Begyndelsen af året har været “a bumpy ride” på Emerging Markets, primært på grund af konflikten mellem USA og Iran. Nordea vurderer, at den kinesiske valuta falder efter 1. del af handelsaftalen er indgået.

Uddrag fra Nordea:

Welcome to the January edition of the Emerging Markets View, our flagship monthly focusing on the latest topics of concern for companies with EM FX exposure or general interest in emerging markets.

CNY: Taking a breather

The CNY saw a strong rebound as a result of the phase one trade deal. 2020 will be a calm year on the trade war front, but we foresee a weakening after that.

RUB: Resilient to political changes

The RUB remains on a strong footing in early 2020. A positive mood in the global markets is proving to be more important than internal political uncertainty.

PLN: Reflation

2020 has started with a high inflation reading and a stronger zloty. Could this reflation story finally spill over to a more hawkish central bank?

FX hedging considerations, the EM Traffic Light and financial forecasts are also covered in this publication.

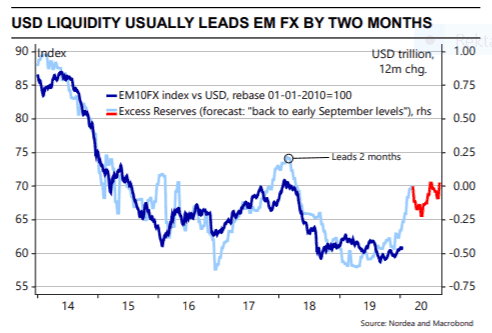

So far in 2020, the EM space has followed the same pattern as in 2019 with higher

equities and weaker currencies (measured on overall indices). In short, it has been a

bumpy ride. The biggest event has undoubtedly been the escalation (and subsequent

slight de-escalation) of tensions between the US and Iran.

The episode offered an important lesson, in our view, that commodity-sensitive EM

currencies do not benefit from these oil price spikes caused by supply-side risks.

Thus, on both 3 and 6 January, when Brent oil rose approximately 7% on a cumulative

basis after the US-Iran escalation, EM commodity currencies such as the RUB, ZAR and

BRL had a clear negative correlation with oil and gold (measured by hourly

calculations, see chart below).

This may seem counterintuitive. However, oil price increases generated by supply

shortages are negative for overall economic growth and consequently for risk appetite.

Moreover, some EM countries, most notably Russia, have taken measures to limit the

impact from external commodity price shocks via specialised budget rules. For the

RUB, this in turn means that the correlation with oil prices has declined over the past

few years, whereas its correlation with equity indices has increased.

This does not mean that the positive relationship between these EM currencies and

commodity prices is broken; it is just weaker. Over a longer time horizon, where

demand-side effects come more into play, there is still a positive correlation – with the

RUB being the most commodity-sensitive EM currency (see chart below). Hence, the

RUB still has a clear positive correlation with oil of around 0.2-0.3, but in 2015-16 it was

clearly higher at 0.5-0.6.

Read the full publication in a PDF version here.