Nordea tror, at næste år bliver fantastisk for investorerne. Så er der politisk afklaring i USA, og så begynder hjælpepakkerne at virke. Der kommer en ketchup-effekt. Men banken gør også opmærksomhed på, at analytikere ofte tager fejl – og viser det i en graf over et overraskelsesindeks.

We were not brought up in markets to be scared of judges

The fiscal deal seems to be stone dead as Trump and the Republicans will pursue a nomination of a Surpreme Court justice instead. This could lead to cross-asset hiccups (at least) until election night, but we are not scared stiff. 2021 will be great!

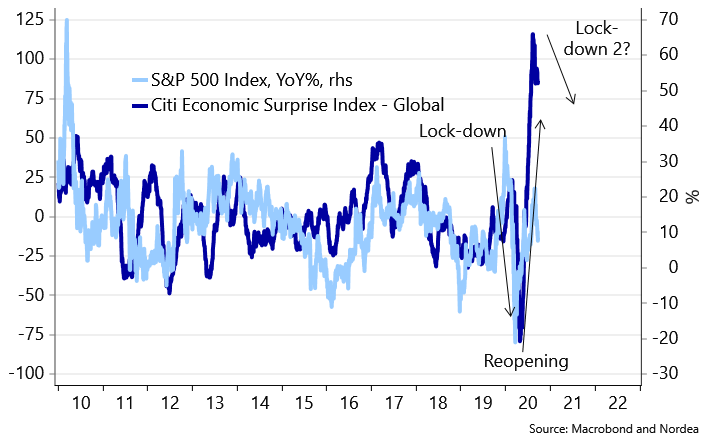

Investors LOVE sequential improvements – in particular if they are surprised positively by the magnitude of the improvements. If we were ever to show the below chart at an exhibition, we would name it “Why analysts are clueless”. When lockdowns were implemented, every single key figure started surprising negatively.

Every single economist was caught on the wrong foot in this process and the global surprise index reached an all-time high. With the new COVID-19 restrictions, we would argue that the risk is clearly tilted towards analyst expectations being too high during Q4 – and investors will probably not like it when key figures start disappointing.

This is a Q4 story and not a 2021 story.

Chart 2. Why analysts are clueless in one chart.

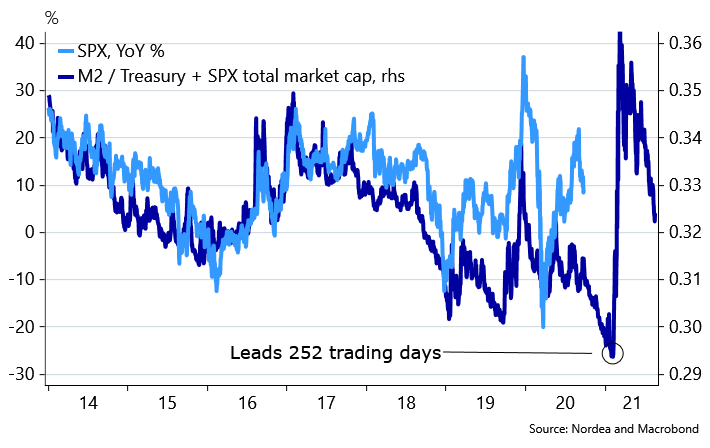

2021 still looks to be a fantastic year for investments (and the economy) in our view. The truckload of liquidity and stimulus from both central banks and administrations will likely lead to a “ketchup effect” as soon as the COVID-19 fog dissipates just a tad or if we get a vaccine.

Stimulus works with a time lag, which is why we are yet to experience the full effects of the plethora of bond purchases and interest rate cuts from Q2.

Chart 3. The explosion in the money supply should lead to a positive 2021.

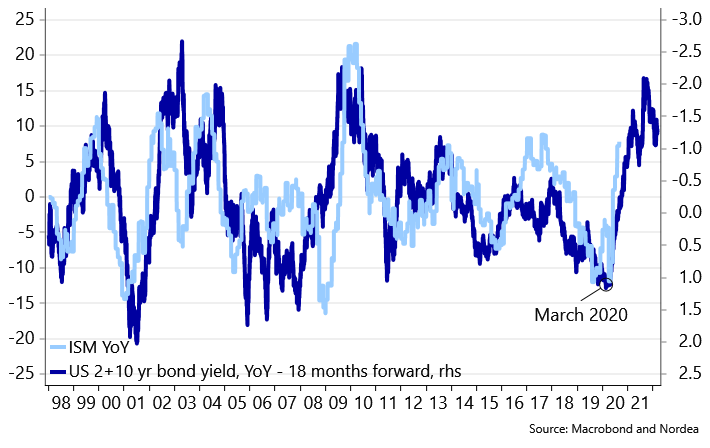

The ISM index will usually gain 15-20 index points versus the year before when interest rates have dropped 200 bp across the USD curve over the past year.

This is the kind of scenario that we are staring directly into during H1 2021, with a possibility of nominal ISM figures at levels that are very rarely seen (>60-65). It’s a tough sell currently but we stick to our story of a strong 2021, not least as the Fed will likely have taken easing actions in the new very benign AIT regime by then.

Chart 4. ISM to explode to the upside in H1 2021?

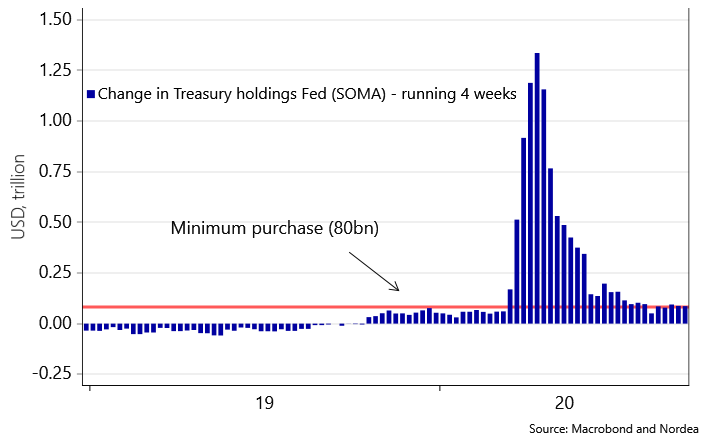

The current hiccups in markets may also have to do with the lack of clarity from Jay Powell and his Fed lieutenants on the new AIT regime. Less profiled members of the FOMC committee have been much clearer in their communication.

Robert Kaplan could support a hike “if inflation hits 2.275-2.350%”; Kashkari has suggested that interest rates are kept at current levels until inflation “breaks above 2% in 12 consecutive months” and also Chicago Fed’s Evans hinted that a rate hike could potentially come into play before 2% is breached, if the Fed was comfortable enough with the inflation outlook.

None of these three more concrete comments hint of a 5-10-year long inflation overshooting regime as some (including the authors of this piece) had initially pencilled in.

Kashkari, who is the über-dove of the FOMC, wants 12 months in a row with PCE core prices above 2% to support a hike. Obviously such 12 months with above 2% inflation cannot be found over the past decade, but it is still not as dovish as we had anticipated initially.

The Fed will likely sooner or later acknowledge that a very easy policy is needed to bring inflation above 2% more than very temporarily, which is why the consensus within the Fed will likely move towards longer overshooting over time, but it is nonetheless too early to declare the yield curve dead even if bonds remain almost completely unresponsive to equity turmoil.

For now, the Fed sticks to its course. 80B’s a month in Treasury purchases, prolonged low-for-long guidance and no new AIT signals from the chairman until after a fiscal deal has been struck by politicians. “Dear Politicians. Give us some more bonds to buy!” was the main message from Powell in Congress this week.