De svenske lønforhandlinger giver en indikation om lønudviklingen i tiden under og efter coronakrisen. Et mæglingsudspil lyder på en lønstigning på 4,5 pct. over de næste to et halvt år, dvs. under 2 pct. om året. Dermed fortsætter mange års trend med konstant lavere lønninger. Nordea konkluderer, at omkostningspresset i den svenske økonomi vil være lav i mange år.

Swedish pay talks: Low initial wage bid

The impartial mediators’ first bid in the ongoing pay talks was lower than expected – at wage increases of 4.5% over 29 months. The bid was rejected by the unions, but still puts pressure on the Riksbank.

Today, the impartial mediators gave their first bid in the ongoing pay talks, covering more than half of the Swedish labour market. The bid was 4.5% over the next 29 months up until March 31 2023, i.e. implying around 1.9% per year.

The unions rejected the bid as “way too low”, while the employer organizations accepted the bid even though it was “still too high”.

Both parties have already agreed on the length of the agreement “if the level is acceptable”.

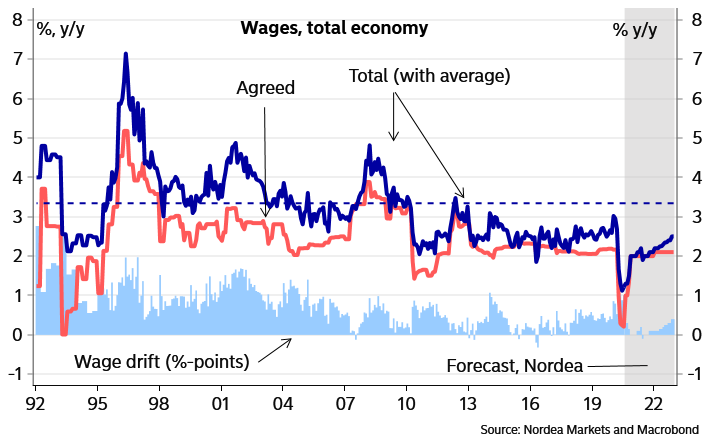

This bid is slightly lower than our forecast of wage increases at 5% over the next 29 months – and markedly lower than the previous wage agreement at 6.5% over 36 months. It is also well below the Riksbank’s forecast.

The initial biddoes not include any retroactive wage increases for those months during 2020 without agreed wage increases as the pay talks were postponed from the spring until the autumn.

It is an unusually difficult situation for the pay talks when different industries are not in sync. Today’s bid indicates that the pay talks are in crisis mode.

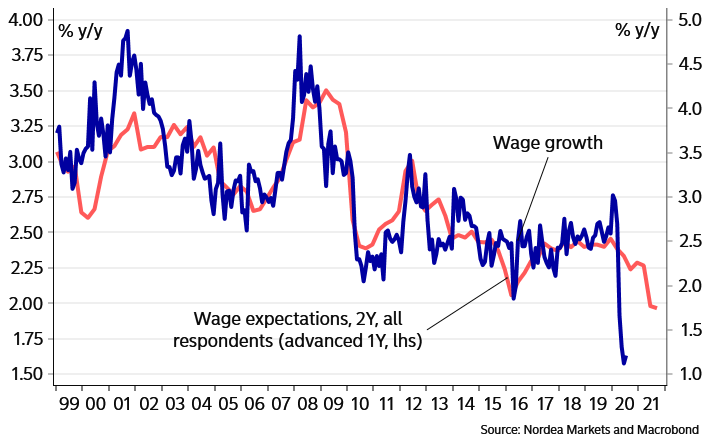

We still see wage agreements at around 2% from October onwards, while today’s initial big from mediatiors highlights downward risks. For the Riksbank, the first impartial bid is a disappointment. It underscores that the underlying cost pressure in the Swedish economy will remain low for several years ahead, putting pressure on already dampened inflation expectations.

Read our full wage forecast here.