Nordea langer kraftigt ud efter de amerikanske og europæiske centralbanker for at tage alt for let på risikoen for en stigende inflation. Ikke mindst på grund af stigende oliepriser kan inflationen komme op på 3 pct. inden sommer. Voldsom økonomisk vækst i EU i andet kvartal kan også presse inflationen op. Nordea mener, at ECB laver skønmaleri.

The ECB is more infantile than both me and you

While the ECB remains busy writing poetry, the inflation debate is starting to run hotter in the US. If we assume a total melt-up in US assets, growth, and inflation by late Q2, will Jay Powell and the Doves not be forced to debate the balance sheet?

Fed Powell and his ilk continue to press back against the idea of a shift towards less dovish policies. SAD! US CPI inflation also disappointed a touch in January, which may have soothed some inflation fears. This will however all change in a couple of months’ time. Indeed, we expect the current inflation breeze to strengthen into gale force winds by the second quarter, at least in terms of the market’s narrative…

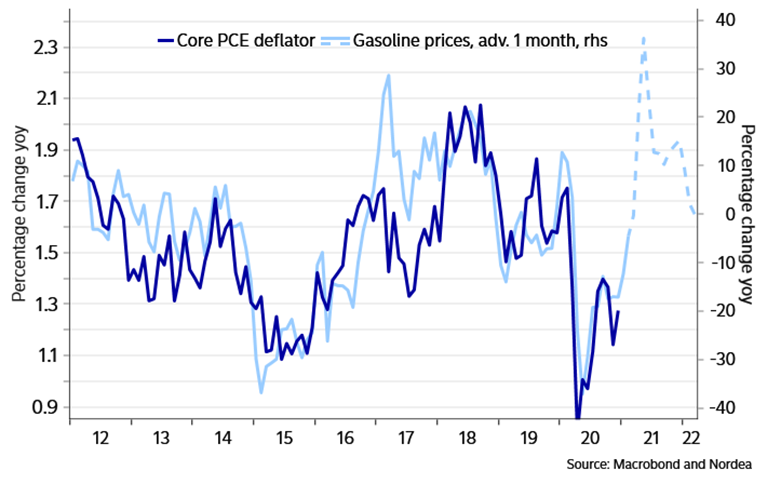

Why is this? For instance, US headline CPI inflation is likely to jump to 2.5% based on the energy contribution alone. And if core inflation starts to move higher based on “unexpected” spill-overs from higher fuel costs – we might get inflation readings around 3% before summer.

Chart 1: Higher gasoline prices could spill over in “unexpected” ways to core inflation

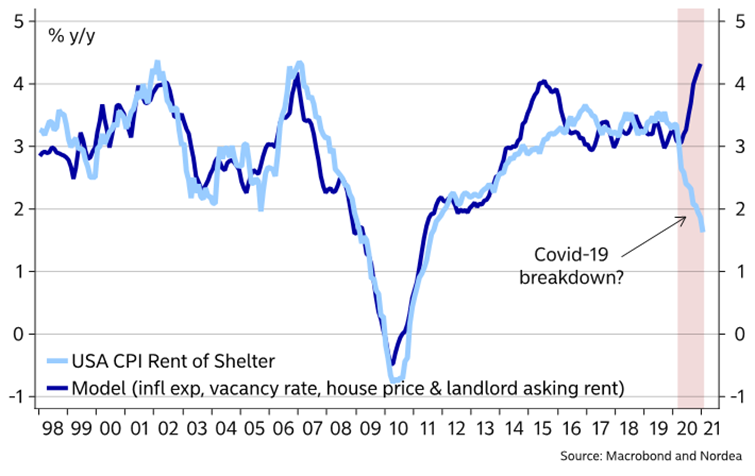

We should also mention the wonky shelter component. US core CPI came in on the low side at 1.4% in January. Trend-wise it’s “rent of shelter” that looks weirdly low compared with underlying rent indicators. It has a 40% weight in core CPI so it matters big time.

We expect a sustained acceleration in rents as the COVID-19 case numbers continue to go down and the authorities let their citizens start to roam somewhat more free (remember to thank the WHO for the drop in case numbers! It did change the testing guidelines so as to lower the COVID-19 case count on Biden’s inauguration day).

Chart 2: Rent of shelter inflation weirdly low vs underlying indicators

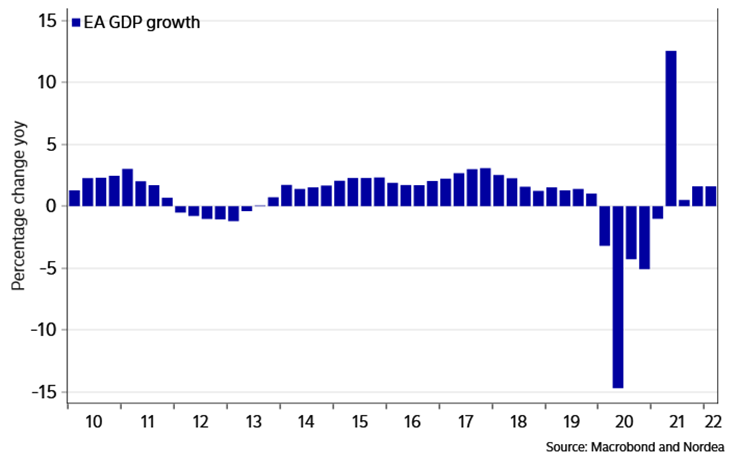

What’s more, this inflation surge is likely to unfold at the same time as global business sentiment remains at über-strong levels. Even the economic Titanic that is the Euro-area could see growth numbers above 10%. If we pencil in 0.4% quarterly growth for the EA, we get a growth number of 12.5% yoy in the second quarter. Of course this doesn’t mean much in the big picture – given the slump of 2020 – but it will likely matter for the growth and inflation narrative by spring.

Chart 3: Euro-area growth of 12.5% in Q2?

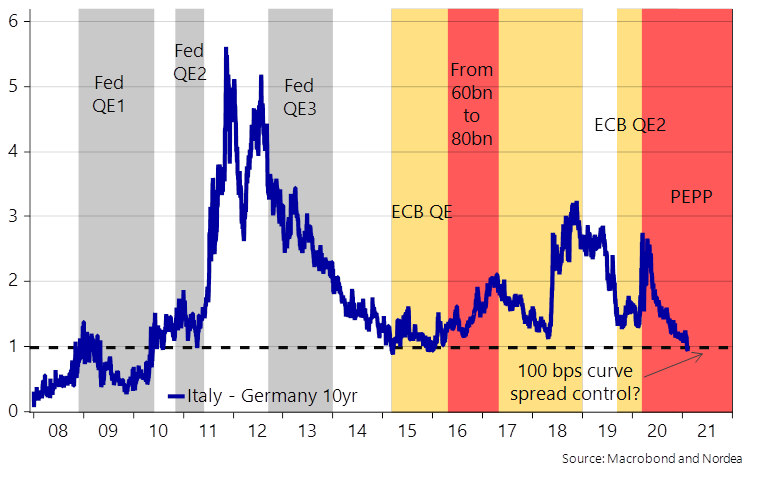

While the ECB is busy writing infantile poems, the Curve Spread Control regime continues to work its magic through Euro area fixed income markets. The 10yr spread between Italian and German bond yields is now below the 100 bps threshold, and if the ECB sticks to its poetic promises (“We’ll keep financing conditions favourable, Til the crisis is through”) the trend is likely to remain your friend in this spread tightening story.

More than 100 economists urged the ECB to cancel the public debt it holds. First, it will never actually happen. Second, it has already happened in practice. When the ECB buys Italian, Spanish or German debt, the yield payments go to the ECB, but are effectively distributed back as “dividends” to the governments via the capital key, why the debt is effectively nulled in practice (at least on an Euro zone aggregate level). The Euro zone hence has more urgent matters to deal with than a technical debate on debt cancelation since it is practically already implemented.