Nordea kommenterer den kaotiske tv-duel mellem Trump og Biden og hæfter sig ved, at der ikke var den Biden-meltdown, som nogle Demokrater har frygtet, trods Trumps afbrydelser. Markederne tog debatten roligt.

No Biden meltdown.. Takeaways from the first presidential debate

Many market participants feared volatility around the first presidential debate due to the risk of a Biden meltdown, but such fears were unfounded. We watched the full first presidential debate and here are our key takeaways.

Our key takeaways:

- Biden performed much better than feared (by some)

- All debate on whether Biden is mentally healthy should end after tonight, but probably wont

- Trump probably gains the most from 1-to-1 debates against Biden

- Markets remained calm throughout the debate

- Our base case is a Biden-victory and a risk asset rally, including a weaker USD, after the election

The first presidential debate did not lead to material market moves as fears of a Biden meltdown were proven unfounded. Biden performed (much) better than feared by many and was never close to a “melt-down” as some market participants saw a risk off. All debate on whether Biden is mentally healthy should rightfully end after tonight, but it probably won’t.

Having said that, it is still clear when watching the debate, that Trump gains the most from 1-to-1 debates against Biden. Biden struggles to bite back fully when Trump bullies and constantly interrupts, while Biden performs better when Trump allows him to speak freely.

The three planned debates between Trump and Biden will likely work to “tighten the gap” in opinion polls, but we still don’t think the momentum will be big enough to tilt the current Biden lead in polls.

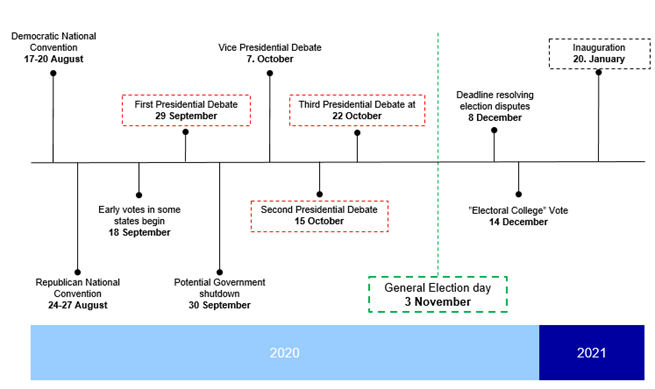

Chart 1. Timeline of events around the US election

The US presidential debate was “contested” in six 15-minute timeslots on each of the following topics. 1) Political records, 2) Supreme Court, 3) Covid-19, 4) Economy, 5) Race protests, 6) Election integrity.

The most interesting debates arose during theme 2, 4 and 5. It seems as if hopes of a big fiscal stimulus deal died on Saturday with the nomination of Amy Barrett for the vacant seat in the Surpreme Court as Joe Biden clearly backed Nancy Pelosis stance on a fiscal deal in congress during the debate tonight.

Pelosi wants another $ 1trn (compared to the Republican suggestion) in various support/bailout schemes to support a fiscal deal, which will likely prove to be too big of a distance to sort-out. Trump on the other hand pushed forward aggressively with the agenda of nominating Amy Barrett during the debate again.

Trump’s biggest knock-out of the night came during theme number 5 on race protests as he kept asking Biden to name just one law enforcement union endorsing his ticket. Biden was not able to answer, which was arguably his weakest moment of the night.

We still don’t buy the risk of a truly “contested election result” even if Trump has the backing of some regional law enforcement unions and keeps saying that “we might not know for months who’s won the election” as he repeated over and over tonight. US Institutions are much bigger than such nonsense.

The debate on the economy was also heated and Trump continued to characterize the rebound as “V-shaped” while Joe Biden labelled it “K-shaped” as some corporate sectors and certain parts of the population are left behind.

Bidens label is probably closer to the truth than Trumps, but toth sides agreed that the economy is doing better than feared in one of the very few short stints of agreement during the debate.

Biden kept reiterating that “billionaires had earned billions through Covid-19” due to Trumps Tax Cuts and Jobs Act of 2017, which could be seen as a signal that Biden still intends to bring Corporate Taxation higher post the election, even if no firm numbers were on the table.