Boris Johnson får sin Brexit, men der kommer ingen handelsaftale med EU foreløbig, skriver Nordea, og forhandlingerne om en aftale bliver vanskelige. Markedet forventer negative britiske renter, og pundet kan komme under yderligere pres.

Brexit watch: Prospects of a deal are Down Under

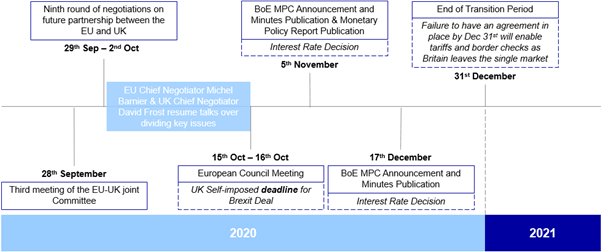

Boris Johnson has set out to – famously – “Get Brexit Done”, but he didn’t get it fully done within his own self-imposed deadline 15th of October 2020 – that seems clear already now.

One thing is certain, Brexit will get done, but a free-trade-arrangement will not be signed this year. Rather a framework will be signed with some general principles on trade – an “Australian-style” deal.

The lack of progress at this week’s EU summit shows that several tricky hurdles remain unsolved, including:

- European fishing vessel’s access to British waters

- Ensuring a level playing field amongst British based companies and their European counterparts

- The UK’s Internal Market bill

It is probably unsolvable with a short time horizon, why the two parties will likely end up with some kind of framework for future cooperation and continue negotiations on the back of such over the coming years. The probability of a bigger free-trade-agreement before New Year is very slim.

Chart 1. Brexit timetable

However, we remain of the belief that there are no hard deadlines in politics, which was clear once again this week as the UK has accepted to breach the self-imposed deadline.

While technically an extension of the transition period as defined by the withdrawal agreement is impossible, we find it very likely that the UK and EU will agree to a “prolongation in disguise”.

They could in essence sign a framework agreement, Australian-style, that includes very fluffy principles on trade. In practice a postponement of the free trade agreement in all but name.

Most of EU / Australian trade is done on WTO terms but they have an framework added from 2017 that is yet to be ratified, which includes some general principles on trade, foreign policy and so on. This also leaves a no-deal like trade scenario for 2021 ahead for UK.

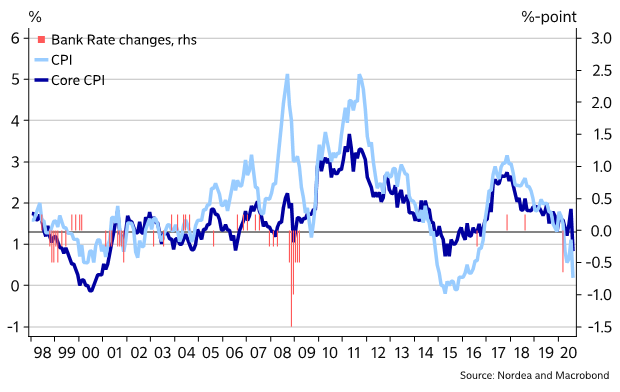

Chart 2. Inflation undershoots by a mile in the UK

As the latest headline inflation print undershoots the inflation target by 1.5% and the lock-down side-effects continue to hurt the UK economy, pressure builds on the Bank of England to expand on their monetary relief efforts.

While speculation in negative rates in the UK is nothing new, the last month has seen increasing talks of BoE employing negative rates, which is a proposition that the BoE appears to be warming up to.

However, according to BoE Governor Bailey, they have yet to properly investigate the negative effects of negative rates – but the tool remains in the toolbox.

We find it very unlikely that BoE will turn to lower the policy rate even further by EOY 2020, instead we find it more likely they will expand their QE programme. This outlook hugely depends on the UK recovery and the forthcoming trajectory of COVID-19, as well as the outcome of the Brexit negotiations.

As Bailey put it, “given the shock we’ve had, there are good reasons to say we shouldn’t rule them out (negative rates) and therefore they’re in the toolbox.”

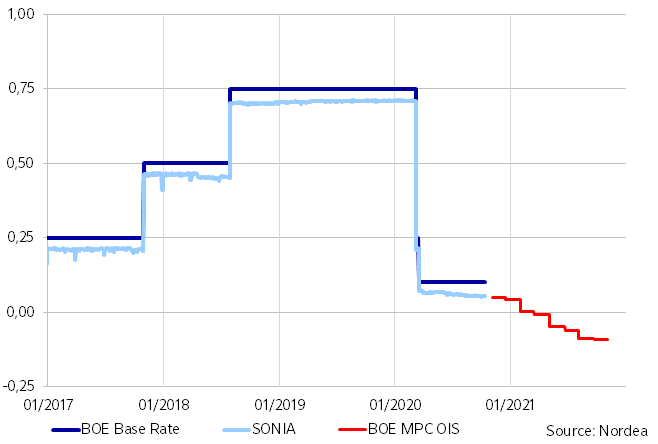

Chart 3. Markets are already pricing cuts in to negative territory

Markets are already pricing negative rates into the OIS forward curve with the forward OIS entering negative territory by March. A 15-20 bps cut of the base rate in to negative territory is hence already priced in during H1-2020.

This leaves a fairly limited downside risk left for GBP and GBP rates unless BoJo completely pulls the rug from under the negotiations going forward, which is only a tail risk scenario.

We expect intense negotiations on a broader trade deal to continue even if an Australian-style framework is agreed upon later this year. An Australia-style deal would clearly open the door for a BoE cut in H1-2021, but markets are already fairly prepared for that.

It still makes sense to keep a GBP negative bias intact since an Australian-style deal is in practice a return to WHO-terms, at least temporarily while negotiations continue.