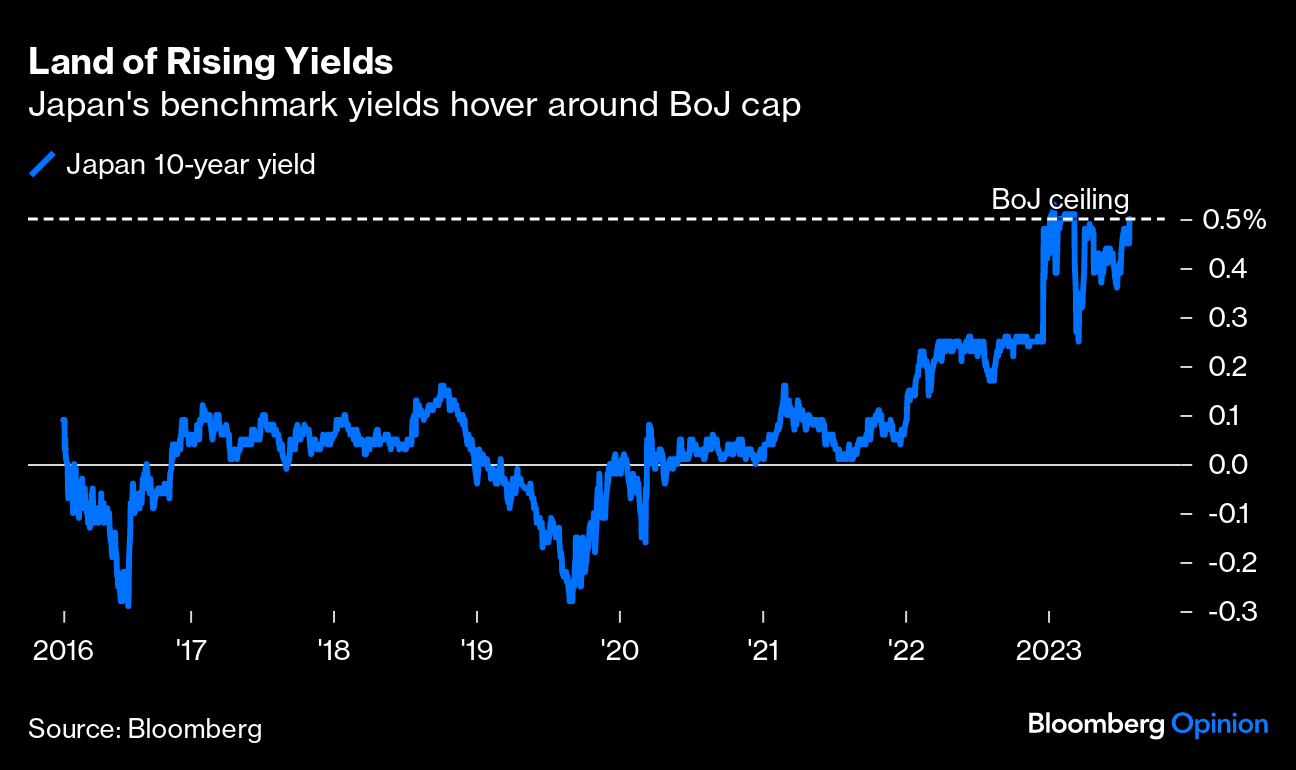

Yield Curve Control (YCC), or intervening to keep 10-year yields down, has been in force for seven years, and the current target of 0.5% had been in place for seven months. The BOJ has now decided to control yields “more flexibly,” which means in practice that it will now tolerate yields as high as 1%, double the previous limit. Nobody saw anything so drastic coming until Nikkei reported in the New York afternoon that changes were being considered. Soon after, the 0.5% ceiling was being breached.

To show how much this matters, far beyond Japan, look at reaction to the Nikkei leak. On its own, the story had reversed gains in the indomitable US stock market. The 10-year Treasury yield surged all the way back up to 4% on that news, a level it broke earlier in July but appeared to have left decisively behind in the wake of benign inflation numbers and a relatively benign Federal Open Market Committee meeting.

That an unsourced article that did no more than suggest the BOJ board would discuss a policy that should plainly be on its agenda could have such an effect shows that anxiety about higher rates remains intense. The Japanese news also tends to confirm the concern, taking hold this week, that the global economy might actually be growing too fast. That would mean higher rates ahead. (More on this below.)

The effect on currencies has been dramatic, with the dollar lower and the euro sharply lower. The latter, which has looked overpriced, had already tumbled after a dovish performance by Christine Lagarde of the European Central Bank. A weaker dollar and euro would please many around the world.

The problem could be the effect on liquidity. By buying every 10-year bond in sight, the BOJ has been injecting cash into the global financial system, and keeping rates low. It’s one thing to be a reliable binky or infant’s pacifier, or whatever metaphor you prefer, for seven years. We’ve just seen how scared investors are of losing that pacifier.

George Saravelos, strategist at Deutsche Bank AG, was one of many in the foreign exchange community who broke their vacation to respond to the Nikkei report. Ahead of the announcement, he made the critical point that the market would perceive the issue as binary.

Central banks like to obfuscate. Sterling’s exit from the European exchange rate mechanism on Black Wednesday 1992 was initially dubbed a “suspension” of membership, for example, and Mexico’s disastrous 1994 devaluation started as a widening of trading bands. “But at the end of the day, it is pretty binary if YCC is gone or not,” Saravelos said. And a “flexible” control and a doubled target will probably be treated as the end of YCC.