Nordea noterer sig, at lederne på G-7 topmødet optrådte uden masker. Det er tegn på, at coronakrisen er overstået. Men det mest afgørende spørgsmål er, om der sker et regimeskifte med inflationen. Nordea tror, at det trækker i retning af et regimeskifte, omend det ikke kommer med det samme. Den amerikanske centralbank kan i morgen give et signal om det.

The crisis is over, but are we amid a regime shift?

The G7 meeting in many ways served as anecdotal evidence that the crisis is mostly over. The big question is now if the crisis response will lead to a regime shift or not? Markets are not yet convinced and the FOMC won’t be either on Wednesday.

The crisis is mostly over. If you need further anecdotal evidence, then look at pictures from the G7 meeting in Cornwall. No masks, no social distancing, no quarantine rules. Nothing. We are not donning our tin-foil hats – we truly just see it as a signal that the crisis is over. Happy days!

The big question is now if the political crisis response to the pandemic will lead us towards a marked regime shift or not. A crisis environment is the only environment that allows for changes to the policy mix that are large enough to potentially define a new era. As the former head of the EU commission, Romano Prodi, once put it “I am sure the euro will oblige us to introduce a new set of economic policy instruments. It is politically impossible to propose that now. But some day there will be a crisis and new instruments will be created.”

Currently we find that 1) everyone and their mother is positioned for a massive inflation spike this summer already and 2) no-one dares to genuinely think that we have gotten a sustained level shift in inflation rates over the coming decade. Most people still lick their decade long wounds of trying to predict or bet on sustained higher inflation. Not least right about every economist.

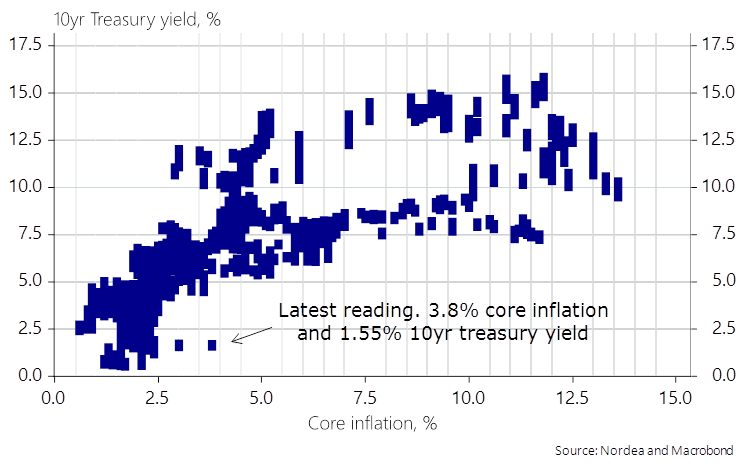

To give you an example: The second lowest 10yr bond yield recorded with a core inflation level of 3.8% YoY is around 5.6% – the lowest is obviously the current observation around 1.5% (on data since 1962).

Chart 1. The market has so far bought the transitory inflation narrative

There are two types of recency bias in play in this inflation debate. First, there is clearly a recency bias in inflation expectations, why markets are already positioned for higher inflation. That is the only way you can explain how important oil is for inflation expectations over the coming 10 years.

Second, there is a recency bias in the way the crisis response is calibrated. The most recent crisis in 2008/2009 was a material demand shock, why everyone currently suggests treating the pandemic as a demand shock, which it is most likely not. Bringing truckloads of fiscal fuel to the fire during a supply shock risks creating bizarre bottlenecks such as the ones we are experiencing right now.

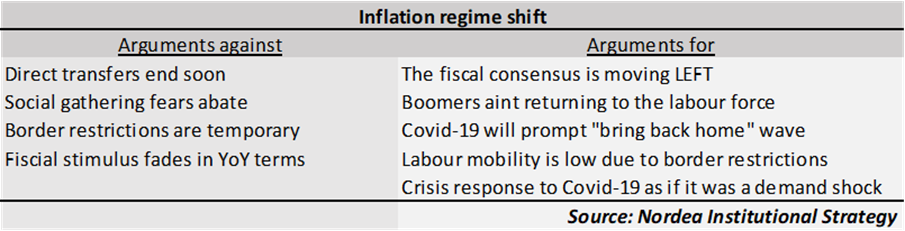

Chart 2. Arguments for and against the world facing an inflationary regime shift

We have summarized the pros and cons of the inflationary regime shift debate in the table above and admittedly find more arguments in favor of a regime shift than against, not least due to the consensus moving leftwards fast on fiscal stimulus, which is a potential game-changer when it is happening amidst a supply shock crisis.

The Fed is also still very scared of repeating some of the post 2009 mistakes, such as tightening too early before the slack in the economy is gone. The FOMC and Jay Powell is now faced with inflation clearly above target ahead of Wednesdays FOMC meeting.

Powell has kept reiterating through the spring that “..we have resisted the temptation to try and quantify what moderate overshooting means, but when we are above target… we can do that”, which probably means that Powell will at least have to a get a bit more concrete on when enough is enough in terms of inflation overshooting.

Is a 5% headline inflation and a 3.8% core inflation a moderate overshoot of the target? We guess it depends on the eyes that look but Jay Powell is likely to explain most of it away as temporary bottlenecks such as those seen in used car prices (Fed preview: Bottlenecks, an early tapering and late hikes).