Nordea rejser det spørgsmål, om det bliver ECB og ikke den amerikanske centralbank, der kommer først med en stramning af pengepolitikken, dvs. med at skære ned på obligationsopkøb, der holder renten nede. ECB’s cheføkonom, Philip Lane, har nemlig åbnet døren for en teknisk nedjustering af opkøbene allerede i september, vurderer Nordea, der i øvrigt har en meget kritisk vurdering af Jerome Powells udtalelser efter Jackson Hole-mødet. Powell sagde i virkeligheden ingenting. Det var, som om han læste op af tidligere udtalelser fra centralbanken, skriver Nordea. Der er ikke klare begrundelser for, hvornår Fed vil aftrappe sine opkøb.

A fast Lane to taper before the Fed?

It is no longer carved in stone that the Fed will taper ahead of the ECB. Lanes comments opened the door for a technical taper in September from the ECB as they look at financial conditions both when they go up and down.

Quote of the week

“You cannot think about the volume of the APP independently of the volume of net bond supply.” – ECB Chief Economist, Phillip Lane

It seems like it caught a lot of people by surprise when the ECB chief economist Lane suddenly admitted to the ECB following financial conditionson the loose side and not only on the tight side. In plain English, Lane basically promised to calibrate the QE program to financial conditions BOTH in an upwards and in a downwards direction, which currently means that the recent new all-time lows seen in EUR real rates could be used as an argument to tone down PEPP-purchases a bit maybe already in September. Bear in mind that the ECB will never explicitly call it tapering, rather just technical adjustments to the program.

In that sense, Lane was almost more concrete than Powell was at the virtual Jackson Hole, since we are still left in the dark on what exact measures or thresholds that could lead the Fed to take the final step towards tapering, even if it remains a base case for the FOMC this year. We imagine that 800k-1000k monthly job reports over the coming months are what they are after, but it is still not an explicit target for the FOMC except for a few of the members of the rates committee.

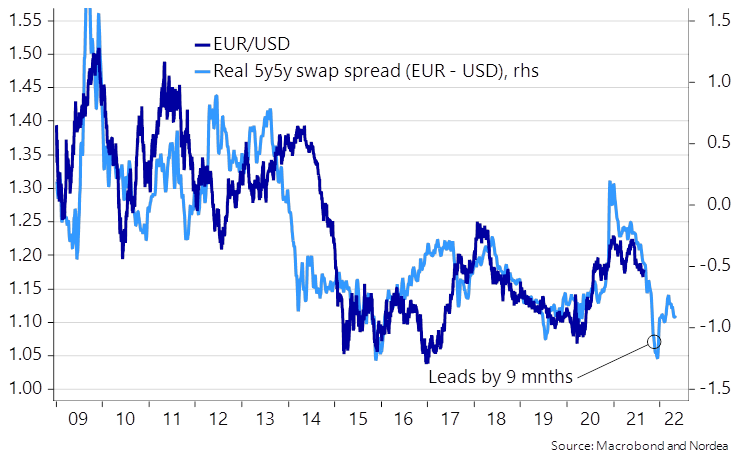

Chart 1. If the ECB steps up and allows EUR real rates to increase a bit, then EURUSD may avoid a big sell-off

We noted two sequences from Lane’s speech, which may be worthwhile reading again for everyone with just a tad of an exposure in the Euro area. First, “We don’t respond day by day, but we did make a conscious decision in March to step up purchases, and we made a conscious decision in June that we should maintain that pace. In the upcoming meetings, whether September or December, we’ll have to take into account the movements in interest rates.” Lane has been vocal on actual financing conditions dictating the ECB balance sheet before, but it is the first time that he refers to them when they have moved to extremely benign levels. Again, there is BOTH a CAP and a FLOOR in EUR interest rates.

Second, “A second consideration is net bond supply. You cannot think about the volume of the APP independently of the volume of net bond supply. The relatively high fiscal deficits that we saw last year and this year will not be lasting in the coming years, but the scale of deficits may remain higher than the pre-pandemic levels.” which was an overlooked component of Lane’s speech as the focus remained glued to the indirect tapering signal of the “financial conditions comment”. Lane basically admits to net supply being a guiding star for the APP program that will continue to run after the PEPP program is tapered post-Covid. If a lot of bonds are issued, then the ECB will buy a lot and vice versa, which is probably as close as you get to de facto monetary financing.

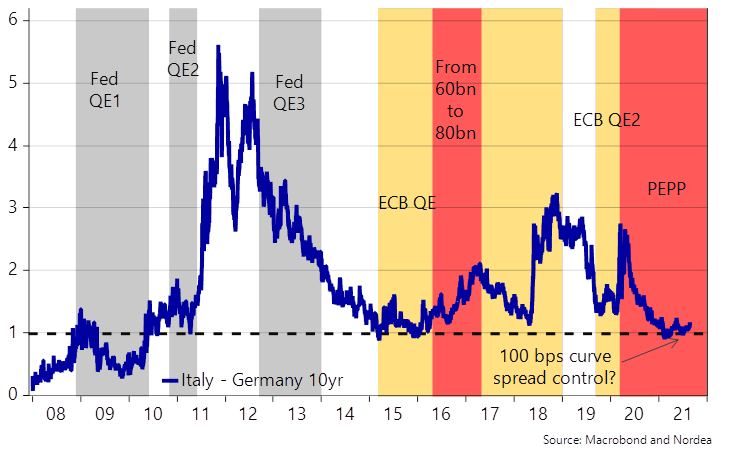

Chart 2. Italian vs. German bond spreads are safeguarded by the ECB in an almost permanent way

Powell, on the other hand, basically refrained from saying anything at all at Jackson Hole. It almost felt as if he was reading out aloud from the most recent FOMC meeting minutes. The phrasing around tapering was a complete copy/paste of the meeting minutes and Powell didn’t try to form or launch a tapering plan that could turn into consensus plan before the September meeting. The most hawkish part of the FOMC has been extremely vocal in recent weeks, including the host of the Jackson Hole, Esther George, but it still seems as if the FOMC is yet to form a consensus/majority view on how to address tapering at the meeting in September.

Our best guess remains that the FOMC (or a big majority of the FOMC) can agree upon a data dependent tapering process, which will include unemployment thresholds that trigger the next phase of tapering should they be met. This will also allow those who are potentially scared of the Delta- derailing the labour market upswing during the autumn to vote for it, as it essentially includes an automatic buffer should the autumn turn out to be much less benign than anticipated in the central scenario.

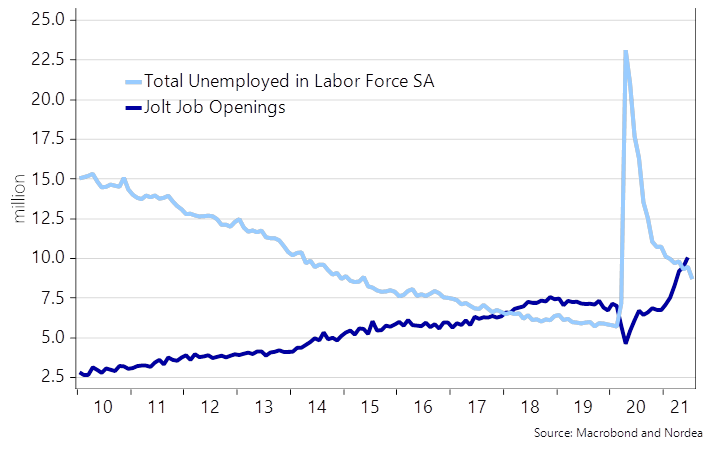

If we assume that the Fed opts for a labour market linked tapering process, then we find it super hawkish news since the employment could surprise right about everyone this autumn on our models. The Fed still (officially) finds NAIRU to be around 4.5%, which is a number that we could easily reach within 2 or 3 months, should current job openings just barely be filled. There are currently more jobs than (officially) unemployed in the US. Wow, just wow. A first reasonable taper threshold in a data dependent tapering process is likely 5% with 4% being the target before the purchases are brought back to zero.

Chart 3. More job openings than unemployed workers.. Tight too become super tight soon

Delta remains a bigger issue in Asia than in the West as the “zero tolerance” policy has reignited bottlenecks and led to a bigger part of the Chinese supply chain being restricted than in 2020. We have seen tons of interesting or even bizarre explanations and excuses for the exploding freight rates in recent weeks, but we find that the real reason is very simple.