Coronavirussen kan få langt bredere virkning end blot kursfald på aktierne, fremgår det af en analyse fra Nordea: Det kinesiske bilsalg kan styrtdykke, handelsaftalen mellem Kina og USA kan falde til jorden, og der kan blive en alvorlig vikning på amerikansk økonomi.

Uddrag fra Nordea:

China is still effectively closed, why the market rightfully almost ignored the rebound in the Euro area PMI. The Fed is openly discussing YCC as an “anti-recession” weapon. Massive good news for Gold and maybe bad news for USD down the road.

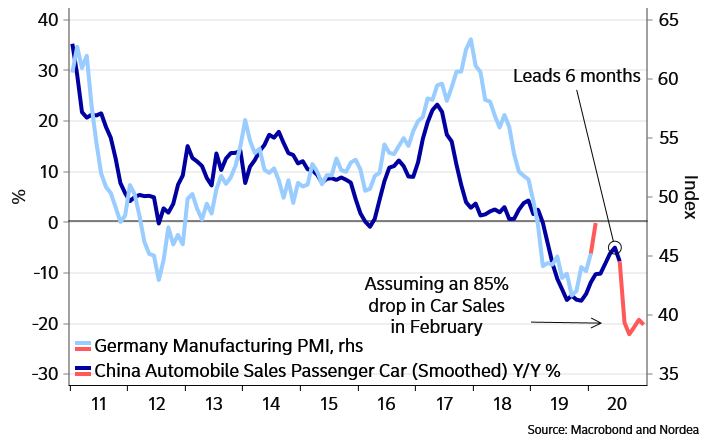

China is still effectively closed down and there are no cars on the street (Week ahead: Where’s my cars). Car sales is down 85% in the first two weeks of February, which makes it easy to construct very gloomy German manufacturing PMI models (and of course gloomy Chinese PMI models), why the market rightly decided to mostly look through the rebound in EA PMIs on Friday. It probably makes sense to stay clear of currencies with a tight China link another week – EUR, AUD, NZD etc.

The phase 1 trade deal is by the way most likely 100% dead already, since China will never be able to i) keep USD/CNY stable and ii) more than double imports from the US due to Wuhan, but they will be able to call on the “force majeure” paragraph in the deal. A renegotiation awaits after the US election, at least if Bernie doesn’t beat Trump. We don’t bet that he will.

Chart 1: Chinese car sales down 85%. Where will this leave German PMIs? Probably not too good

USD: YCC in 20201? But first, get ready for a tapering attempt of POMOs

One of our “Fed favourites”, Lael Brainard, held a speech on Friday, a speech potentially quite gold-positive as well as dollar-negative, should the Fed be forced to implement significantly more easing – for instance due to negative effects from the recently re-escalation of the virus situation after a likely monetary policy review this summer. The TL;DR is as follows: given a distinct lack of room for conventional stimulus (i.e. rates already low), the Fed ought to jump onto the easing accelerator via forward guidance, bond purchases and yield-curve control (YCC) a la BoJ.

She furthermore argues the case for letting inflation overshoot to compensate for previous undershoots (opportunistic reflation). Meanwhile macroprudential tools should be used to limit a surge in eg. household debt from the mega-loose monetary policy (an alternative reading would be that households must be prevented from protecting themselves from the effects of the policy).